NEWS

10 Jul 2023 - Performance Report: ASCF High Yield Fund

[Current Manager Report if available]

10 Jul 2023 - New Funds on Fundmonitors.com

|

New Funds on FundMonitors.com |

|

Below are some of the funds we've recently added to our database. Follow the links to view each fund's profile, where you'll have access to their offer documents, monthly reports, historical returns, performance analytics, rankings, research, platform availability, and news & insights. |

|

|

|||||||||||||||||||

| MHC Digital Asset Fund | |||||||||||||||||||

|

|||||||||||||||||||

| MHC Digital Market Neutral Fund | |||||||||||||||||||

|

|||||||||||||||||||

| View Profile | |||||||||||||||||||

|

|||||||||||||||||||

| Pella Global Generations Fund (Class B) | |||||||||||||||||||

|

|||||||||||||||||||

| View Profile | |||||||||||||||||||

|

|||||||||||||||||||

| Agio Global Business Investment Fund | |||||||||||||||||||

|

|||||||||||||||||||

| View Profile | |||||||||||||||||||

|

|||||||||||||||||||

| MA Credit Opportunities Fund | |||||||||||||||||||

|

|||||||||||||||||||

| View Profile | |||||||||||||||||||

|

Want to see more funds? |

|||||||||||||||||||

|

Subscribe for full access to these funds and over 700 others |

7 Jul 2023 - Hedge Clippings | 07 July 2023

|

|

|

|

Hedge Clippings | 07 July 2023 A New Financial Year - Same Old Inflation Story "Poor old Philip Lowe" - as described this week by the opposition finance spokeswoman, Senator Jane Hume - and we agree! Philip Lowe is a convenient scapegoat for inflation, and if or when it occurs, for a recession, and the government is happy for that to be the case, even as the RBA hit the pause button this week. The reality is that Lowe's got both hands tied behind his back, and only has monetary policy to "head" off inflation, just like his counterparts at the Bank of England and the US Federal Reserve, who are facing much the same challenge. Except they're not about to lose their jobs! Chalmers and Albanese have promised to announce later this month if Lowe's tenure is up in September, and if not, who will replace him. Their failure to back him as incumbent suggests two things: Firstly, he won't get the job, and secondly, that works well for them, as it avoids the government's responsibility for doing anything (or should that be nothing) to fight inflation. So while government ministers and panels of economists are happy to take pot-shots at Lowe and the RBA, they can change their mins, and forecasts on a month to month basis. We'd love to analyse their past forecasting track records going back a few years. How many of them would have agreed with Philip Lowe in 2020 (mid COVID) and 2021 (pre Ukraine), given the then prevailing circumstances, that interest rates were unlikely to rise until 2024? As for how slowly it's taking the RBA's 13 rate rises to date, totaling over 4%, to slow the economy, and thus tame inflation, part of the reason can be seen in the chart below, which shows the actual increase across all mortgages of less than 2% after adjusting for those on fixed terms. Australians preference for variable rates is greater than home owners overseas, with the US number showing why the US economy and employment is so resilient. According to the 2021 census only 35% of Australian homes are owned with a mortgage, and 31% are owned outright, and 30% rented. Of those with a mortgage, only a small proportion will have "maxed out" their borrowing limit in the past few years. Add to that, research from PEXA shows that over 25% of houses bought in 2022 in NSW, Victoria, and Queensland were bought for cash. So while mortgage stress (and now rental stress) are daily news fodder, higher interest rates aren't biting too hard in the majority of households. What will slow consumer discretionary spending will be a combination of inflation itself (particularly for those affected by interest rates), and consumer sentiment and confidence. And while the R word is not yet a reality, and unemployment remains at historically low levels, that's not really happening. |

|

|

News & Insights Banks, interest rates and opportunities in the finance sector | Magellan Asset Management AI Revolution | Insync Fund Managers 10k Words | June Edition | Equitable Investors |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday |

7 Jul 2023 - Stupid is Good

|

Stupid is Good Marcus Today June 2023 |

|

Las Vegas houses some of the world's most magnificent hotels. The Wynn, the Encore, the Bellagio, the Venetian, the Palazzo, the Palms, the Trump Hotel, the Aria, the Mandarin Oriental, the Mirage, the MGM Grand and Caesars Palace, to name just a few. And Caesars Palace in particular. It's the most colossal hotel and casino complex you have ever seen. Begun in 1966, it now boasts six massive towers. The Forum, Roman, Centurion, Palace, the Augustus and now the Octavius. It has 3960 rooms, eight Roman-style swimming pools, 160 restaurants and shops, four gigantic ballrooms and three wedding chapels. The game in Vegas is to wow you with so much pizzazz that you don't see what's going on until it's too late. The classic example is the Palazzo, which is completely indoors and designed to feel like Venice at 8pm, at night, all day. Who wants to gamble at 9am? At the Palazzo, you don't have to. Of course, most people buy into the whole thing and have a blast - they go hard, spend their money and retire hurt with lifelong memories that make it worthwhile. But stay long enough and you see through it, if you care to, which is why Vegas is only ever a place you visit. It's not a place you live because if you stray too far from the game plan, walk about during the day, turn the lights on and stop to notice what's going on, then your epiphany will be that all those hotels, all those towers, all those incredible casinos were built on the backs of losers. It is rather incredible, really, that despite Caesars Palace standing right out in the middle of the Strip as a gigantic, unembarrassed testament to the odds at a casino, people still turn up to play. Maybe that's why they bus you straight into the underground car parks - so you don't look around, so you don't notice, so you don't begin to question too soon just where all the money came from. Then there's Australia. A nation of gamblers whose courage and risk taking is legendary. After all, Australia is a nation built by people who took a risk, simply by coming to its shores. The legacy is that half of adult Australians gamble on a regular basis. And to the incredulity of Bill Bryson, an objective English Author, we have close to 200,000 gaming machines, which is almost one per on hundred adults and our total gambling turnover is around $225 billion a year, and more during the pandemic when the proportion of online gamblers rose to 78%. See this article in the Washington Post about Australians. We have half a per cent of the World's population but 20% of the World's pokies. Gambling is in the Australian DNA, it must be, because faced with almost certain loss, we have still turned up, and keep turning up, with hope in our hearts. In Australia we admire a winner. We laud a "Boy done good" particularly if they were lucky. In Australia taking risk and luck is a noble, not stupid, trait. Lucky Country? Or unlucky country? The comparisons between gambling and the share market are unashamedly unconcealed. In the casino, they distract you with flash and feathers and disable you with drink. Meanwhile, somebody has their hand in your back pocket. In the share market, they dazzle you with colourful software, trading platforms, average returns, IPOs, dividend yields, franking, charts and the media iced by jargon, urgency and ever-thinning sophistication, whilst someone has their hand in your SMSF. And the marketing is the same. Drive from the Las Vegas airport to your hotel and you will hear the taxi driver's story of the girl who put a single dollar in the pokie machine at the airport and won a million dollars; a delusion of success reinforced by casino-floor plasma screens showing winners and their hauls. And so it is that the share market also blinds us with the winners and their books about "How I Made $2,000,000 in the Share market". It is no different. The stock market's casino owners are out lauding the winners as well, by glorifying the success of Warren Buffett and by suggesting that you too can achieve a limo at 24 by trading forex on your mobile phone. And one of the most convenient truths of all, for the casinos as well as the stock market, is that in any betting/gambling industry, while the winners buy Ferraris so we will notice them, the losers seek the dark corners of anonymity. The winners stay and play, and the losers go away. Perfect. Perfect for any industry that sells transformation through risk taking. Thankfully for them, no one ever publishes a book called "How I Lost My Kids' School Fees in Leveraged Derivatives". Even the losers wouldn't want anyone telling their stories, and they don't. Convenient. Yet gambling is one of the oldest industries in the world. And for a reason. People love gambling, you can't stop them and they don't want to be stopped. The confusion for you as a long time sensible investor is that this short term momentum driven activity has no reference in value, and has added volatility, noise and predators. It is hard to tell them apart these days, the bookies from the financial services providers. The bookies use the same jargon, dress code, media outlets and, even, licences, as everyone else in the industry. And as they do so they are plundering the limited store of stock market respectability and integrity built over hundreds of years, as a camouflage for their bet-taking platforms and products. They are using us, well, our share prices, as the base price for many highly marketed gambling options. And that's before we mention crypto. What a perfect combination for predators. A pandemic of government stimulated gamblers combined with a brand new highly volatile hard to explain, hard to argue against, social media driven, hyped up plaything, that anyone old, experienced and sensible couldn't possibly know anything about. Don't listen to us. Brilliant. For the now failing platforms that clipped the ticket. But its not all bad. The stock market may be more volatile now than ever, there may be more sentiment that value in the share price equation, and there may be more guesswork than science in the trend, but don't give up on the stock market just yet. While stock market price integrity has become more fluid, volatile and vacuous, the underlying fundamental value of the companies on whose share prices the gamblers now rely, are still there. In the long term. And no manner of hype and herd will take that away. So rest easy. And for traditional investors, this is your take home. Do not dismiss the gamblers, welcome them. They are a gift, delivered to you daily. For two reasons. The first is that short term momentum-based activity based on urgent guesswork creates volatility and price extremes. For the investor that creates regular, exploitable opportunity. That's great. And secondly, you should welcome the stupid into the market. The more uninformed people in the market, the more people there are to exploit. Or let me put it this way. In a paddock packed with bunnies, even the sheep start to look like wolves. Author: Marcus Padley, Founder of Marcus Today |

