NEWS

3 Oct 2023 - Investment Perspectives: A big disinflation tailwind is coming

29 Sep 2023 - Hedge Clippings | 29 September 2023

|

|

|

|

Hedge Clippings | 29 September 2023 Although some sections of the media attempted to make a big deal of it, Wednesday's headline annual inflation rate for August, which came in at 5.2%, up from 4.9% the previous month, was both widely expected, and no cause for the RBA to reverse their recent "pause" approach. That will come as a relief for Michele Bullock, who would hardly have wanted to kick her tenure off with a rate rise after three straight months of them holding steady. The RBA board will be more interested in the core inflation level, which excludes volatile items such as fruit and vegetables, fuel, and holiday travel, and which fell to 5.5% from the previous month's level of 5.8%. The pain points in the numbers were bread and cereals, and dairy, both of which recorded a 12 month rise of just over 10%, offset by fruit and vegetables which fell by 8.3%. We assume anyone on a diet of bread and potatoes therefore (apart from a growing girth) would have come out about even! On a more serious note, gas and electricity rose over 12%, and fuel costs were up almost 14%, as anyone who has filled up recently would know. While inflationary, both these are in part doing the RBA's job of dampening consumer demand, as evidenced by the insipid retail sales figures for August, which came in at 0.2% for the month, and 1.5% for the year. While a few economists are still predicting the possibility of one more rate rise down the track from the RBA, on current data that's unlikely. However, the "stronger for longer" inflationary and interest rate outlook is far more likely, with our view that the 2-3% band is at best a long way off, and quite possibly a thing of the past. Ditto in the US, although the potential for one more rate rise is possibly a little higher than here. However Jerome Powell is shooting for 2%, as opposed to the RBA's 2-3% band, and that's going to be even harder to achieve without more consumer and economic pain. Ditto, or at least "deja vu" seems to be the best way to describe a number of goings on in the US at present: The recurring potential for a government funding shutdown is on again, although as yet markets don't seem too concerned. Maybe they're getting used to it, having seen previous negotiations always end up the same way - with an increased debt ceiling. Sooner or later one would think the ceiling's going to crack, or ...? And finally, in the US everything to do with Donald Trump also seems to be a recurring theme, with yet another court appearance (and loss), and yet another non-appearance at a Republican presidential debate. Neither avoidance, nor appearance seem to dent Trump's self belief, or for that matter, his supporters' commitment to his cause. Only in America! Moving on: We could try to intertwine commitment into any discussion regarding the Wallabies performance in the RWC last week, but that might be a cheap shot. If you take a youthful squad, many of whom should only have been playing at the 2027 event, and leave your most experienced players behind, what do you expect? As far as commitment goes, or the perception of it, Eddie's discussions with the Japanese RU will hopefully result in him accepting their job offer. If it comes, it can't come soon enough! We hope the Wallabies can overcome Portugal on Monday morning, but even that might not be a foregone conclusion based on last week's performance. However, this week-end should see a tighter contest at both the AFL and ARL Grand Finals. Sit back and enjoy, and may the best teams win. News & Insights Market Commentary | Glenmore Asset Management Climate Finance Strategies and Global Decarbonisation | Emit Capital Market Update August | Australian Secure Capital Fund August 2023 Performance News |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday |

29 Sep 2023 - Performance Report: Insync Global Quality Equity Fund

[Current Manager Report if available]

28 Sep 2023 - Performance Report: DS Capital Growth Fund

[Current Manager Report if available]

28 Sep 2023 - The Rate Debate - Ep 42: Inflation has peaked

|

The Rate Debate - Ep 42: Inflation has peaked Yarra Capital Management September 2023 Outgoing Reserve Bank governor Philip Lowe finished his tenure as he began by keeping rates on hold as inflation cools. With inflation past its peak, can we expect rate cuts on the horizon, and could a softening of China's economy bring them even closer, or will services inflation drive the incoming governor Michele Bullock to deliver a rate rise later this year? Darren is joined by special guest Roy Keenan, Co-Head of Fixed Income, to explore this and the outlook for credit markets in episode 42 of The Rate Debate. |

|

Funds operated by this manager: Yarra Australian Equities Fund, Yarra Emerging Leaders Fund, Yarra Enhanced Income Fund, Yarra Income Plus Fund |

