Find a Fund

Peer Group Analysis View All»

| Index Selector Links | 1 Year | 3 Year | 5 Year |

|---|---|---|---|

8.43% |

7.02% |

8.38% |

|

5.96% |

5.95% |

3.07% |

|

45.97% |

40.91% |

48.73% |

|

20.19% |

10.53% |

6.55% |

|

12.54% |

8.27% |

9.13% |

|

14.15% |

11.57% |

10.67% |

|

15.16% |

9.50% |

7.95% |

|

12.90% |

10.71% |

11.36% |

|

17.83% |

16.34% |

11.76% |

|

20.18% |

11.41% |

10.01% |

|

20.69% |

17.27% |

11.68% |

|

15.17% |

8.89% |

10.39% |

|

9.38% |

7.52% |

7.10% |

|

8.20% |

8.42% |

7.45% |

|

7.72% |

0.32% |

4.32% |

|

8.87% |

8.75% |

7.76% |

Hedge Clippings

10 Oct 2025 - Hedge Clippings |10 October 2025

|

|

|

|

Hedge Clippings | Friday, 10 October 2025

News | Insights When Regimes Shift, So Should Portfolios | East Coast Capital Management Plans are worthless but planning is essential | Canopy Investors September 2025 Performance News Bennelong Australian Equities Fund Quay Global Real Estate Fund (Unhedged) |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday |

13 Oct 2025 - Performance Report: Altor AltFi Income Fund

[Current Manager Report if available]

13 Oct 2025 - Performance Report: Argonaut Global Gold Fund

[Current Manager Report if available]

