NEWS

20 Jun 2023 - Performance Report: Delft Partners Global High Conviction Strategy

[Current Manager Report if available]

20 Jun 2023 - Australian Secure Capital Fund - Market Update May

|

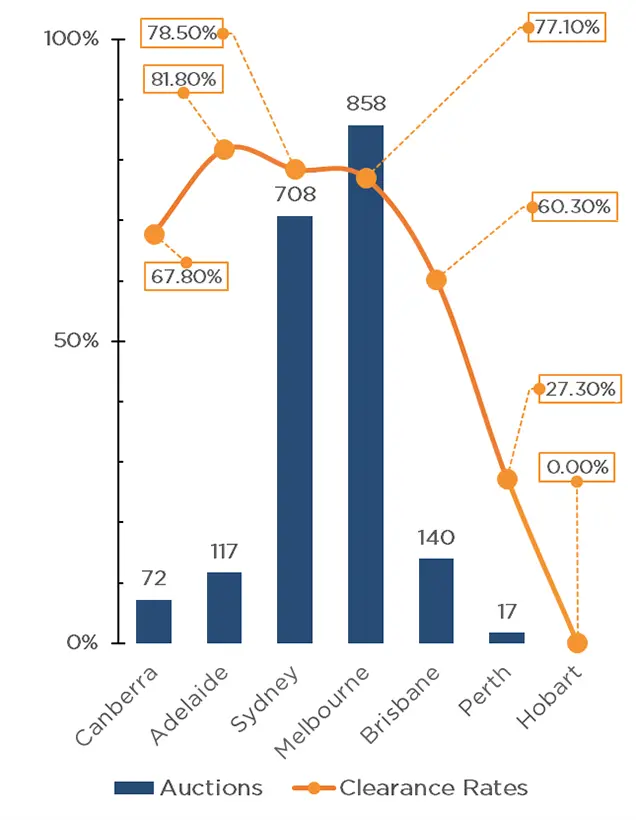

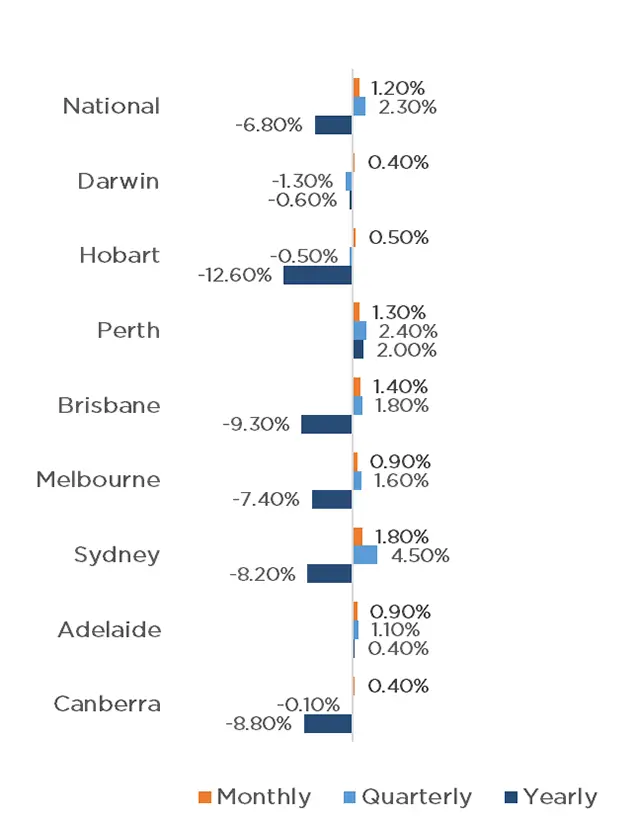

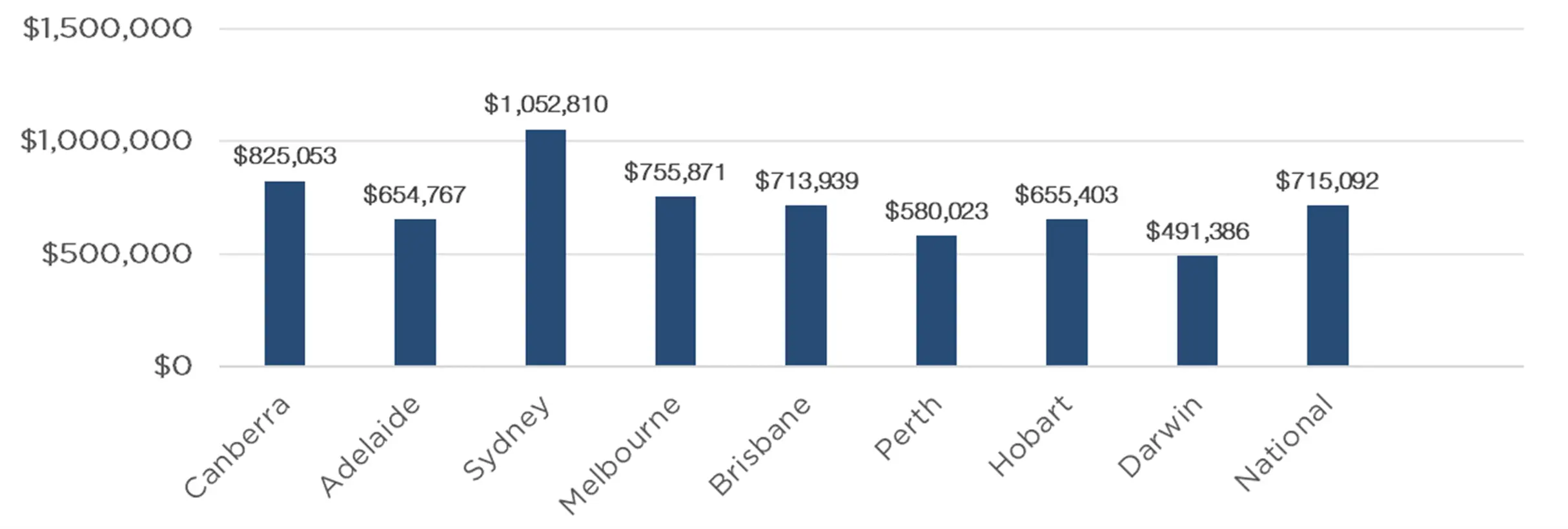

Australian Secure Capital Fund - Market Update May Australian Secure Capital Fund June 2023 The Australian housing market continues to bounce back despite further interest rate rises, with CoreLogic's national Home Value Index rising by 1.2% in May. The capitals and the regions both performed strongly, with all capital cities recording a month-on-month increase, and only regional Victoria decreasing. Once again, the capital cities performed well with Sydney leading the way with a 1.8% increase, followed by Brisbane (1.4%), Perth (1.3%), Melbourne (0.9%), Adelaide (0.9%), Tasmania (0.5%), Darwin (0.4%) and Canberra (0.4%). Performance across regional areas was also largely positive, with only Victoria experiencing a reduction in values (-0.5%). The Northern Territory and ACT, maintained values, whilst New South Wales (0.5%), Western Australia (0.5%), Tasmania (0.7%), Queensland (0.8%) and South Australia (0.9%) all experienced growth. The property market continues to experience a lack of supply, with the last weekend of May holding just 1912 auctions, well below the 3226 that occurred on the same weekend in 2022. This lack of supply is likely the factor propping up property prices. Melbourne (858) and Sydney (708) led the way with significantly more auctions taking place than the rest of the country with Brisbane (140), Adelaide (117), Canberra (72) and Perth (17) all well below previous year figures. Whilst the total auctions were down considerably, clearance rates were exceptionally high, with a weighted average of 75.9% across the capital cities, well above the 59.3% last year. Adelaide had the highest clearance rate across the country, with 81.8% (up from 73.6% last year). Sydney and Melbourne also performed strongly with 78.5% and 77.1% respectively, well above the 56.4% and 60.4% last year. Canberra recorded 67.8% (64.4% last year) with Brisbane also outperforming last year, with 60.3% (51.2% last year). Perth was the weakest performance of the cities, with only a 27.3% clearance rate, down from 42.1% last year. Clearance Rates & Auctions 22nd - 25th of May 2023

|

19 Jun 2023 - Performance Report: PURE Resources Fund

[Current Manager Report if available]

19 Jun 2023 - Performance Report: 4D Global Infrastructure Fund (Unhedged)

[Current Manager Report if available]