|

Funds operated by this manager: |

6 Jul 2023 - Power-hungry AI a watch-out for equities investors

|

Power-hungry AI a watch-out for equities investors Pendal June 2023 |

|

Big US tech stocks are soaring on a wave of new, advanced AI applications. But similar to Bitcoin's early days, excited AI investors may be overlooking the technology's extremely high power costs and potential associated sustainability issues, argues Pendal Aussie equities analyst Elise McKay. While the remarkable progress of AI promises to revolutionise industries, the sheer cost of the electricity needed to train and run the systems puts a question mark over the long-term prospects of adoption. "There's three key components of power usage required for running a generative AI model," says McKay. "First of all, there's the power needed to simply build the equipment that it runs on. "Then there is the enormous power required to train the model. "And then every time you ask it a question it requires new computations — and that means more power." Even before generative AI became widely available, demand for data was expected to increase at a compound annual growth rate of 40 per cent per year. The data centre industry is already estimated to account for about 1 per cent of global energy demand, says McKay. "Just because it's on your phone doesn't mean it's not in a data centre somewhere — and data centres need electricity. Any new technology just increases demand for power." McKay uses the example of bitcoin mining, which rapidly increased its share of global energy consumption from next to nothing to an estimated 0.5 per cent in 2021. "Emerging technologies like bitcoin mining can see very rapid adoption and dramatic increases in demand for power," says McKay. "We are now seeing the broad take up of generative AI, which is significantly more power hungry than existing technologies." A study by Stanford found that training the popular GPT-3 generative AI system contributed almost 10 times the emissions that the average car consumes in its lifetime, says McKay. Estimates are the newer GPT-4 model was eight times more power intensive again, she says. "And you don't just do this once, you do it regularly." OpenAI — the company behind ChatGPT — says it continuously improves its AI model by "training on the conversations people have with it". "And each model can only do one search at a time," says McKay. "So, if 100,000 people search for something at the exact same time you need 100,000 copies of the model otherwise queries will be queued. "Estimates are that every time you query ChatGPT, it is 300 times more expensive than a Google search." High power usage has also raised question marks over the carbon footprint of the technology industry, with many providers shifting to renewable energy to minimise their impact on the environment. "The high cost of providing AI will hinder its adoption," says McKay. "It may mean that only companies willing to pay a high price will be able to use it. There's a good use case for companies willing to pay for it because it improves productivity, but will we see broad adoption for low-paying use cases?" Author: Elise McKay, Investment Analyst |

|

Funds operated by this manager: Pendal Focus Australian Share Fund, Pendal Global Select Fund - Class R, Pendal Horizon Sustainable Australian Share Fund, Pendal MicroCap Opportunities Fund, Pendal Sustainable Australian Fixed Interest Fund - Class R, Regnan Global Equity Impact Solutions Fund - Class R, Regnan Credit Impact Trust Fund |

|

This information has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and is current as at December 8, 2021. PFSL is the responsible entity and issuer of units in the Pendal Multi-Asset Target Return Fund (Fund) ARSN: 623 987 968. A product disclosure statement (PDS) is available for the Fund and can be obtained by calling 1300 346 821 or visiting www.pendalgroup.com. The Target Market Determination (TMD) for the Fund is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Fund. An investment in the Fund or any of the funds referred to in this web page is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested. This information is for general purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient's personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation. The information may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information. Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance. Any projections are predictive only and should not be relied upon when making an investment decision or recommendation. Whilst we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections. For more information, please call Customer Relations on 1300 346 821 8am to 6pm (Sydney time) or visit our website www.pendalgroup.com |

5 Jul 2023 - 10k Words | June Edition

|

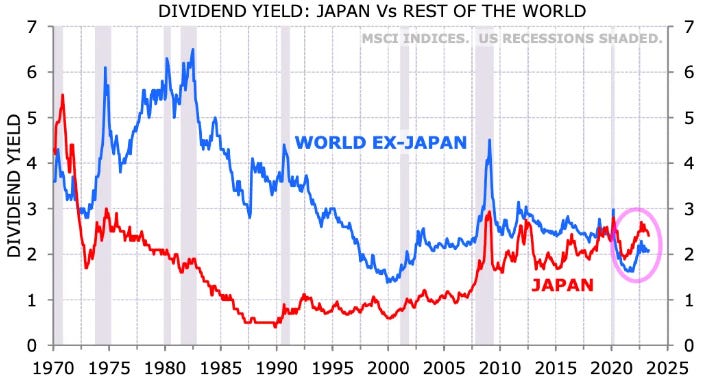

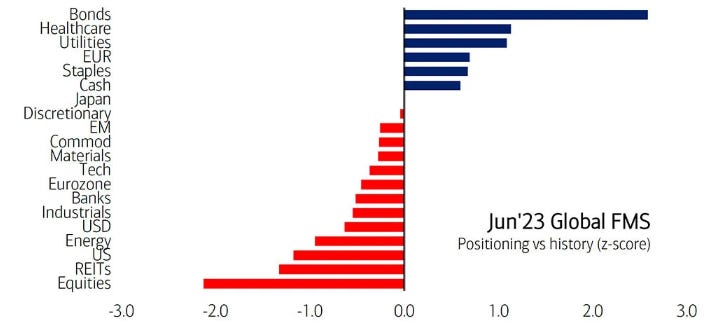

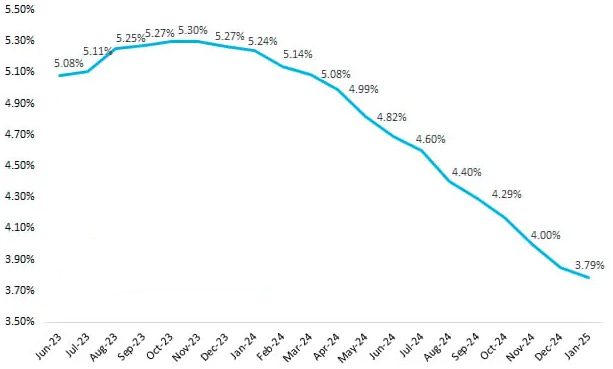

10k Words Equitable Investors May 2023 Changes in the cost of capital remain front and centre with Japan's dividend yield surpassing the rest of the world's for the first time in 50 years and asset class yields converging as fund managers express bullishnes on bonds, with 30+ countries facing inverted yield curves and the futures market still pricing a decline in the Fed Funds rate. It is amazing how even having the ticker "AI" has been enough to attract buyers. Amidst such sentiment, Nvidia has joined the trillion dollar market cap club - being in the sector that has diverged from bonds of late. Such mega caps are living in a different world from small businesses facing into tighter lending. We look at the S&P 500's trends relative to interest rates and "QE" and how large cap growth has been above other market segments over the past decade. There's still not much joy in IPO markets - especially for those who didn't sell quickly. Finally, we take a look at the decline of cash in the Australian economy and the resurgence of commercial aircraft orders. Japanese dividend yield exceeds the rest of the world for first time in 50 years

