NEWS

30 Nov 2023 - Performance Report: Equitable Investors Dragonfly Fund

[Current Manager Report if available]

30 Nov 2023 - On the road: is India starting to live up to its promise?

|

On the road: is India starting to live up to its promise? abrdn November 2023 My recent trip underlined the nation's growth potential, with a vibrant economy, increasing investments and the promise of fresh overseas capital into its bond market. The burgeoning potential of India's vibrant economy is palpable from the moment you set foot in the country, with its young workforce noticeable as soon as you land. On my latest visit to the country in September, what became immediately apparent was infrastructure improvements to ease congestion - an encouraging sign of government progress. Construction to develop other transport links are also in the pipeline, including Mumbai Metro Line 3 connecting Cuffe Parade to Aarey district and a bullet train from Mumbai to Ahmedabad. The bullet train will cut travelling time between Mumbai and Ahmedabad to just two hours. It underlines India's growth potential. At an estimated cost of $13.6 billion and completion date of 2027, the bullet train will cut travelling time between the cities to just two hours, from over six hours previously. It underlines India's growth potential. Site of main bullet train terminal (highlighted in red) and the metro (highlighted in orange) in Mumbai. But while congestion has improved, it's from a low base. India has ground to cover to drive efficiency and keep its GDP growth outlook on track, which most economists estimate at 6-6.5% per year. But the government is in action mode, with INR3.7 trillion ($45 billion) in public spending for the first five months of the current financial year already INR2.52 trillion higher than the same period last year. Feedback on the groundMy discussions with companies on the ground underlined the resilience of both the domestic jobs market and India's broader economy. Company leaders aren't anticipating any imminent reduction in interest rates, with the Reserve Bank of India (RBI) having held steady at 6.5% since February and retained a tight stance on liquidity to shift inflation of 6.8% down towards its 4% target. With recent data showing investment up 8% year-on-year in the second quarter, we see room for a pick-up in private investment, with companies' capital spending still allocated to sectors with the highest growth potential. This places less demand on the government to drive growth, allowing it to focus on fiscal consolidation and, in turn, lowering its funding requirements from the bond market. Mumbai is awash with infrastructure projects. Renewable energy is one area where we see an increase in investment. Sprawling conglomerate Reliance Industries - best known for its oil refinery business - has pledged to deploy capital into new energy over the long term to develop this segment of its business. Reliance is also investing heavily in the rollout of 5G over the next 12 months to tap into India's high adoption of smart phones. A recent survey by Ericsson estimated that 31 million users were likely to upgrade to 5G phones by the end of this year. Separately, fellow conglomerate Tata group - one of the country's largest employers - is looking for new office space to meet growing demand for its IT consultancy services. Indeed, the nation's services exports are holding up despite the global slowdown in demand for goods. India's services balance for the second quarter of 2023 was over $4 billion higher year-on-year and has been useful to offset weakness in goods exports. Most businesses welcome RBI's efforts to suppress foreign exchange volatility since it allows them to plan and hedge with greater certainty, although the small pick-up from rupee deposits currently on offer at around 6.5% isn't attractive enough to encourage immediate repatriation of export earnings when US dollar equivalents are above 5%. While exporters must convert these to local currency within 90 days, most are in no hurry until they see higher local deposit rates from here, which would slow RBI's pace of FX accumulation. Importantly, the recent decision to include Indian government bonds (IGBs) in the JP Morgan GBI Emerging Markets Global Diversified Index from June next year is a hot topic after much speculation over recent years. Now the onus is on other index providers to do the same. Both onshore and offshore stakeholders in India welcome this development since it promises to expand the bond market's investor base, adding a positive tilt to the demand-supply dynamics for Indian fixed income. Initially, the index provider estimated that inclusion would result in $25 billion in inflows (10% of the $250 billion tracking the index), although we anticipate higher flows since a third of the $250 billion comes from customised indices that exclude China in the investible universe. This points to a sizeable pool of active managers more likely to have overweight positions in India. While there are fears about the potential for large foreign outflows in a risk-off environment, ultimately expected inflows would still be less than 5% of the RBI's $600 billion war chest of FX reserves. Adding to this favourable backdrop, a recent rule change to allow banks to hold more high-quality bonds in their hold-to-maturity portfolios should provide another source of support for government debt. Together with index inclusion, it creates a positive demand picture for Indian bonds. Reasons to be bullishDomestic investors are known for a bullish outlook on India. But the reasons are starting to stack up given favourable demographics, its status as a global IT services hub and the fact it is a beneficiary of the China+1 strategy where companies seeking to diversify are looking to invest in India. Central bank action means rupee volatility is also among the lowest of all Asian currencies. Few investors that I spoke to are talking about the tail-risk scenario raised by JP Morgan chairman Jamie Dimon recently that US interest rates could hit 7%, which would likely have a major impact on emerging markets, including India. Perhaps that's because there's an expectation that income growth in a vibrant population of 1.4 billion people could counterbalance any external global shocks. If improvements in infrastructure are anything to go by, India may finally be living up to its much-vaunted promise. Author: Soh Wai-Kiat, Investment Manager, Fixed Income Asia |

|

Funds operated by this manager: Aberdeen Standard Actively Hedged International Equities Fund, Aberdeen Standard Asian Opportunities Fund, Aberdeen Standard Australian Small Companies Fund, Aberdeen Standard Emerging Opportunities Fund, Aberdeen Standard Ex-20 Australian Equities Fund (Class A), Aberdeen Standard Focused Sustainable Australian Equity Fund, Aberdeen Standard Fully Hedged International Equities Fund, Aberdeen Standard Global Absolute Return Strategies Fund, Aberdeen Standard Global Corporate Bond Fund, Aberdeen Standard International Equity Fund, Aberdeen Standard Multi Asset Real Return Fund, Aberdeen Standard Multi-Asset Income Fund |