13 Oct 2025 - 10k Words | October 2025

|

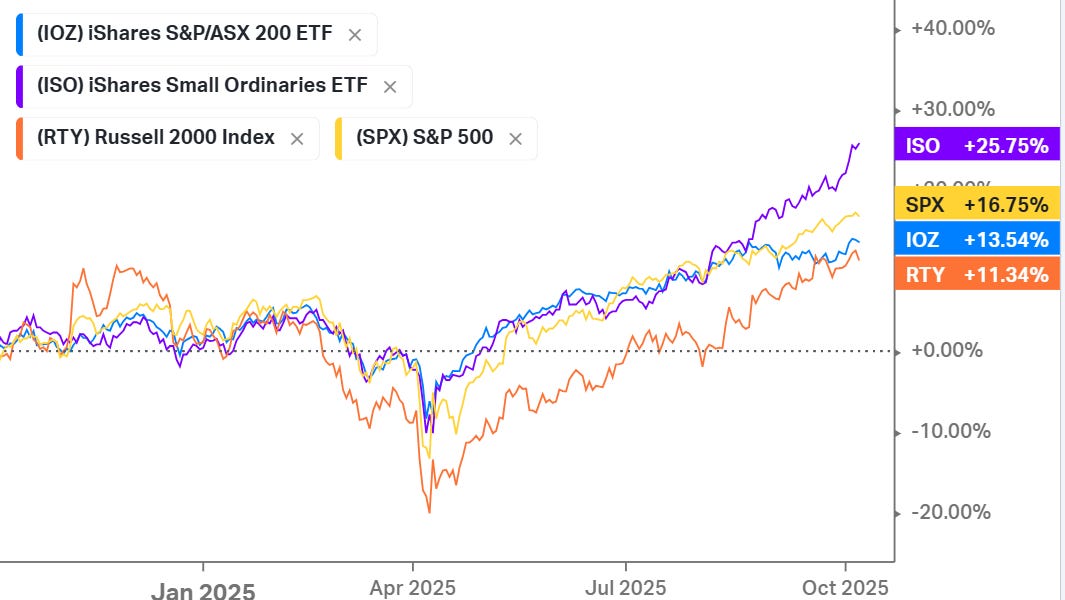

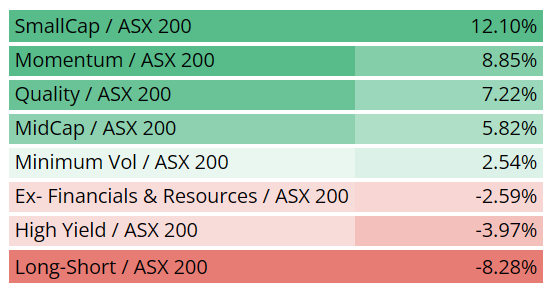

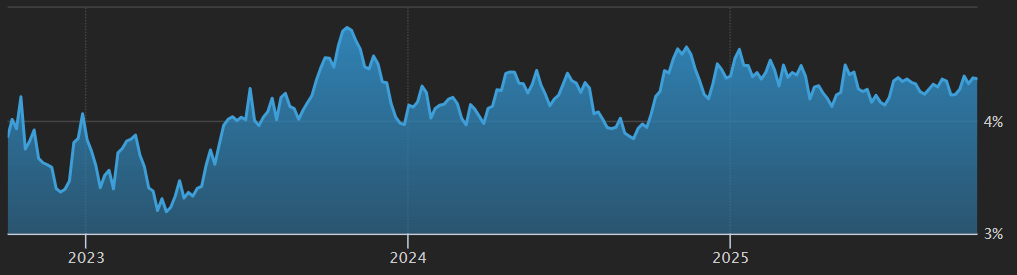

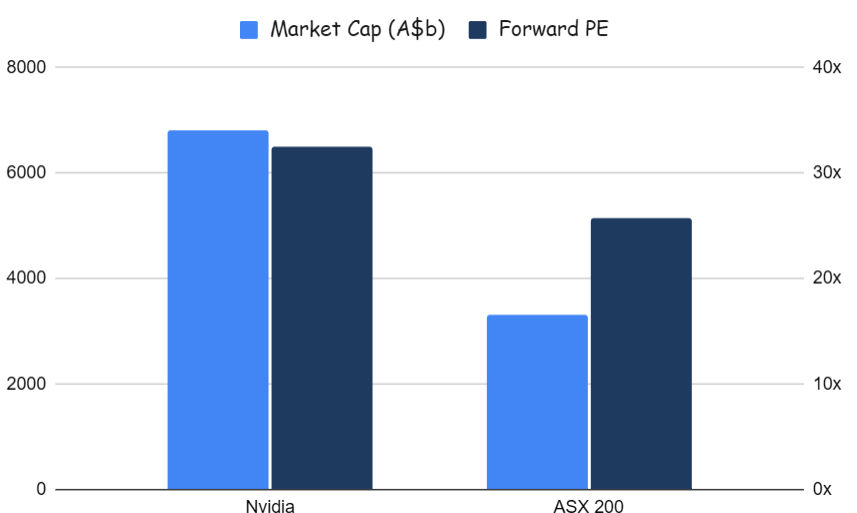

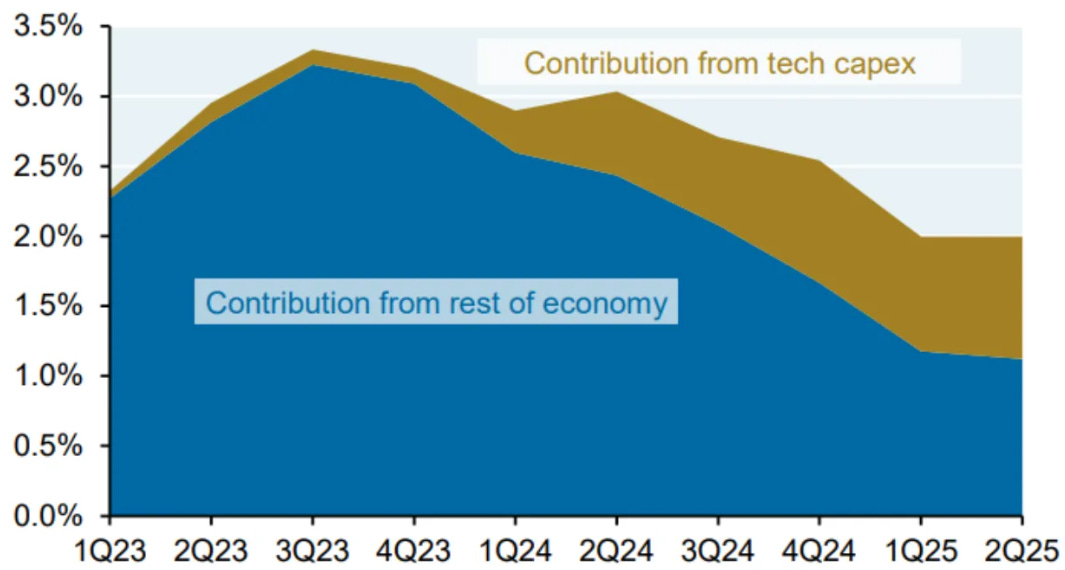

10k Words Equitable Investors October 2025 Small stocks are making up some lost ground with investor interest returning. Size has been the key factor on the ASX over the past 12 months, whereas in the US it has only come to the fore in the past three months. Australian 10 year bond yields have been pretty stable for the past few years but political turmoil in Japan and France shows up in their equivalent bond yields. The extent to which AI is dominating venture funding is unprecedented. But so is the extent to which Nvidia dominates the total value of Australia's top 200 companies. Surging earnings is the difference when comparing Nvidia's valuation to that of Cisco during the dot com boom. The economy is certainly relying more heavily on tech sector capex - and anticipating 4x growth in power demand from AI data centres over the next 10 years. Finally, we still have over 1,000 companies a month entering external administration in Australia, compared to just over 500 a month between FY2020 and FY2023. Record weekly value of trade in S&P/ASX Emerging Companies stocks (5 highest weekly amounts since 2004 v averages) Source: Equitable Investors, Iress One year returns - Australian small caps leading large caps in Aus and US Source: Koyfin Ten year returns - small caps still lagging Source: Koyfin ETF-based factor analysis highlgiths size as the key on the ASX over the past 12 months Source: Equitable Investors US factor ETF performance / S&P 500 ETF performance over past 3 months Source: Koyfin 10 year Japanese government bond yield Source: WSJ.com 10 year French government bond yield Source: WSJ.com 10 year Australian government bond yield Source: WSJ.com AI's share of value of venture deals over trailing 12 months Source: PitchBook Nvidia's market cap and PE multiple relative to the S&P/ASX 200 Source: Equitable Investors, Koyfin Cisco v Nvidia in terms of market cap and net income (net profit) Source: Koyfin US real GDP growth contribution from tech capex