27 Sep 2023 - Performance Report: Insync Global Capital Aware Fund

[Current Manager Report if available]

27 Sep 2023 - Climate Finance Strategies and Global Decarbonisation

26 Sep 2023 - Performance Report: PURE Resources Fund

[Current Manager Report if available]

26 Sep 2023 - Australian Secure Capital Fund - Market Update

|

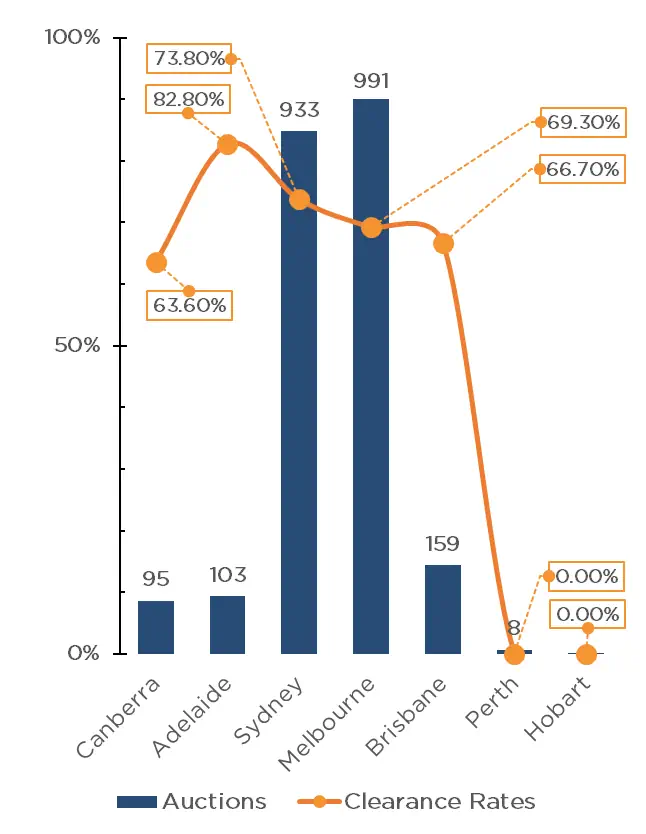

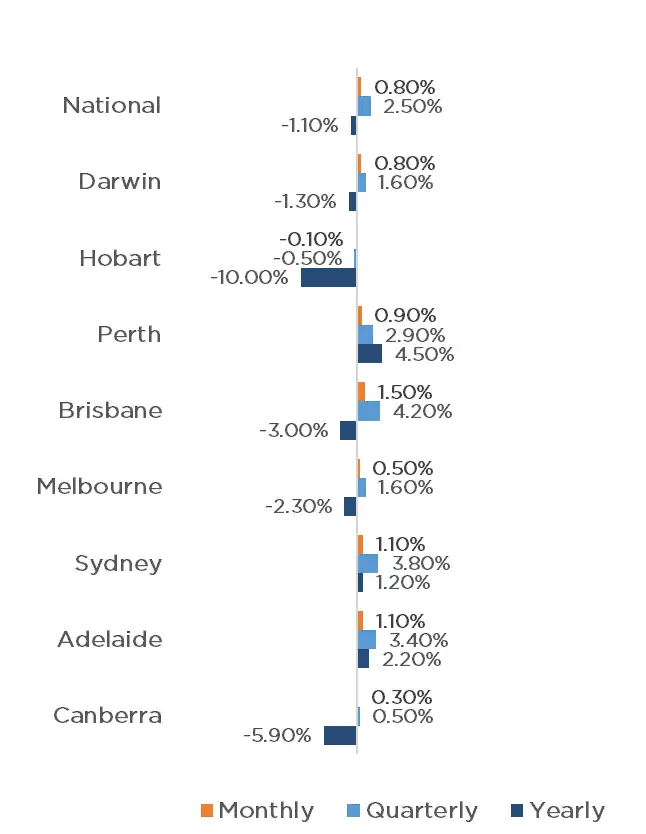

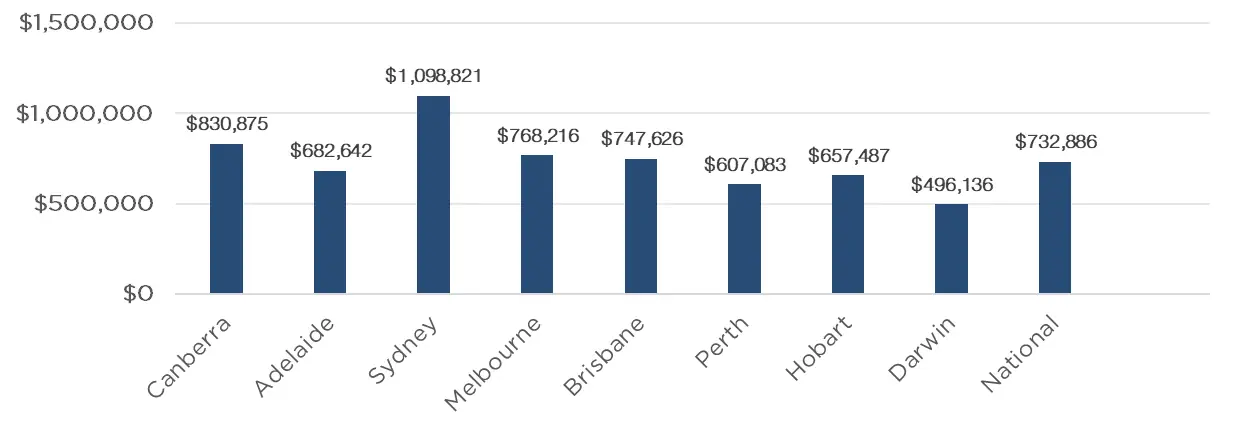

Australian Secure Capital Fund - Market Update Australian Secure Capital Fund September 2023 The RBA has elected to maintain the current cash rate for the third month in a row, with economists predicting we are at the top of the interest rate cycle. This is a positive sign for Australian property prices, as consumer confidence begins to increase. The CoreLogic Home Value Index for the month of August is extremely positive, with all capital cities excluding Tasmania recording growth. Brisbane has led the way, with a 1.5% increase for the month, followed by Sydney and Adelaide, both recording a 1.1% increase. Perth, Darwin, Melbourne and Canberra also recording monthly growth of 0.9%, 0.8%, 0.5% and 0.3% respectively. Tasmania was the only capital city which did not experience growth for the month, falling just 0.1%. Whilst the capital city data was favourable, the regions experienced mixed results, with only regional South Australia, Queensland and Western Australia experiencing growth with 0.9%, 0.8% and 0.1% respectively. Regional Victoria fell