29 Nov 2023 - Performance Report: Insync Global Capital Aware Fund

[Current Manager Report if available]

29 Nov 2023 - 10k Words | November 2023

|

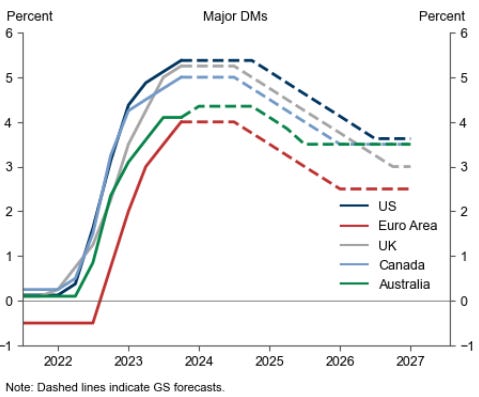

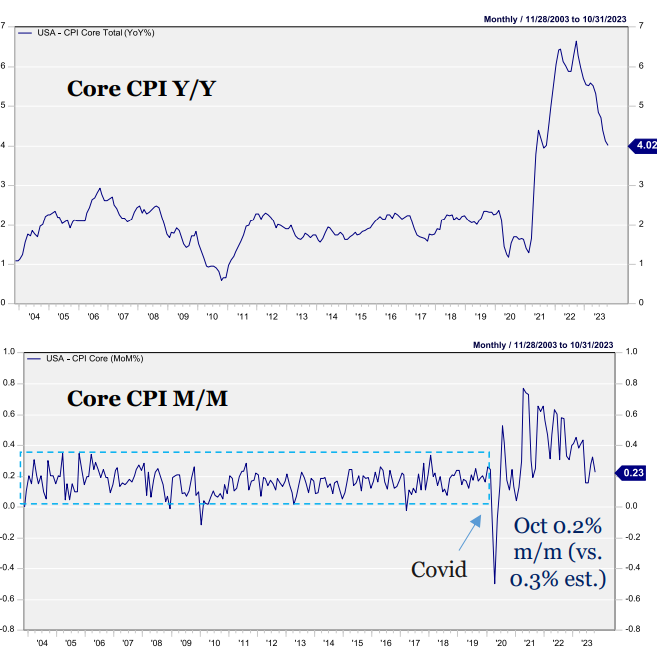

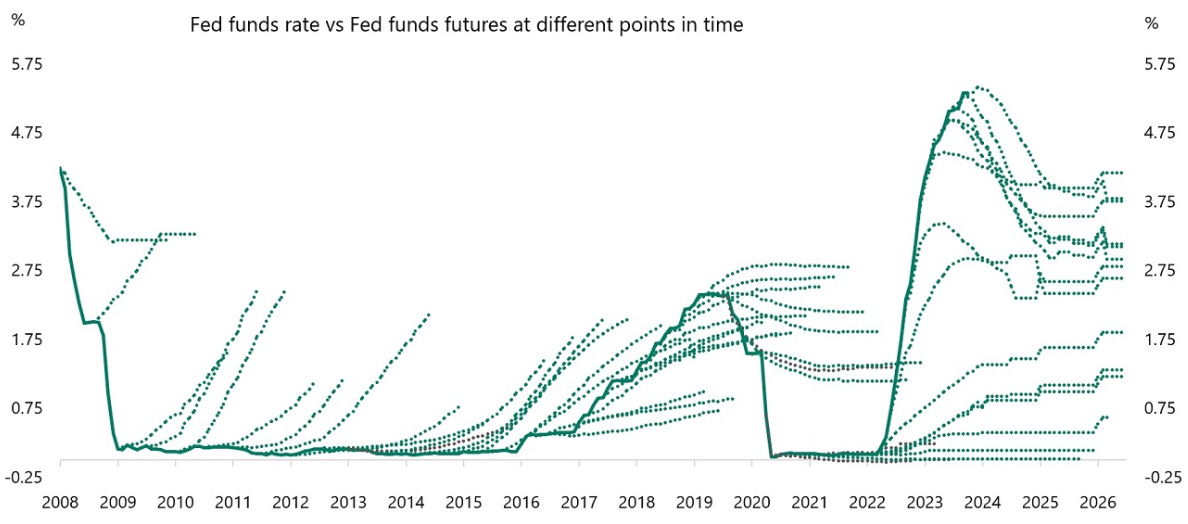

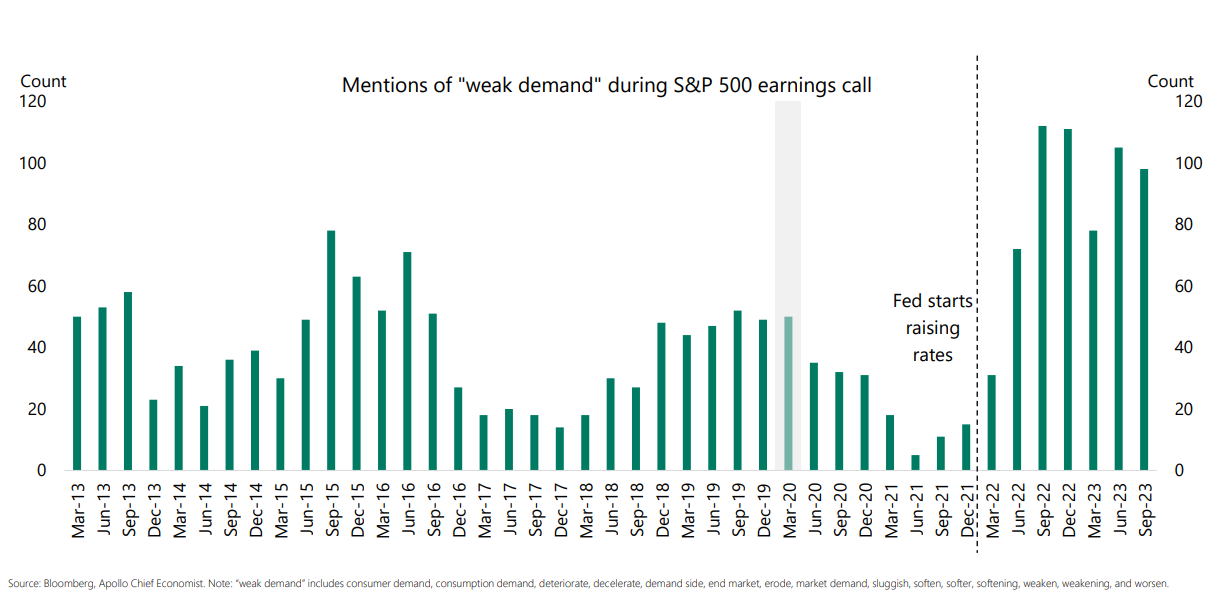

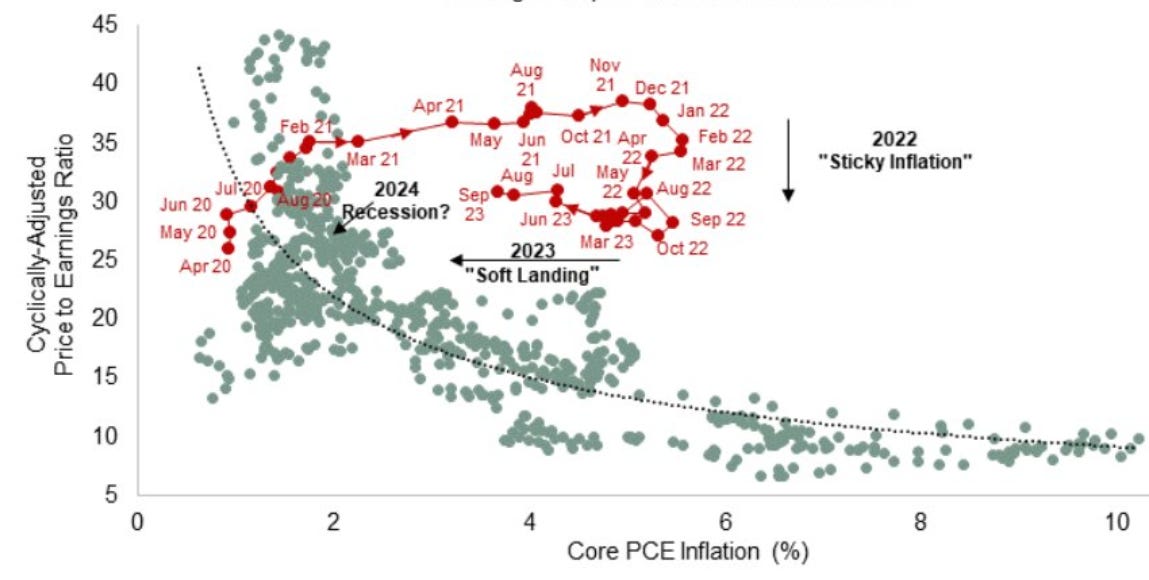

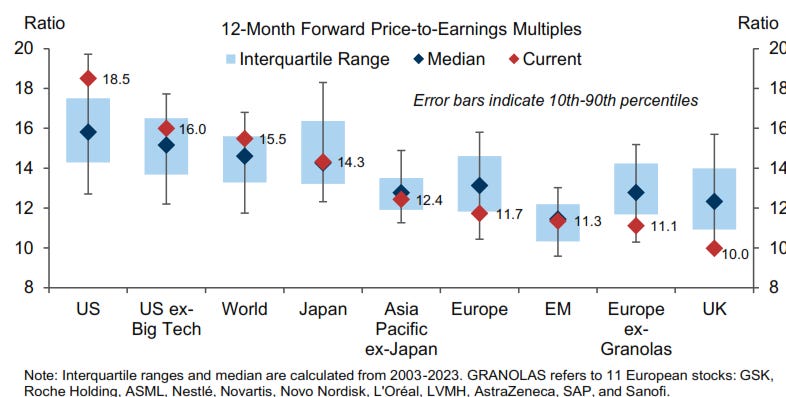

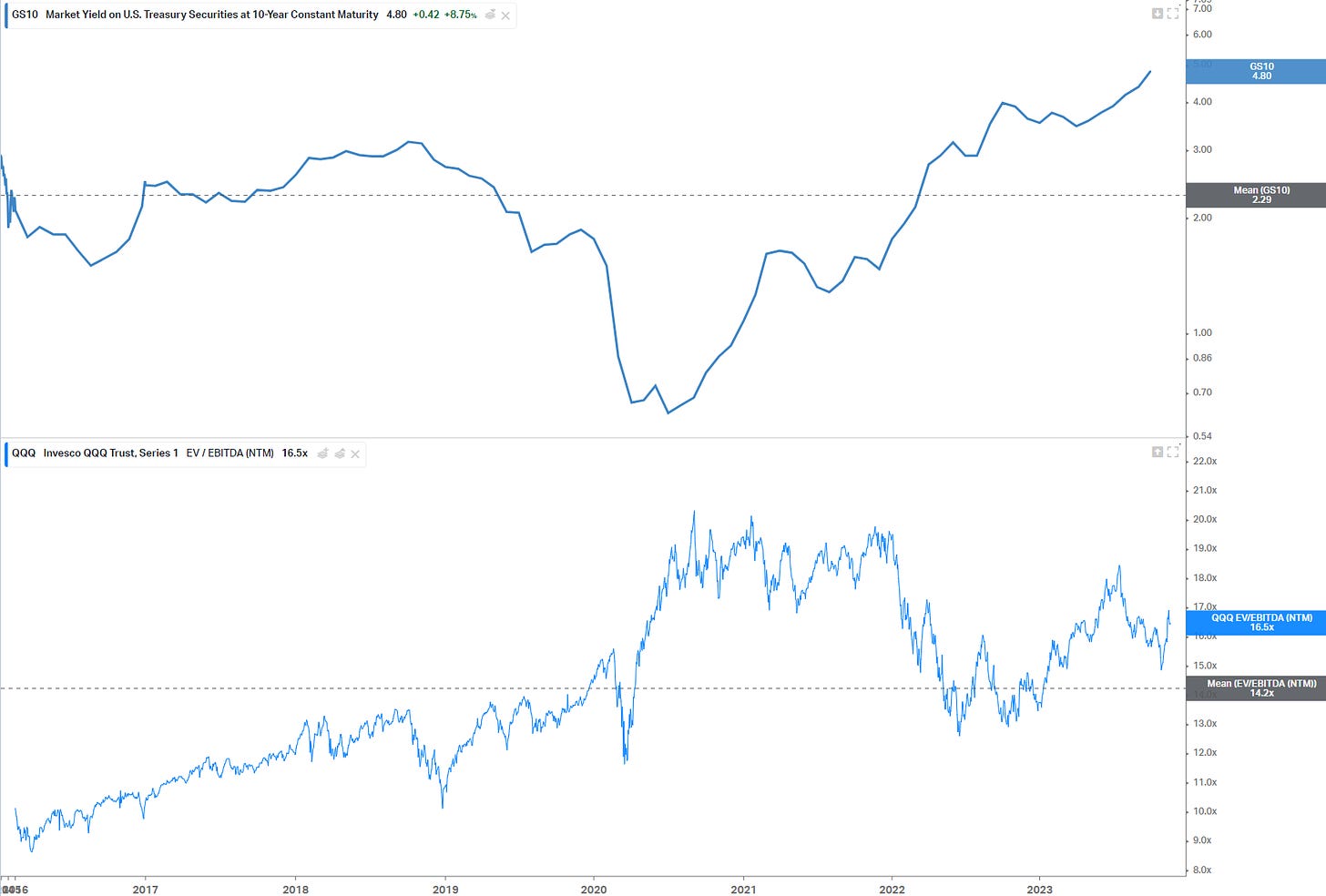

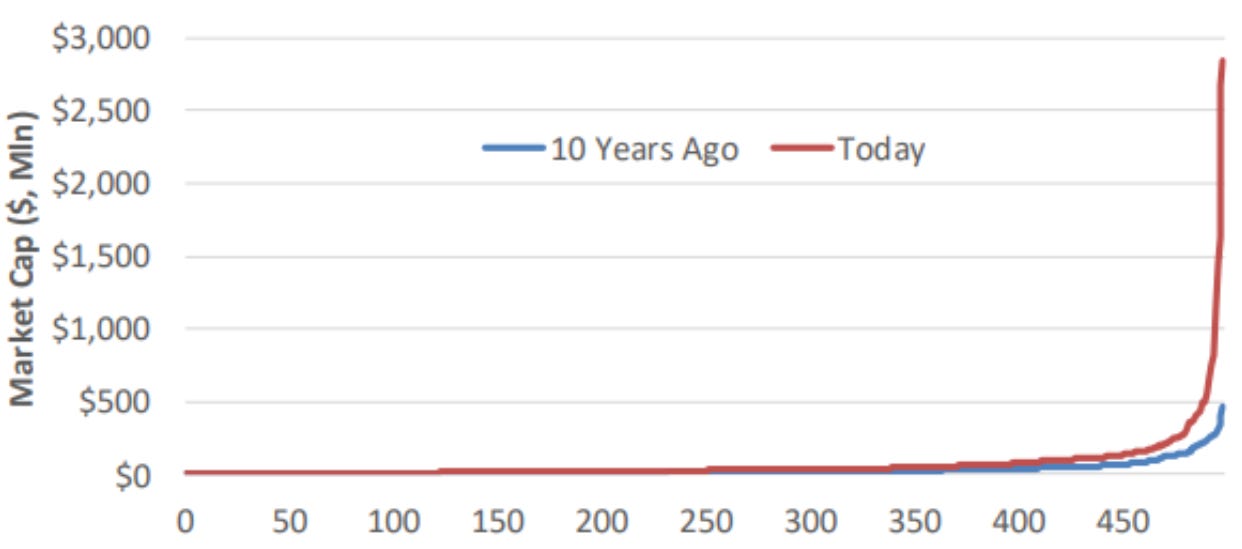

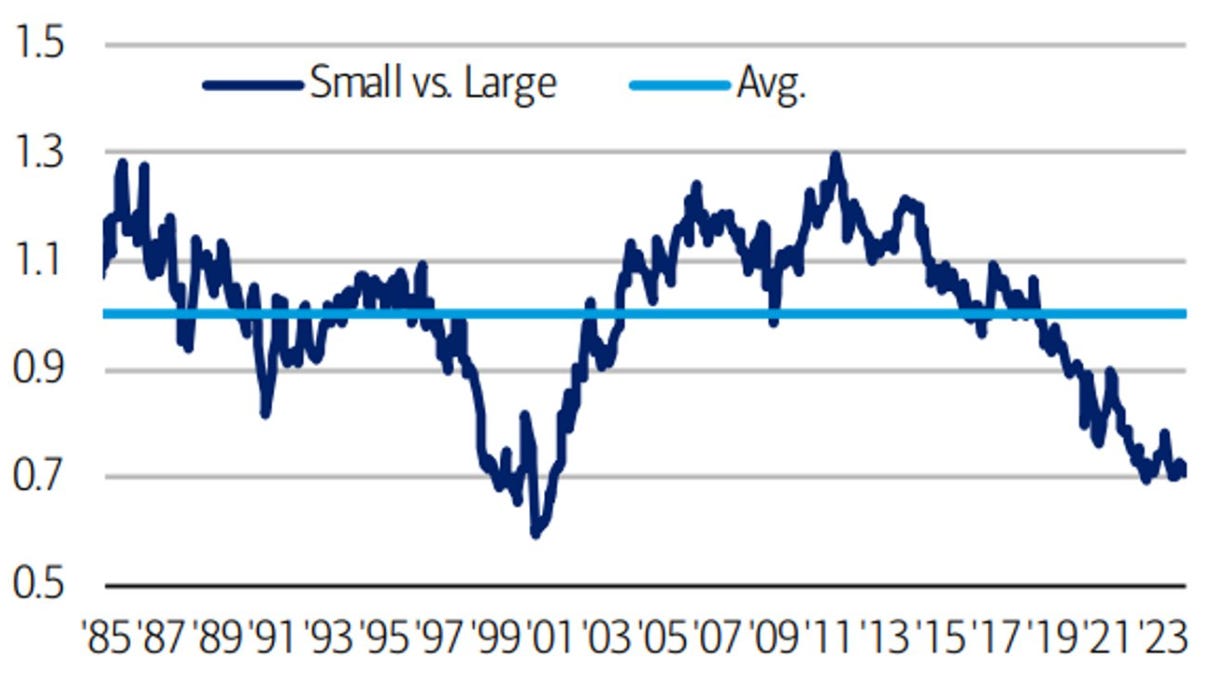

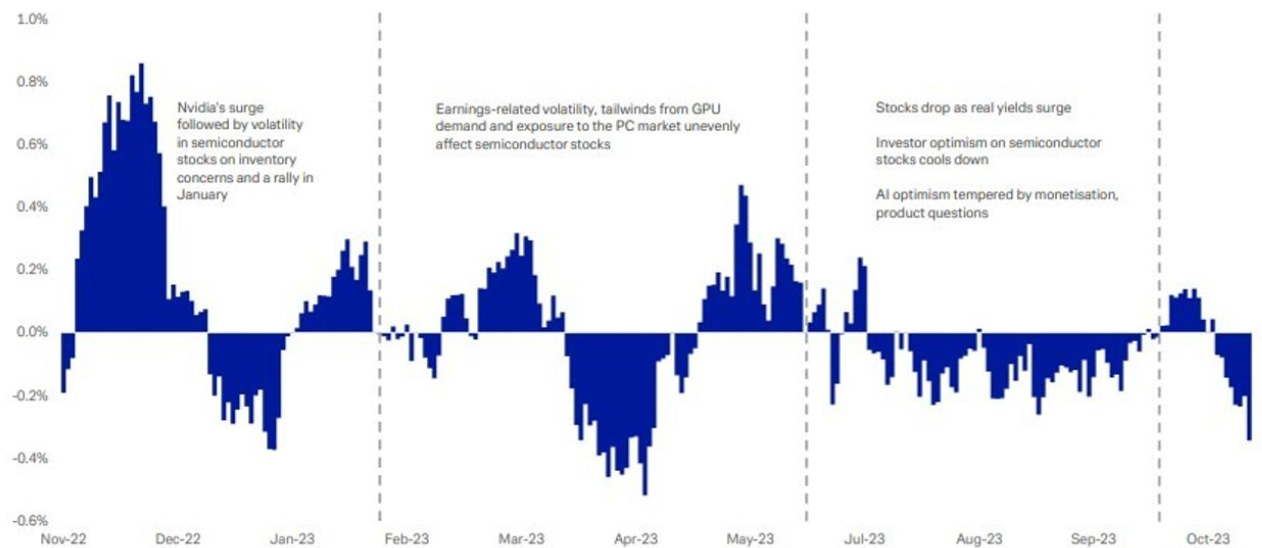

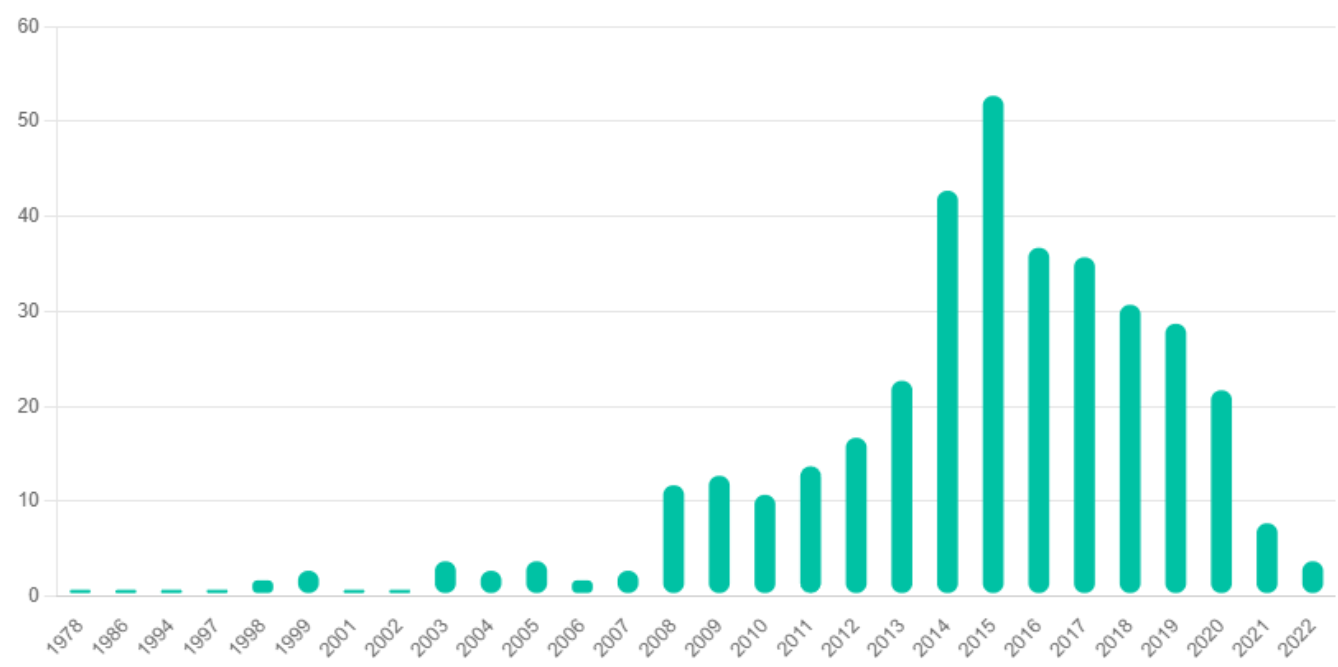

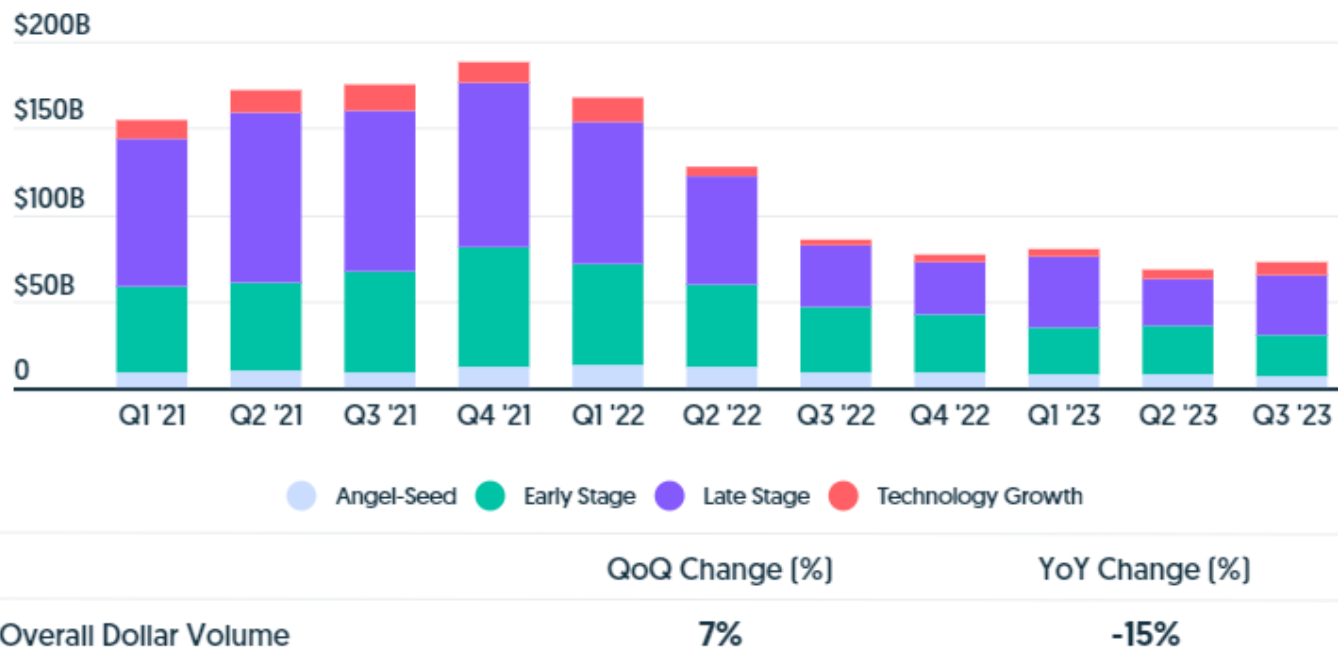

10k Words Equitable Investors November 2023 "Although we forecast that major DM central banks (aside from Japan) are finished hiking, our baseline forecast implies little incentive for them to cut interest rates in the near term," Goldman Sachs foreshadows, with Raymond James charting the cooling of core US inflation to levels still higher than seen for many years. Our favourite chart this month has Apollo showing that the market is almost always wrong about what the Fed will do next. Apollo backs up with a graphic on "weak demand". SMBC NIkko gives us a view on the relationship between inflation and valuation. Tech stocks are at record highs relative to the broader market as Bank of America charts, while Goldman shows the impact on market valuations. Equitable Investors looks at movement in the EV/EBITDA multiple on tech stocks relative to bond