Source: JP Morgan Bridgewater Power demand from AI data centres to quadruple in 10 years according to Bloomberg Source: Bloomberg NEF The first time an Australian company enters external administration or has a controller appointed - monthly Soure: ASIC Funds operated by this manager: Equitable Investors Dragonfly Fund Disclaimer Past performance is not a reliable indicator of future performance. Fund returns are quoted net of all fees, expenses and accrued performance fees. Delivery of this report to a recipient should not be relied on as a representation that there has been no change since the preparation date in the affairs or financial condition of the Fund or the Trustee; or that the information contained in this report remains accurate or complete at any time after the preparation date. Equitable Investors Pty Ltd (EI) does not guarantee or make any representation or warranty as to the accuracy or completeness of the information in this report. To the extent permitted by law, EI disclaims all liability that may otherwise arise due to any information in this report being inaccurate or information being omitted. This report does not take into account the particular investment objectives, financial situation and needs of potential investors. Before making a decision to invest in the Fund the recipient should obtain professional advice. This report does not purport to contain all the information that the recipient may require to evaluate a possible investment in the Fund. The recipient should conduct their own independent analysis of the Fund and refer to the current Information Memorandum, which is available from EI. |

10 Oct 2025 - Performance Report: Bennelong Long Short Equity Fund

[Current Manager Report if available]

10 Oct 2025 - Performance Report: Quay Global Real Estate Fund (Unhedged)

[Current Manager Report if available]

10 Oct 2025 - Performance Report: Bennelong Australian Equities Fund

[Current Manager Report if available]

10 Oct 2025 - New Funds on Fundmonitors.com

|

New Funds on FundMonitors.com |

|

Below are some of the funds we've recently added to our database. Follow the links to view each fund's profile, where you'll have access to their offer documents, monthly reports, historical returns, performance analytics, rankings, research, platform availability, and news & insights. |

|

||||||||||||||||||||||

| TAMIM Global Infrastructure Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

|

||||||||||||||||||||||

| ASCF Private Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

|

||||||||||||||||||||||

| Metrics Real Estate Income Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

|

|

||||||||||||||||||||||

| Pantheon Global Private Equity Fund (PGPE) | ||||||||||||||||||||||

|

||||||||||||||||||||||

|

Want to see more funds? |

||||||||||||||||||||||

|

Subscribe for full access to these funds and over 900 others |

9 Oct 2025 - Geopolitics - Markets to take a backseat, investors need not do the same

|

Geopolitics - Markets to take a backseat, investors need not do the same Janus Henderson Investors September 2025 Jay Sivapalan, Head of Australian Fixed Interest, discusses the impact of geopolitical shifts on global economic dynamics, emphasising the need for investors to realign with government strategic priorities. Timely & Topical Geopolitical issues are currently having a heavy influence on economic and market outcomes. Global tectonic shifts are occurring in the areas of trade, defence, energy, technology and a desire for national resilience. Consequently, the key pillars that drove synchronised global economic growth are under threat with economic growth drivers such as the peace dividend we've enjoyed over the last 80 years and free trade agreements we've appreciated for decades, no longer intact. Whilst we in the investment community would like to think markets are central to government actions, the harsh reality is that they are not. The market feedback mechanism is important in governments achieving their economic and geopolitical objectives. However, higher order priorities for governments are increasingly apparent. For much of the past four or five decades, investors have been able to rely on some simple principles for investing within free market based capitalist economies. The allocation of scarce resources was driven almost solely by the highest return on capital available, feedback from market pricing and free competition anchored by comparative advantage. The role of government mostly centred around delivery of public goods and services, provision of safety nets as well as keeping checks and balances in place through regulation. An environment where private sector decisions ultimately drove markets whilst governments played a supportive role. Markets were at the forefront of these private sector (and some public sector) decisions. Looking ahead, we see the potential for the roles of government and the private sector to be reversed. Where governments have strategic priorities driving critical decisions around the use of capital, labour, technology and other scarce resources dictating the growth or fall in certain sectors, the higher order priority now is to achieve nationalistic objectives. While the private sector will absolutely be necessary for governments to achieve their more strategic goals, the bigger picture decisions are not likely to be driven by free market pricing signals per se. Going forward, the role of the private sector, whilst different and not in the driving seat, remains critical to governments achieving their objectives. The main reason being that the intellectual property, investor capital, skilled labour and track record of delivery sits within the private sector. Governments also absolutely need the private sector to execute their objectives. Therefore, key success factors for private sector participation will be:

Thinking differentlyThe geopolitical environment over the coming decades will be significantly different to the past. The historical norm of shooting for comparative advantage in trade is one case in point. Countries specialising in producing and exporting goods and services for which they have a lower production cost compared to others, enables greater total production and consumption than otherwise achieved in isolation. This is at the heart of globalisation and global commerce. In a controlled environment, a constrained optimum, a framework that delivers the benefits of comparative advantage can still hold but the level of complexity increases. Regulation, resource availability, technological factors and social and political objectives have always been in the frame as constraints. Increased nationalist and protectionist policies can add further distortion and friction to otherwise economically rational decisions which have sharpened the focus of governments and their policy makers. For investors, the implications are that the economy and markets are no longer front and centre in policymakers thought processes. Rather, markets are a tool through which economies and their respective governments to achieve their strategic priorities. Protectionist policies, for example, may mean that there's no certainty a trading partner can be relied upon to maintain willingness/capacity to deliver goods and services as required. Instead of an optimally efficient economic outcome being pursued, higher order government policies may take precedent. That is, governments may no longer pursue the cheapest option, but that with the greatest certainty of execution. The outcome is that winners and losers will emerge and the gulf between each is likely to expand. Governments will be much more influential in who those winners and losers are at the country, industry and company level. Investment implications - There will be winners and losersFor investors, the playbook for success has changed. Identifying the strategic priorities for governments and the number one, two and three operators with a track record of successful execution in these areas is a good start. Determining which industries could receive subsidies and tax breaks could also prove advantageous. As a guide, investors would be well served to assess investments with a focus on:

This shift in approach from starting with the private sector to now commencing with governments' strategic priorities, whilst it may change the way industries and companies will succeed or fail, does not preclude successful investing and strong returns on invested capital across a range of asset classes. There will be winners and losers! Companies poised to benefit from strategic priorities such as the following are worth exploring:

A way forwardClearly, investors need to think and allocate differently to how they have in the past and will need to work portfolios harder and more diligently to achieve their objectives. Pursuing similar return targets to those achieved previously but in a safer way may be the better way to go, rather than leaning into risk which has been so well rewarded. For example, to maintain purchasing power and grow a corpus in real terms, pension funds, endowments, foundations and insurance companies often target CPI + 3%. Currently, investors are better able to avoid leaning as heavily into growth assets to achieve these objectives, with a greater allocation to defensive assets possible. The past year has proven this to be the case with fixed income reestablishing itself as a compelling opportunity to drive attractive returns. The full gamut of options have delivered attractive return outcomes. Investment grade credit, the sweet spot between traditional equities and more pedestrian cash where risk of default, especially in Australia, is remote and has delivered 7.8% returns for FY25*, close to long term assumptions for equity market returns in asset allocation models. Investing differently for successful outcomesThe world is changing rapidly and for policymakers, markets are not the primary focus. Investors can still succeed but need to change the way they invest. When assessing policy and geopolitics, it is more relevant to back solve for what is firstly in the best interests of a nation and its public objectives, then the economy and markets - it's simply a different playbook. Just because markets have taken a back seat to geopolitics doesn't mean investors have to do the same. Many of the higher order government objectives will need to be delivered by the private sector. And with potentially government supported policy, regulation, subsidies, discounted funding and equity backing. Successful investment outcomes are very likely but achievable investing through a different lens. |

|

Funds operated by this manager: Janus Henderson Australian Fixed Interest Fund , Janus Henderson Conservative Fixed Interest Fund , Janus Henderson Diversified Credit Fund , Janus Henderson Global Natural Resources Fund , Janus Henderson Tactical Income Fund , Janus Henderson Australian Fixed Interest Fund - Institutional , Janus Henderson Conservative Fixed Interest Fund - Institutional , Janus Henderson Cash Fund - Institutional , Janus Henderson Global Multi-Strategy Fund , Janus Henderson Global Sustainable Equity Fund , Janus Henderson Sustainable Credit Fund , Janus Henderson Net Zero Transition Resources Fund *Bloomberg AusBond Credit 0+ Yr Index, as at June 2025. All opinions and estimates in this information are subject to change without notice and are the views of the author at the time of publication. Janus Henderson is not under any obligation to update this information to the extent that it is or becomes out of date or incorrect. The information herein shall not in any way constitute advice or an invitation to invest. It is solely for information purposes and subject to change without notice. This information does not purport to be a comprehensive statement or description of any markets or securities referred to within. Any references to individual securities do not constitute a securities recommendation. Past performance is not indicative of future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested. Whilst Janus Henderson believe that the information is correct at the date of publication, no warranty or representation is given to this effect and no responsibility can be accepted by Janus Henderson to any end users for any action taken on the basis of this information. |