Source: Minack Advisors, Asian Century Stocks Compression of yields across assets

Source: Financial Times Fund Managers' bullish bonds, negative equities, relative to historical levels (June 2023 survey)

Source: Bank of America, commodityreport@substack.com 33 countries have an inverted yield curves

Source: worldgovernmentbonds.com Market expectations for Fed Funds Rate (as per futures)

Source: @CharlieBilello Recent surge in price of C3.ai (Ticker "AI")

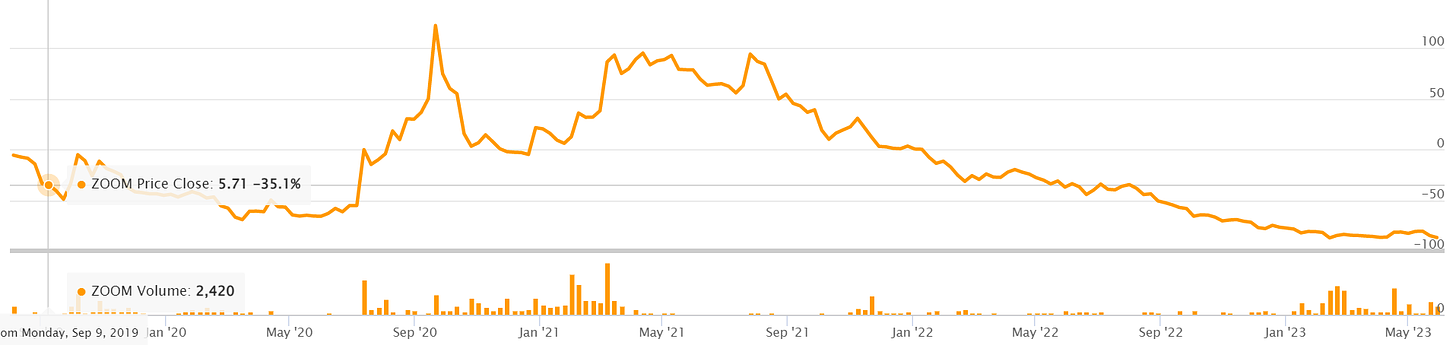

Source: TIKR Stock code "ZOOM" took off when Zoom Video Communications (ZM) surged in 2020

Source: TIKR Nvidia joins "Trillion Dollar" Market Cap Club

Source: Statista Divergence between tech valuations & bond yields

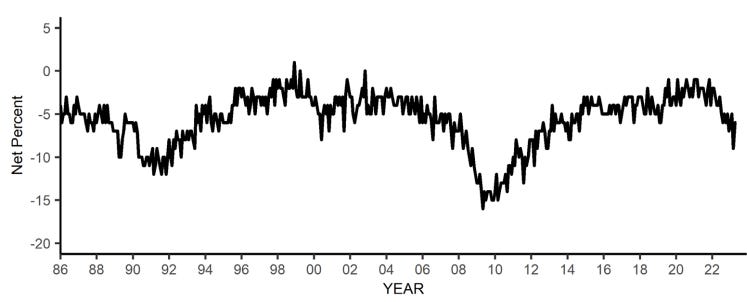

Source: Bloomberg, Koyfin Loan availability compared to three months ago

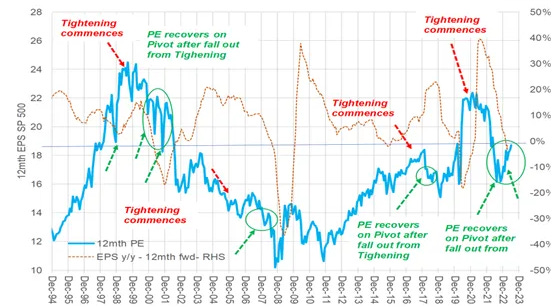

Source: NFIB Small Business Economic Trends May 2023 Fed tightening, EPS growth & PE multiple expansion/contraction