yields. We get another take on the surge in index concentration from Bespoke - and small v large via Bank of America. Deutsche Bank reckons AI didn't drive markets. Finally we get stuck into VC, where Crunchbase data shows significantly less unicorns being born and funding remaining subdued, with the Refinitiv Venture Capital Index remaining well of its highs despite recent gains. Goldman Sachs' policy rate forecasts for developed markets Source: Goldman Sachs Core US CPI Source: Raymond James The market is almost always wrong about what the Fed will do Source: Apollo Mentions of "weak demand" during S&P 500 earnings calls Source: Apollo Earnings multiples mapped against inflation Source: SMBC NIkko via Bloomberg Tech sector at all-time high vs S&P 500 Source: Bank of America Price-to-Earnings multiples by market - tech sector elevates US multiples Source: Goldman Sachs US 10 year bond yield (top) mapped against US tech sector (QQQ ETF - bottom) Source: Koyfin, Equitable Investors S&P 500 stocks from smallest to largest - 10 years ago v today Source: Bespoke US small caps histoically cheap vs large caps (Forward PE of Russell 2000 v Russell 1000) Source: Bank of America Difference between abnormal returns for semiconductor and software firms, 20 day moving average Source: Deutsche Bank Emerging unicorns by the year founded Source: Crunchbase Global venture funding (US dollar volume) Source: Crunchbase Refinitiv Venture Capital Index Source: Financial Times November Edition Funds operated