8 Oct 2025 - Plans are worthless but planning is essential

|

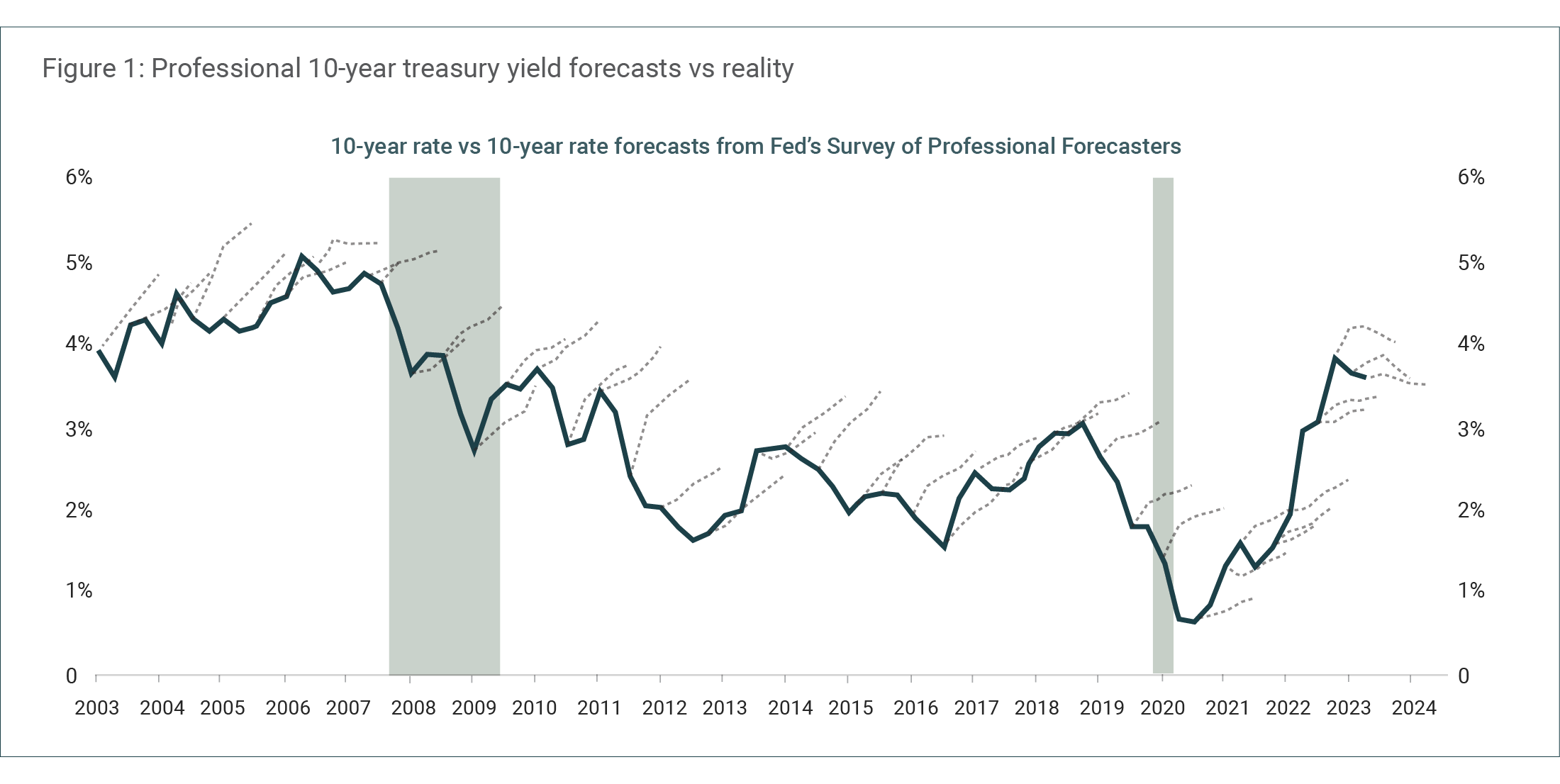

Plans are worthless but planning is essential Canopy Investors September 2025 5 min read 'Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.' Warren Buffett has previously observed that for information to be useful in investing, it must be both important and knowable. While macroeconomic outcomes are undeniably important, evidence suggests they cannot be predicted with useful accuracy. The forecasting fallacyThe track record of professional macro forecasting is remarkably poor. Prakash Loungani's 2001 study analysed consensus GDP growth forecasts from private sector economists across sixty-three countries, examining sixty recessions from 1989 to 1998. His analysis showed that only two of the sixty recessions were predicted a year in advance, two-thirds remained undetected by April of the recession year, and in about a quarter of cases forecasters were still predicting positive growth in October of the recession year. As Loungani concluded, "the record of failure to predict recessions is virtually unblemished." Major institutions perform no better despite employing teams of PhD economists and having privileged access to non-public information. Andrew Brigden of Fathom Consulting examined International Monetary Fund (IMF) predictions across 194 countries, analysing 469 economic downturns from 1988 to 2018. The IMF successfully predicted only four recessions a year in advance - a success rate of just 0.85% - with all successful predictions involving smaller developing economies rather than major markets. This pattern extends beyond recessions to other key macro variables. Figure 1 below shows two decades of professional interest rate forecasts consistently overestimating future yields and missing every major decline.