the furthest, with a 0.6% reduction, along with New South Wales recording a 0.2% fall. The other regions remained stable. In a positive sign, property prices have continued to increase despite supply also increasing. The number of auctions taking place continues to increase, with 2,291 auctions taking place on the first weekend of September, up from 1,823 on the same weekend in 2022. Further bolstering the apparent strength of the Australian property market is that clearance rates also remain high, with a 71.2% clearance rate for the combined capital cities, up from 59.4% from last year. Melbourne and Sydney held the most auctions with 991 and 933 respectively, with Brisbane (159), Adelaide (103) and Canberra (95) well behind. Further behind was Perth and Tasmania recording just 8 and 2 auctions for the weekend. Adelaide recorded the highest clearance rate of 82.8%, followed by Sydney (73.8%), Melbourne (69.3%) and Brisbane (66.7%) all performing above last years results. Canberra was the only market in which the clearance rate dropped, with 63.6% for the weekend, down from 67.7% last year. Economists now predict we are at the end of the rate hike cycle and that demand should also increase as consumer sentiment rises on the back of interest rate stability, and the expectation that rates may begin to fall in mid to late 2024. Clearance Rates & AuctionsWeek of the 3rd of September 2023

|

25 Sep 2023 - Performance Report: Bennelong Twenty20 Australian Equities Fund

[Current Manager Report if available]