by this manager: Equitable Investors Dragonfly Fund Disclaimer Nothing in this blog constitutes investment advice - or advice in any other field. Neither the information, commentary or any opinion contained in this blog constitutes a solicitation or offer by Equitable Investors Pty Ltd (Equitable Investors) or its affiliates to buy or sell any securities or other financial instruments. Nor shall any such security be offered or sold to any person in any jurisdiction in which such offer, solicitation, purchase, or sale would be unlawful under the securities laws of such jurisdiction. The content of this blog should not be relied upon in making investment decisions. Any decisions based on information contained on this blog are the sole responsibility of the visitor. In exchange for using this blog, the visitor agree to indemnify Equitable Investors and hold Equitable Investors, its officers, directors, employees, affiliates, agents, licensors and suppliers harmless against any and all claims, losses, liability, costs and expenses (including but not limited to legal fees) arising from your use of this blog, from your violation of these Terms or from any decisions that the visitor makes based on such information. This blog is for information purposes only and is not intended to be relied upon as a forecast, research or investment advice. The information on this blog does not constitute a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Although this material is based upon information that Equitable Investors considers reliable and endeavours to keep current, Equitable Investors does not assure that this material is accurate, current or complete, and it should not be relied upon as such. Any opinions expressed on this blog may change as subsequent conditions vary. Equitable Investors does not warrant, either expressly or implied, the accuracy or completeness of the information, text, graphics, links or other items contained on this blog and does not warrant that the functions contained in this blog will be uninterrupted or error-free, that defects will be corrected, or that the blog will be free of viruses or other harmful components. Equitable Investors expressly disclaims all liability for errors and omissions in the materials on this blog and for the use or interpretation by others of information contained on the blog |

28 Nov 2023 - Performance Report: PURE Resources Fund

[Current Manager Report if available]

28 Nov 2023 - Acceleration of innovation now spells danger for investors

|

Acceleration of innovation now spells danger for investors Insync Fund Managers November 2023

A new app, 'Threads' built by Instagram, which enables the sharing of text updates and joining public conversations, recently reached 100 million users within an astonishing five days. 'This is a powerful demonstration of the lightning speed at which innovation is accelerating,' says Insync Funds Management (Insync)'s Head of Strategy and Distribution, Grant Pearson. 