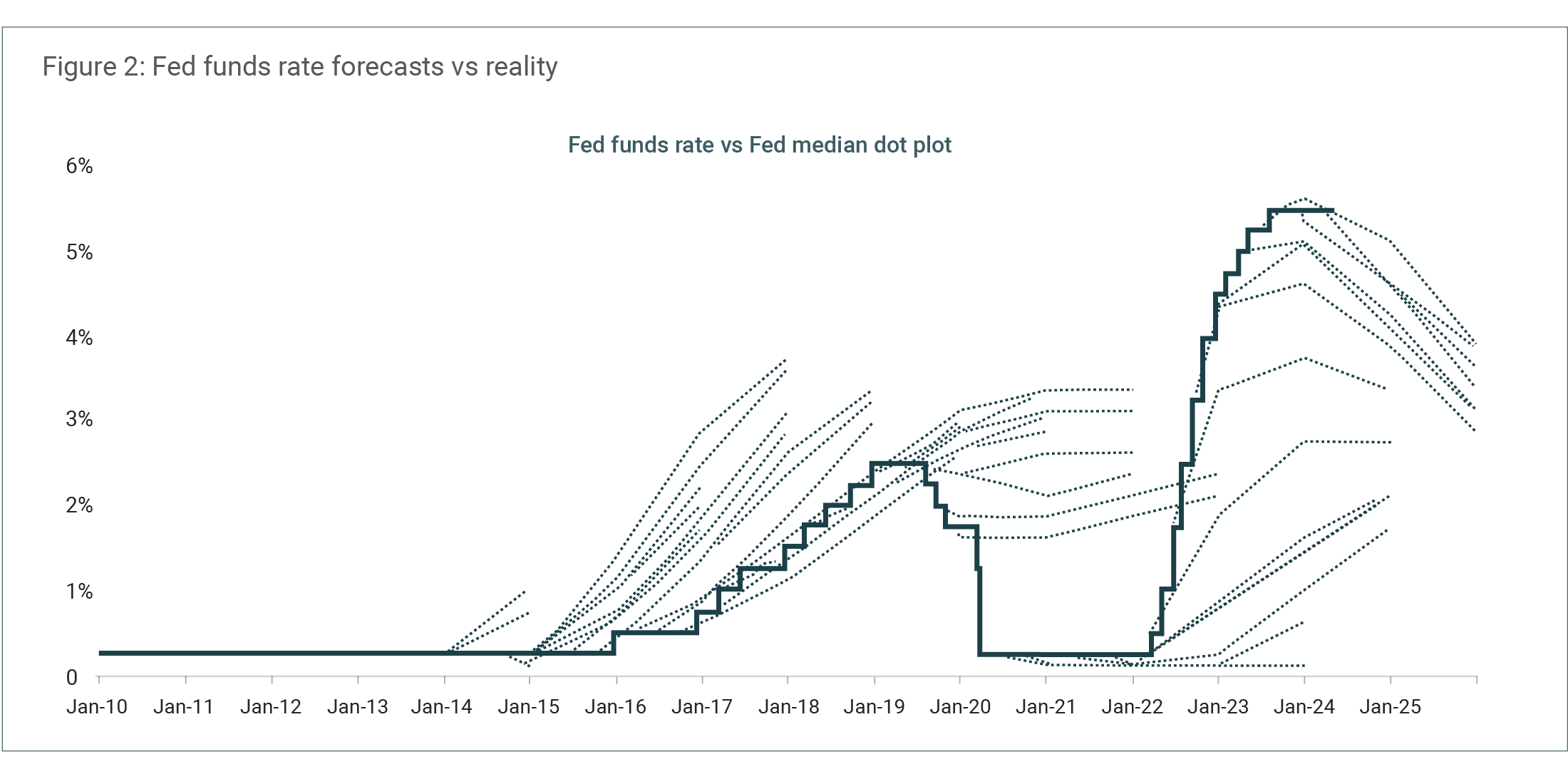

Source: Bloomberg, Philadelphia Fed Survey of Professional Forecasters, Apollo Chief Economist. Tellingly, the Federal Reserve struggles to predict even its own policy decisions. Figure 2 below highlights how Fed officials' projections of the funds rate (a metric they directly control) consistently miss the mark by wide margins.

Source: FOMC, Bloomberg, Apollo Chief Economist. The double prediction problemImagine that you could predict every recession, every inflation spike, and every policy change. Would you be guaranteed investment success? The surprising answer is no. As Howard Marks explains, "Even if you somehow manage to get an economic forecast correct, that's only half the battle. You still need to anticipate how that economic activity will translate into a market outcome. This requires an entirely different forecast, also involving innumerable variables, many of which pertain to psychology and thus are practically unknowable." We see this challenge in action when identical economic news can drive markets in unpredictable, sometimes opposing directions depending on prevailing sentiment, prior expectations, and what's already priced in. Lower inflation could spark a rally (rate cuts ahead!) or trigger selling (economic weakness!). The recent inflation cycle illustrates this perfectly. Economists consistently underestimated how aggressively the Fed would raise rates to combat inflation, forecasting a peak Fed funds rate in 2022 of around 3.5% when it actually reached 5.25-5.50%. Yet even perfect rate forecasting wouldn't have helped predict the subsequent market behaviour. Basic finance theory suggests higher rates should pressure valuations, but the S&P 500 has hit repeated record highs since then, powered most recently by optimism around artificial intelligence. Perfect economic forecasting, in other words, is only half the challenge. |