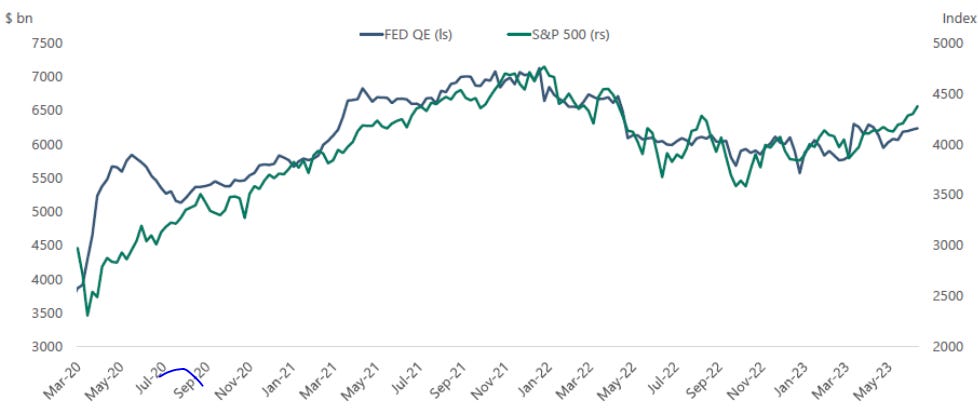

Source: @EquitOrr S&P 500 performance and Federal Reserve net Quantitative Easing (QE)