'Make no mistake, the frantic pace of change now spells danger for investors.' For context, Facebook took 4.5 years to reach 100 million users, Instagram took 2.5 years, TikTok achieved it in nine months, and Chat GPT took two months. 'The reason this means big trouble for investors is that they could be in the right company today and, as little as weeks later, be in the wrong company,' Mr Pearson says. The pace of innovation does not just affect pure technology plays. 'All companies could be affected as they all rely on technology of some sort,' he says. 'If their competition embraces new technology better and faster, a dominant company today may find its revenues and profits under immediate threat. And let's not forget brand new competitors for firms that technology has opened the gates to.' Mr Pearson says that while in the past investors had months or even years to discover an emerging technological breakthrough, assess it, seek views, and then act; now they have next to no time and the skills required to do it are often outside the investment industry. 'In fact, the average life span of successful businesses is being compressed into less than 10 years duration,' he went on to say. 'This is disruption accelerating at the same time that time frames are compressing.' Annual increases in computing processing power are now many hundreds of times faster than previous computers which are themselves under five years old. 'Look out further, say six years, and it's even more profound,' he says. 'Google's latest Sycamore Quantum Computer, testing now with operational status by 2029, is an astonishing 241 million times more powerful than today's fastest supercomputers!' In other words, Sycamore can solve in seconds a problem that takes today's fastest supercomputer 47 years. 'This first iteration of Sycamore is only the 'Model T' of what is to come,' Mr Pearson says. 'The alarming thing for the investment community is that we are only at the very beginning of this acceleration. It is akin to sitting in a roller coaster as it has just tipped into its near vertical first run.' Couple this extraordinary increase in power with the advances in AI and Mr Pearson says gargantuan change is afoot, change that will revolutionise our world and turn most industries upside down, along with investor returns. 'Fund managers and researchers need to quickly create robust means to assess and counter the acceleration of technological change and shrinking time frames, to reduce the threats to returns, as well as better understand which companies will deliver the decent performances of tomorrow,' he says. 'Our industry has a reputation for being slow to change, with egos routinely getting in the way of adapting. Investors need to check carefully that their fund managers are very clear as to how these factors impact their investment processes if they are not to be blindsided and saddled with disappointing returns.' Funds operated by this manager: Insync Global Capital Aware Fund, Insync Global Quality Equity Fund Disclaimer |