|

Funds operated by this manager: |

7 Oct 2025 - When Regimes Shift, So Should Portfolios

|

When Regimes Shift, So Should Portfolios East Coast Capital Management September 2025 When Regimes Shift, So Should Portfolios For decades, investors have leaned on a familiar comfort: when equities stumble, bonds will catch the fall. It's the failsafe that underpinned the traditional 60/40 portfolio. But as the AFR recently highlighted in the article How a Regime Change Threatens to Upend an Investor Failsafe, picking up on insightful work by NAB's Chief Economist Sally Auld, a regime change is threatening to upend this assumption. Rising rates, stubborn inflation, and shifting geopolitical sands have eroded the very diversification investors once relied upon. The danger isn't just financial; it's psychological. Anchored to the past, many investors cling to strategies that no longer work, exposing portfolios to concentration risk, blind spots in diversification, and costly behavioural biases. At ECCM, we see this moment differently. For systematic trend followers, regime change isn't a threat. It's opportunity. Concentration Risk: When Safety Nets Fail In 2022, both equities and bonds fell together, breaking the old model wide open. Investors discovered that a portfolio concentrated in traditional assets was far less diversified than it appeared. Trend following offers a different safety net. Because we trade across nearly 100 global futures markets, from equities and bonds to commodities and currencies, we aren't tied to one economic narrative. When bonds fail to diversify equities, currencies or commodities may step in. That breadth allows us to adapt as correlations change. Diversification Gaps: Beyond Equity Proxies Private equity, venture capital, and private credit are often pitched as "alternatives." Yet beneath the surface, they remain highly tied to equities, real estate, or interest rates. In a regime where those links break down, many investors find their "alts" weren't alternative at all. Our approach is different. By systematically trading markets as diverse as copper, feeder cattle, the Japanese yen, or U.S. treasuries, we access return streams truly distinct from traditional asset classes. That's real diversification: the kind that matters when regimes shift. Behavioural Biases: Fighting Human Nature When conditions change, investors often make the wrong move at the wrong time. Buying what feels cheap, selling what feels expensive, or clinging to past frameworks that no longer hold. These biases are magnified during regime shifts, when uncertainty drives emotional decisions. Trend following replaces instinct with process. Our rules cut losses early, let winners run, and respond to what markets are doing, not what we wish they would do. In other words, we don't argue with the wind; we set our sails to harness it. Why This Matters Now NAB Chief Economist Sally Auld is right: regime change is here. Inflation cycles, policy reversals, and geopolitical fragmentation are rewriting old assumptions. But investors don't need to be caught off guard. At ECCM, we believe the solution lies in systematic, adaptive strategies that thrive across regimes. For more than five years, our ECCM Systematic Trend Fund has delivered double-digit compound returns net of fees, with consistently low correlation to traditional assets. For investors, the choice is clear: continue relying on an old failsafe that may no longer work, or embrace strategies designed for the uncertainty ahead. Conclusion Our purpose is simple: to help investors protect and grow wealth in every market condition. Regime changes may unsettle the old order, but with discipline, breadth, and expertise, they can be transformed from threat to opportunity. At ECCM, we're ready to help wholesale clients build portfolios resilient enough to weather storms, and strong enough to thrive in what comes next. Funds operated by this manager: |

25 Sep 2025 - Manager Insights | East Coast Capital Management

|

Chris Gosselin, CEO of FundMonitors.com, speaks with Simone Haslinger, Chief Executive Officer at East Coast Capital Management. Simon explains ECCM's fully systematic, data-driven trend-following approach across 80+ highly liquid global futures, designed to sidestep human bias and add low-correlated diversification to Australia-heavy portfolios. She highlights real-world examples from gold to feeder cattle, shares a strong multi-year track record, and contrasts liquid alternatives with illiquid private markets-making the case for a meaningful allocation to trend following.

|

19 Sep 2025 - Why the Gold Price Keeps Rising

|

Why the Gold Price Keeps Rising Marcus Today August 2025

|

|

Why does the gold price go up? Let me tell you the main reason the gold price goes up. All the gold dug up in the world is a lump of metal: 20.4m by 20.4m by 20.4m. That's all the gold ever dug up in the world. It grows about 2% per annum with production, and it shrinks about 2% per annum with consumption in things like electronics. So you've got this inert lump of metal, 20.4m square, sitting there -- earning nothing, doing nothing, looking pretty if it can -- and a whole load of people are running around it deciding what the price is. In the last couple of decades, two things have happened. One is exchange traded funds came along and bought. If it bought three metres by three metres by three metres, it completely changed the supply dynamics of this inert piece of metal. It's an amazing thought that if you could create an exchange traded fund backed by physical gold and start selling it, then as you sell you've got to find the gold. So you go into this inert, stable 20.4m cube and start buying chunks of it so that people invest in gold. It was self-fulfilling really. When exchange traded funds started in 2003, people started buying gold as an investment. It shoved demand up. Consequently, the gold price went from between $200 and $500 an ounce to $3,500. Now it's 20 years later and it's still going on. Exchange traded funds are buying gold, and when gold has a run it's a squeezy commodity to get hold of. That is backed by physical gold. So gold is being squeezed -- and squeezed again. Add on top of that currency. If you've got an inert piece of metal and everyone's running around it wondering what price it should be, and it's priced in US dollars, then because of a global financial crisis you print twice as many US dollars, the US dollar is worth half as much. For one thing it was the GFC, then Covid for another. Print twice as many US dollars and the currency is worth half as much. So the price of gold, and anything else priced in US dollars, doubles -- not because gold is worth any more, but because the currency is worth less. That's what's driven the gold price as well. One of the biggest drivers for the gold price is when the US dollar goes down. You'll find the gold price goes up. At the moment the US has a lot of debt. That weakens the currency. A currency is really a reflection of how strong an economy is. If they put tariffs in and it slows the US economy down, the US dollar goes down. If they start to cut interest rates, which it looks like they're going to, the currency goes down because it doesn't yield as much. All this is pushing towards a weaker US dollar. And a weaker US dollar is going to cause the gold price to go up again. So combined with the risk of "The Big One", a falling US dollar, exchange traded fund buying -- the gold price goes up. And that's what's going on at the moment. DISCLAIMER: This content is for general information purposes only and does not constitute personal financial advice. Please consider your own circumstances or seek professional advice before making investment decisions. |