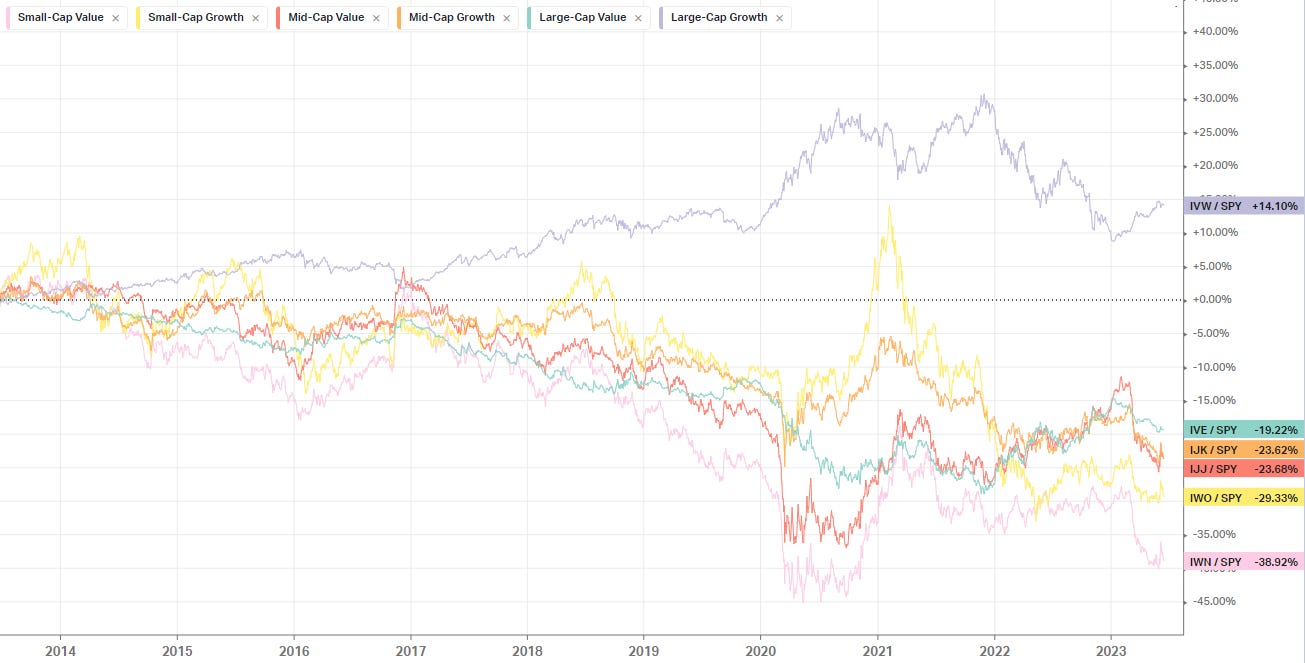

Source: Bloomberg US equities - growth v value over the past 10 years

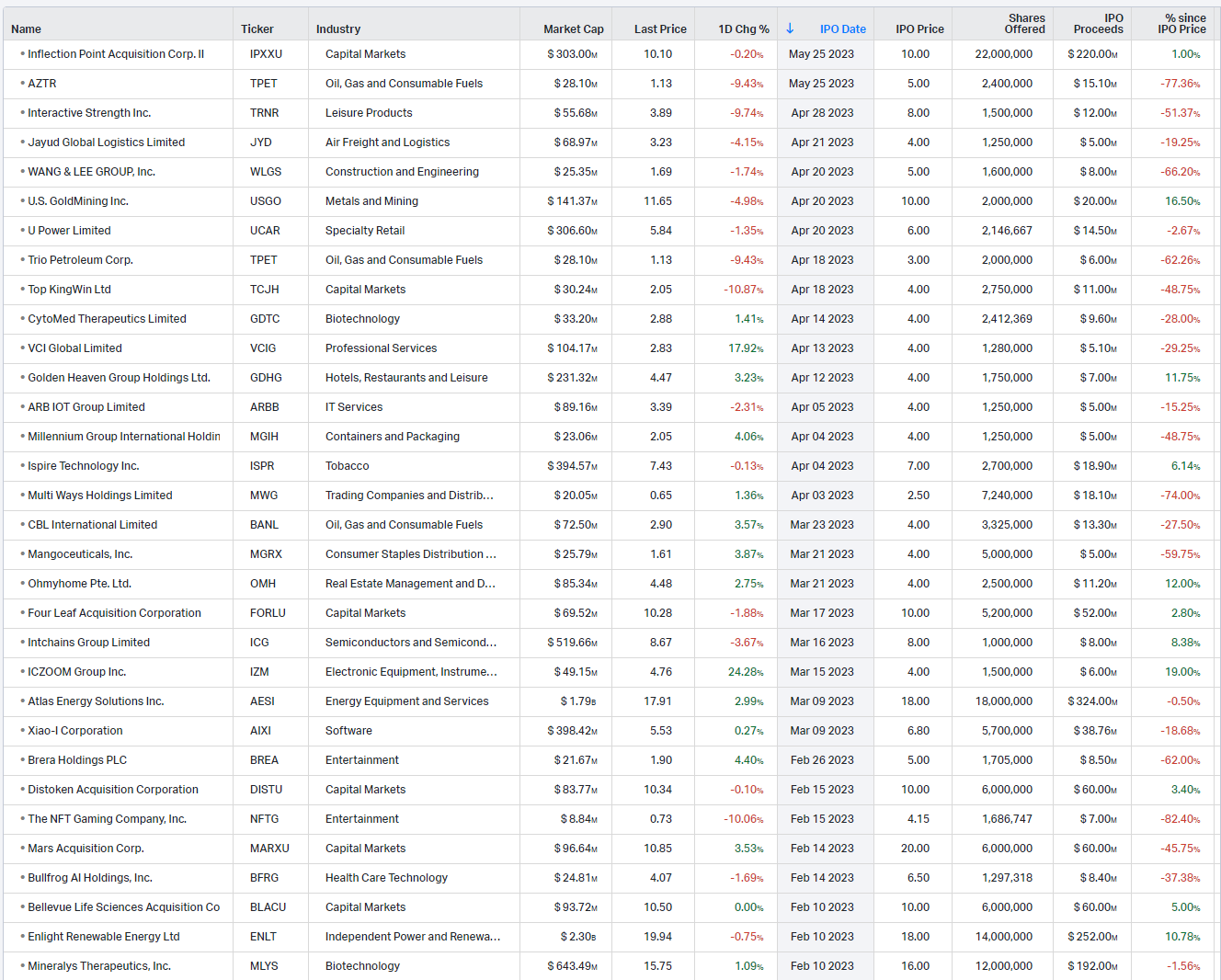

Source: Equitable Investors, Koyfin Recent US IPOs

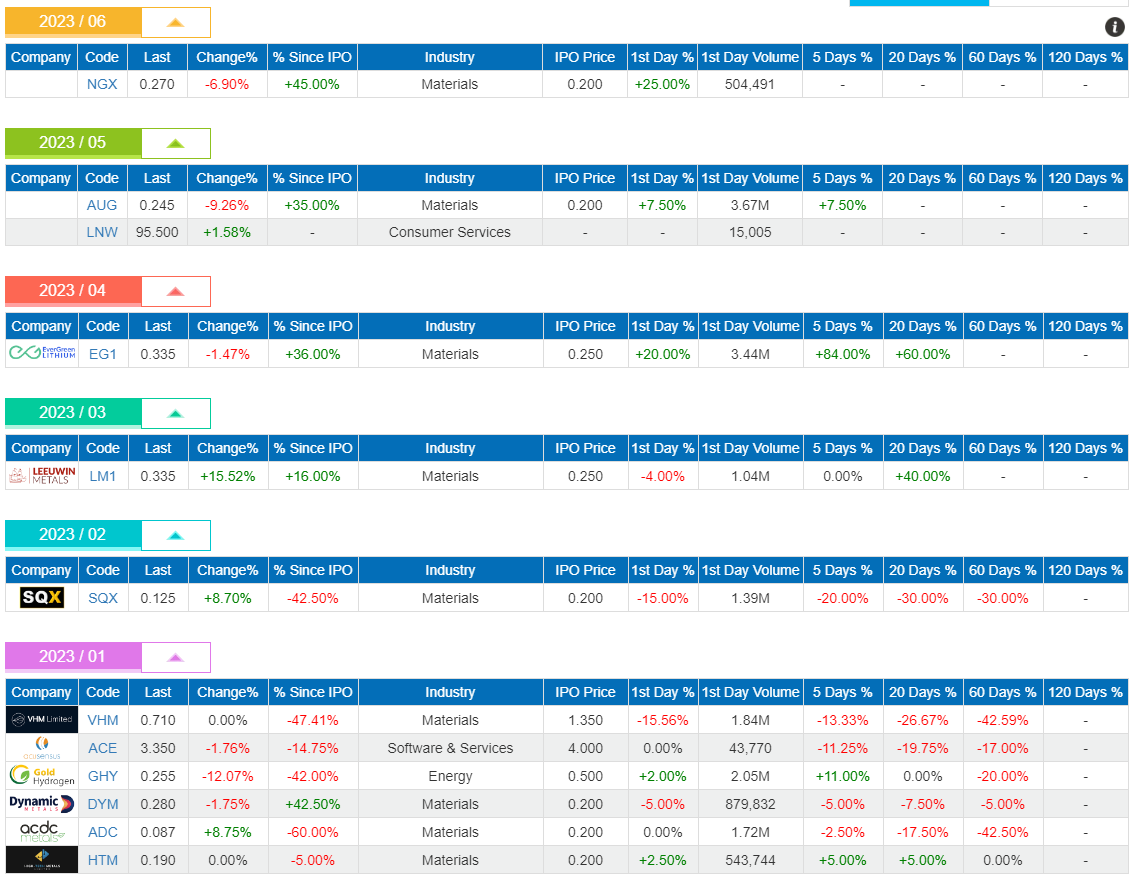

Source: Koyfin ASX IPOs in CY2023

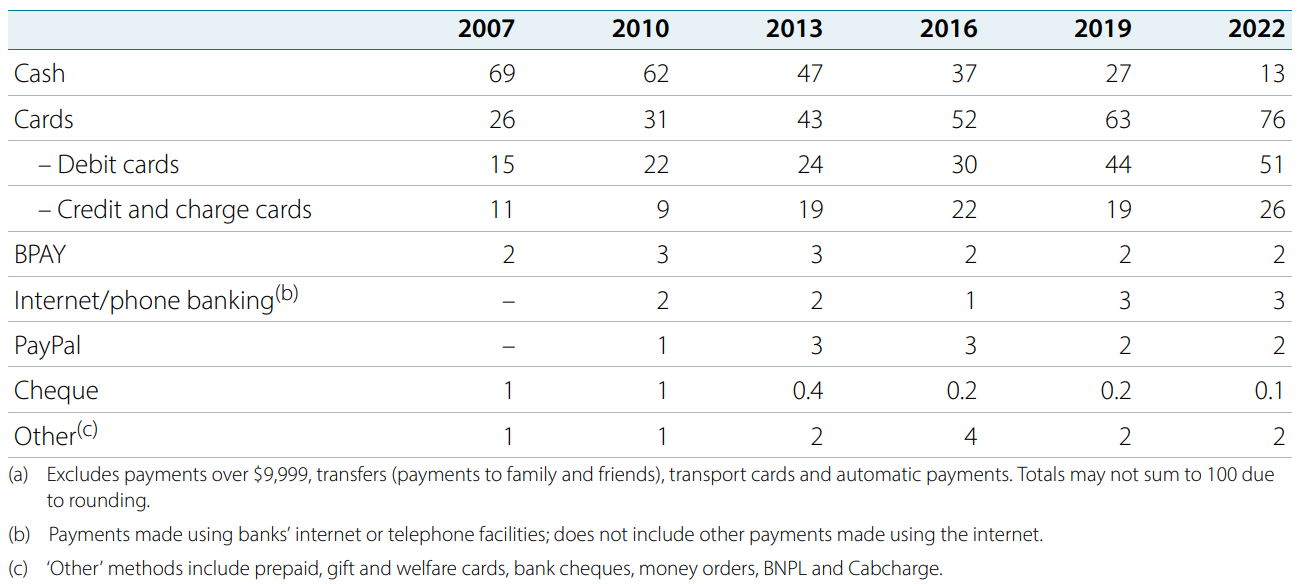

Source: 61Financial Sharp decline of cash's share of Australian payments

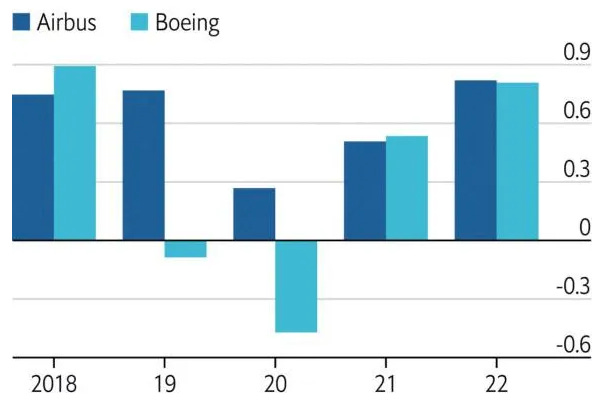

Source: RBA Net orders for commercial aircraft

Source: The Economist June Edition Funds operated by this manager: Equitable Investors Dragonfly Fund Disclaimer Nothing in this blog constitutes investment advice - or advice in any other field. Neither the information, commentary or any opinion contained in this blog constitutes a solicitation or offer by Equitable Investors Pty Ltd (Equitable Investors) or its affiliates to buy or sell any securities or other financial instruments. Nor shall any such security be offered or sold to any person in any jurisdiction in which such offer, solicitation, purchase, or sale would be unlawful under the securities laws of such jurisdiction. The content of this blog should not be relied upon in making investment decisions. Any decisions based on information contained on this blog are the sole responsibility of the visitor. In exchange for using this blog, the visitor agree to indemnify Equitable Investors and hold Equitable Investors, its officers, directors, employees, affiliates, agents, licensors and suppliers harmless against any and all claims, losses, liability, costs and expenses (including but not limited to legal fees) arising from your use of this blog, from your violation of these Terms or from any decisions that the visitor makes based on such information. This blog is for information purposes only and is not intended to be relied upon as a forecast, research or investment advice. The information on this blog does not constitute a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Although this material is based upon information that Equitable Investors considers reliable and endeavours to keep current, Equitable Investors does not assure that this material is accurate, current or complete, and it should not be relied upon as such. Any opinions expressed on this blog may change as subsequent conditions vary. Equitable Investors does not warrant, either expressly or implied, the accuracy or completeness of the information, text, graphics, links or other items contained on this blog and does not warrant that the functions contained in this blog will be uninterrupted or error-free, that defects will be corrected, or that the blog will be free of viruses or other harmful components. Equitable Investors expressly disclaims all liability for errors and omissions in the materials on this blog and for the use or interpretation by others of information contained on the blog |