16 Jun 2023 - Hedge Clippings | 16 June 2023

|

|

|

|

Hedge Clippings | 16 June 2023 Inflation: No Pain, No Gain. Paul Keating will long be remembered for his "recession we had to have" comment, made way back in 1990. The self-styled "World's Greatest Treasurer" embraced the attention the comment gave him at the time, and has frequently dined out on it ever since. 33 years later we're back to facing another recession - with a number of leading business figures this week putting the chances at 50:50. Anecdotal evidence indicates that sections of the economy, and/or the community, are closer than others (if not there already), but meanwhile we're still treading the "narrow path" that Philip Lowe is trying to take the economy down, inflicting economic pain to achieve an inflationary gain. The causes - and hopefully the effects - of the 1990's recession and today's recession - or should that be tomorrow's - are quite different, although there are some parallels. The excesses of the '80's led to the crash of '87, which flowed to Australia, as did high inflation. By 1992 unemployment was 11 per cent, and mortgage rates topped 17%. This time around, we're still hostage to global tides and currents, and as such the economic after-effects of the GFC, QE, COVID, and Ukraine, but we are thankfully a long way from approaching the levels of 1992. Where Keating was keen to deflect responsibility (nothing's changed!) even to the extent of implying he should be given the credit, this time around all the criticism has been directed at Philip Lowe thanks to his forward guidance in March 2020 that rates, then at an unprecedented level of 0.1%, would remain there for an "extended period". In November of that year, in an attempt to stimulate an economy he's now trying to cool, he defined that period as "at least three years". In February 2021, he made his now famous prediction that the RBA's expectation was that rates would "not increase until 2024 at the earliest". While all the finger pointing is going on, and with the benefit of hindsight, let's remember the timeline: In March 2020, when Lowe's forward guidance mentioned an "extended period" of low rates, COVID-19 had just emerged. Later that month the government declared a state of emergency, 14 day quarantines, and a national lockdown. In NSW, indoor and outdoor gatherings were limited to two people. In July 2020, Victoria commenced a 16 week lockdown. Consequently in the June quarter of 2020, GDP fell 6.7%, then rebounded in the following four quarters, before falling 2.1% in September 2021. The RBA's targeted inflation band was (and remains) 2-3%. In December 2020 inflation came in at just 0.09%, resulting in the RBA's February 2021 guidance that "the Board will not increase the cash rate until actual inflation is sustainably within the 2 to 3% target range". At that stage inflation had not been above 2% for more than one quarter since September 2014, and by June 2020 it had dipped -0.3%. Lowe and the RBA Board undoubtedly misjudged the post COVID rebound, and can be excused for not foreseeing Russia's invasion of Ukraine in early 2022, but two things emerge: Firstly, for the previous six or seven years they had been battling LOW inflation, and particularly given COVID, they were keen, or possibly desperate, to stimulate the economy. Secondly, fellow central bankers around the world made the same mistakes. However, Lowe is on the outer, particularly with Chalmers, who unlike Keating in 1990, is looking for a scapegoat. So where to now? Earlier this week the Federal Reserve held US rates steady for the first time in a year, despite projecting that inflation will persist, leaving their options open to move rates higher going forward. In Australia, May's unemployment level fell back to 3.6%, contradicting the weak March GDP number of 0.2%, the weakest result since September 2021. By that time Australia's economic journey down the "narrow path" will have been confirmed, along with Philip Lowe's walk down a wooden plank. |

|

|

News & Insights Market Commentary | Glenmore Asset Management Quay podcast: The surprising trends emerging in real estate | Quay Global Investors May 2023 Performance News |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday |

16 Jun 2023 - Performance Report: ASCF High Yield Fund

[Current Manager Report if available]

16 Jun 2023 - Performance Report: Collins St Value Fund

[Current Manager Report if available]

16 Jun 2023 - Glenmore Asset Management - Market Commentary

|

Market Commentary - May Glenmore Asset Management May 2023 Equity markets were mixed in May. In the US, the S&P 500 rose +0.3%, the Nasdaq rebounded sharply +5.8%, whilst in the UK, the FTSE 100 declined by -5.4%. In Australia, the All Ordinaries Accumulation index fell -2.6%, driven by ongoing investor caution around the impact of interest rate hikes by the Reserve Bank of Australia. The technology sector was the top performing sector, as investor sentiment continues to recover after materially underperforming in 2022. Consumer discretionary was the worst performer, with multiple ASX listed stocks flagging consumer spending is weakening due to rising interest rates and cost of living pressures. Gold stocks also underperformed in the month. Small cap stocks significantly underperformed as investor funds moved to the perceived safety of larger cap stocks. As an example, on the ASX, the Emerging Companies index fell -6.4%, whilst the Small Ordinaries Accumulation index declined -3.3%. In bond markets, the US 10 year bond yield rose +20bp to close at 3.66%, whilst the Australian 10 year bond rate increased +26bp to 3.60%. Both movements were due to increased inflation expectations. In currency markets, the A$/US$ declined -2% to close at US$0.65. Commodities were broadly weaker in May. Brent crude oil declined -8.6%, copper -6.5%, iron ore -5.0%, whilst gold -1.2%. Thermal coal fell sharply, down -27.3%. The numerous interest rate hikes implemented by the Reserve Bank over the past 12 months are clearly having an impact on consumer spending, as evidenced by multiple ASX listed retailers announcing profit downgrades in recent weeks. Whilst some components of the CPI basket are declining (eg. Commodities), other parts such as power prices and wages are still rising (eg. Recent 5.75% award wage increase which commences on 1 July). Services inflation in particular, continues to be too high, as businesses across the board increase prices. With regards to interest rates, given inflation is proving more difficult to reduce to the Reserve Bank's targeted band of 2%-3%, it now appears likely that the RBA will need to lift rates 2-3 more times in this cycle. One theme that continues to impact the fund's relative performance versus benchmark is the underperformance of small/mid cap stocks on the ASX, noting the fund has a strong skew to this part of the market. Whilst this has been negative for the performance of the fund in recent months, we strongly believe this focus will produce some outstanding buying opportunities for longer term focussed investors over the next 6-12 months. The Fund continues to see numerous attractively valued stocks across a wide range of sectors and is well capitalised to take advantage of this current short term investor bearishness. Funds operated by this manager: |

15 Jun 2023 - Performance Report: DS Capital Growth Fund

[Current Manager Report if available]

15 Jun 2023 - Performance Report: Airlie Australian Share Fund

[Current Manager Report if available]