|

Funds operated by this manager: |

17 Sep 2025 - Australian Equities Reporting Season Update September 2025

|

Australian Equities Reporting Season Update September 2025 Airlie Funds Management September 2025 |

|

Deputy Portfolio Manager Joe Wright and Portfolio Manager Will Granger provide an update of the recent reporting season. Joe and Will unpack the headline results but also explore the underlying themes that emerged across sectors. They share their perspectives on how companies have navigated a challenging economic environment, highlighting where management teams have delivered strong operational performance and where headwinds remain. Funds operated by this manager: Airlie Australian Share Fund , Airlie Small Companies Fund Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 trading as Airlie Funds Management ('Airlie') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should obtain and consider the relevant Product Disclosure Statement ('PDS') and Target Market Determination ('TMD') and consider obtaining professional investment advice tailored to your specific circumstances before making a decision about whether to acquire, or continue to hold, the relevant financial product. A copy of the relevant PDS and TMD relating to an Airlie financial product or service may be obtained by calling +61 2 9235 4760 or by visiting www.airliefundsmanagement.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any financial product or service, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of an Airlie financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Airlie makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Airlie. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. No representation or warranty is made with respect to the accuracy or completeness of any of the information contained in this material. Airlie will not be responsible or liable for any losses arising from your use or reliance upon any part of the information contained in this material. Any third party trademarks contained herein are the property of their respective owners and Airlie claims no ownership in, nor any affiliation with, such trademarks. Any third party trademarks that appear in this material are used for information purposes and only to identify the company names or brands of their respective owners. No affiliation, sponsorship or endorsement should be inferred from the use of these trademarks. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Airlie. |

8 Sep 2025 - Manager Insights | Altor Capital

25 Aug 2025 - Manager Insights | Argonaut Funds Management

|

Chris Gosselin, CEO of FundMonitors.com, speaks with David Franklyn, Managing Director and Co-Head of Funds Management at Argonaut. David outlines the Argonaut Natural Resources Fund, launched in 2020, which has delivered strong returns by investing across mining companies from majors like BHP to small-cap explorers. He highlights the fund's focus on themes such as energy transition and geopolitical risk, with gold as a safe haven and copper as the key growth driver, while noting that resources remain undervalued but vital to global growth.

|

18 Aug 2025 - Manager Insights | Digital Asset Funds Management

|

Chris Gosselin, CEO of FundMonitors.com, speaks with Clint Maddock, Director and Co-Founder at Digital Asset Funds Management, about the firm's Digital Income Fund and its market-neutral arbitrage strategy in the cryptocurrency space. Clint explains how the fund has delivered consistent double-digit annual returns with minimal drawdowns, and why growing mainstream adoption of digital assets continues to create opportunities.

|

14 Aug 2025 - Expert Analysis of the RBA's August 12 Rate Decision

|

Expert Analysis of the RBA's August 12 Rate Decision FundMonitors.com August 2025 |

|

Chris Gosselin, CEO of FundMonitors.com, speaks with Nicholas Chaplin, Director and Portfolio Manager at Seed Funds Management, and Renny Ellis, Director & Head of Portfolio Management at Arculus Funds Management, following the Reserve Bank of Australia's surprise 25 basis point rate cut. The panel debates whether the decision was justified or politically driven, explores its implications for inflation, the property market, and investors, and examines the potential for further rate cuts. They also discuss global influences, including U.S. tariffs and their impact on inflation and markets. |

11 Aug 2025 - Webinar Recording 04 August 2025 | How to get the most from Fundmonitors

|

Webinar Recording | How to get the most from Fundmonitors FundMonitors.com 04 August 2025 |

|

To help you get a better understanding of the www.fundmonitors.com database, watch this webinar recording to help you learn to navigate the database and get the most out of its powerful fund analytics. The webinar covered the following:

If you like to see just 1 aspect of the webinar feel free to jump to the relevant timestamp: |

8 Aug 2025 - Expert analysis on what the RBA will do next Tuesday, August 12

|

Expert analysis on what the RBA will do next Tuesday, August 12 FundMonitors.com August 2025 |

|

Chris Gosselin, CEO of FundMonitors.com, speaks with Nicholas Chaplin, Director and Portfolio Manager at Seed Funds Management, and Renny Ellis, Director & Head of Portfolio Management at Arculus Funds Management, ahead of the RBA's August board meeting. Both accurately predicted July's decision to hold rates and weigh in on whether a cut is likely this time. They discuss key economic indicators--including unemployment, inflation, fiscal stimulus, and consumer sentiment--arguing that while conditions justify holding steady, political pressure may force the RBA's hand. The conversation also touches on global influences, particularly rising inflation risks in the US driven by tariffs and currency movements. Both managers share their outlook for the remainder of the year, expecting at most one further rate cut, and outline how they're positioning portfolios amid uncertainty in rates, credit markets, and global economic trends. |

4 Aug 2025 - Webinar Recording 28 July 2025 | How to get the most from Fundmonitors

|

Webinar Recording | How to get the most from Fundmonitors FundMonitors.com 28 July 2025 |

|

To help you get a better understanding of the www.fundmonitors.com database, watch this webinar recording to help you learn to navigate the database and get the most out of its powerful fund analytics. The webinar covered the following:

|

Online Applicatons

Free, simple and secure

Olivia123 - the fast simple and secure online alternative to completing paper based application forms.