4 Jul 2023 - Global Matters: The importance of emerging markets to the infrastructure opportunity

3 Jul 2023 - Webinar Recording 27 June 2023 | Resource Funds - Analysing the Opportunities and Risks

|

Webinar Recording | Resource Funds - Analysing the Opportunities and Risks FundMonitors.com 27 June 2023 |

|

Resource funds can offer a unique avenue for capitalising on the growing demand for natural resources and the global shift towards sustainable energy and materials. In this webinar, we looked at the strategies and approaches employed by three successful resource fund managers and learn how they navigate the opportunities and risks associated with this asset class. Watch the recording of our manager round table webinar, where we were joined by Dan Porter from Pure Asset Management, David Franklyn from Argonaut Funds Management, and Matthew Langsford from Terra Capital. They shared their views on this interesting and diverse market sector. |

30 Jun 2023 - Hedge Clippings | 30 June 2023

|

|

|

|

Hedge Clippings | 30 June 2023 CPI and Retail Sales Numbers throw doubt on Tuesday's RBA decision May's CPI and Retail Sales numbers released by the ABS this week gave economists reason to reconsider where inflation really sits. However, looking through headlines to the details, the question remains: Will the numbers be sufficient to convince the RBA to hit the "pause" button next Tuesday? Even if they do hold off, it's likely to only be temporary, and in the longer term, there's little chance there'll be any meaningful relief for stressed mortgage holders for at least another year, and possibly two. Taking a look at the Monthly CPI results first, which seasonally adjusted at 5.6% for the 12 months to May, and down from 6.8% in April, were, on the face of it, a cause for optimism. Stripping out volatile items (fruit and vegetables, fuel, holiday travel, and accommodation) the number was less encouraging at 6.4%, but still a marginal improvement on April's rise of 6.5%. Annual Trimmed Mean inflation (i.e. stripping out the extremes) was 6.1%, also down from April's figure of 6.7%. The first issue is fuel, which was the only negative number, falling 8% for the month, but as anyone who owns a motor vehicle (or at least pays at the bowser) would know, IS volatile, having risen 9.5% in the 12 months to April, and fallen 8.2% in the 12 months to March. Of the items which significantly offset fuel's negative number, the largest increases were in every day (and therefore largely unavoidable) items, such as Bread and Cereals (+12.8%), Dairy (+15%), Food Products (11.5%), and Electricity (+14.1%), and all of which had been elevated at or around those levels for April and March. Leaving aside the question of whether suppliers and retailers of these categories are taking advantage because A) they're staples and therefore largely unavoidable purchases, or B) they can lay the blame for price rise on their suppliers or the overall consumer expectation of inflation, are the above numbers in part responsible (in conjunction with mortgage and housing) for consumer confidence and financial concerns as a whole? Hedge Clippings rather selfishly notes that Alcohol is running below the inflationary average at 5.0%, down somewhat from the April and March numbers, but let's not go there. Against this, Retail turnover (as reported by the ABS) for May rose 0.7%, following a flat result in April, and a rise of 0.4% in March, supported by a rise in spending on food and eating out, combined with a boost in spending on discretionary goods, as consumers took advantage of larger than usual promotional activity and sales in May, along with Mother's Day. As the ABS noted, "Food retailing has recorded a monthly rise for 16 or the last 18 months," and continued by saying that "most of the growth in food-related spending this year has been driven by rising prices." Back to Tuesday's meeting and decision, the RBA will obviously be looking behind the headline numbers that the average consumer recalls, particularly the ongoing strength in the employment statistics, and the National Wage Case Decision increasing the minimum wage by 5.75% handed down in June, but yet to impact the numbers. As we noted at the outset, will the seasonally adjusted result of 5.6%, down from 6.8% be enough for the pause button to be pressed? Even if it is, we would expect it is far too early to budget for any reduction. As much as the RBA is expecting inflation to improve in 2024/2025, there's no way they will risk letting persist at current levels (or worse) by acting too soon. That's assuming they can get the inflation genie back in the bottle by then, without triggering a recession. While everyone is aware of inflation, and few can avoid it, it is evident that it is only impacting the shopping habits of certain (although increasing) consumer demographics. Unfortunately, interest rates are the bluntest of instruments (and the only one) in the RBA's tool kit. This week we held the last of our regular Webinars, with our COO Damen Purcell interviewing three guest fund managers, namely Matthew Langsford from Terra Capital, Dan Porter, from Pure Asset Management, and David Franklyn, from Argonaut Resources who discussed their approach to the opportunities and risks in the Resources Sector. Click here to view a recording (45 minutes) of the Webinar, and here to view each of the Fund's Profiles on www.fundmonitors.com. |

|

|

News & Insights Risk-adjusting small-cap upside | PURE Asset Management Investment Perspectives: Do developers offer the best exposure to a recovering residential property | Quay Global Investors May 2023 Performance News Bennelong Concentrated Australian Equities Fund Skerryvore Global Emerging Markets All-Cap Equity Fund Bennelong Twenty20 Australian Equities Fund Insync Global Capital Aware Fund |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday |

30 Jun 2023 - Performance Report: Equitable Investors Dragonfly Fund

[Current Manager Report if available]