27 Nov 2023 - Performance Report: Emit Capital Climate Finance Equity Fund

[Current Manager Report if available]

27 Nov 2023 - New Funds on Fundmonitors.com

|

New Funds on FundMonitors.com |

|

Below are some of the funds we've recently added to our database. Follow the links to view each fund's profile, where you'll have access to their offer documents, monthly reports, historical returns, performance analytics, rankings, research, platform availability, and news & insights. |

|

||||||||||||||||||||

| EQT Tax Aware Australian Share Fund (Retail) | ||||||||||||||||||||

|

||||||||||||||||||||

| View Profile | ||||||||||||||||||||

| EQT Tax Aware Australian Share Fund (Wholesale) | ||||||||||||||||||||

|

||||||||||||||||||||

| View Profile | ||||||||||||||||||||

| EQT Tax Aware Diversified Fund | ||||||||||||||||||||

|

||||||||||||||||||||

| View Profile | ||||||||||||||||||||

| EQT Diversified Fixed Income Fund (Retail) | ||||||||||||||||||||

|

||||||||||||||||||||

| EQT Diversified Fixed Income Fund (Wholesale) | ||||||||||||||||||||

|

||||||||||||||||||||

| View Profile | ||||||||||||||||||||

|

||||||||||||||||||||

| Maple-Brown Abbott Australian Sustainable Future Fund | ||||||||||||||||||||

|

||||||||||||||||||||

| View Profile | ||||||||||||||||||||

|

Want to see more funds? |

||||||||||||||||||||

|

Subscribe for full access to these funds and over 750 others |

24 Nov 2023 - Hedge Clippings | 24 November 2023

|

|

|

|

Hedge Clippings | 24 November 2023 As much as we'd like to move on from discussing inflation in Hedge Clippings each week, the reality is that while lower than it was, it will be some time before the genie is safely back in the bottle. And while that's the case, there's little chance of interest rates falling, either locally or offshore in the US, UK or Europe. In the US there were hopes that they might consider easing sooner rather than later, but more recent minutes from the Federal Reserve's November meeting indicate a distinct unwillingness to do so, fearing that pivoting to a downward trend in rates too soon would potentially waste the hard won success to date. If anything the Fed warned rates could still rise if required, and meanwhile they'd "proceed carefully" before moving. In the UK - where inflation has been as high as 11% and is now back down to 4.6% - the message is the same. The UK kept rates steady at 5.25% for the second time following 14 consecutive hikes, but BoE governor Andrew Bailey was clear that he wasn't going to be rushed into cuts, saying the fear of persistent inflation was too great to risk doing so. Equally ECB president Christine Lagarde echoed those thoughts. Meanwhile at home freshly appointed RBA governor Michele Bullock scotched any thoughts that the fight had been won, even singling out dentists and hairdressers as jumping on the price rise bandwagon and pushing up inflation in the services sector. While unlikely that there'll be a further rate rise in December, and with no RBA meeting in January, it doesn't rule out yet another move upward in February or March. If anything Bullock is sounding more hawkish than Philip Lowe, possibly because she doesn't have his legacy of saying rates wouldn't rise until 2024. As Bullock noted in her speech to economists during the week, interest rates are a "blunt instrument" when it comes to taming inflation, but it's also pretty much the only instrument she has. And as we've noted before, that instrument strikes those least able to cope, assuming they have a mortgage. What hasn't happened yet - and we don't believe it will - is that increased mortgage rates will lead to an increase in arrears, and subsequently forced sales and falling house prices. That scenario would only be predicated on a full scale recession, which we also think unlikely. Even without a mortgage, rental rates are also increasing as investors strive to offset increased repayments, added to which the overall housing shortage is being magnified by short terms rentals via the likes of Airbnb, and high levels of immigration. So the outlook remains for inflation to remain front and centre, and therefore on our weekly agenda, for some time to come. Meanwhile, this week marked a few milestones and anniversaries - the most poignant one probably being the assassination of President Kennedy in Dallas 60 years ago last Wednesday. Once known by all those old enough to remember where they were when they heard the news, there's now a whole generation for whom the death of JFK is just a page in the history books. More up to date, and still on the subject of US presidents, three years ago today the formal transition to Joe Biden's administration began - so that's three years of Donald Trump claiming he didn't lose the election. You can't say he isn't persistent! News & Insights New Funds on FundMonitors.com Investment Perspectives: What does 'higher for longer' mean for real estate? | Quay Global Investors Stock Story: ResMed | Airlie Funds Management Events & Webinars October 2023 Performance News Bennelong Long Short Equity Fund Bennelong Twenty20 Australian Equities Fund Digital Asset Fund (Digital Opportunities Class) |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday |

24 Nov 2023 - Performance Report: PURE Income & Growth Fund

[Current Manager Report if available]