NEWS

12 Oct 2021 - Misunderstood Multiples

|

Misunderstood Multiples Amit Nath, Montaka Global Investments September 2021

This is one of the most used and repeated phrases of market commentary. In fact, multiples are probably the most enduring pieces of investment analysis of all time. Unfortunately, they are often completely useless. The law of the instrument, or 'Maslow's hammer', is a cognitive bias where people rely too much on a familiar tool. The renowned American phycologist, Abraham Maslow, articulated this concept with his hammer and nail metaphor -

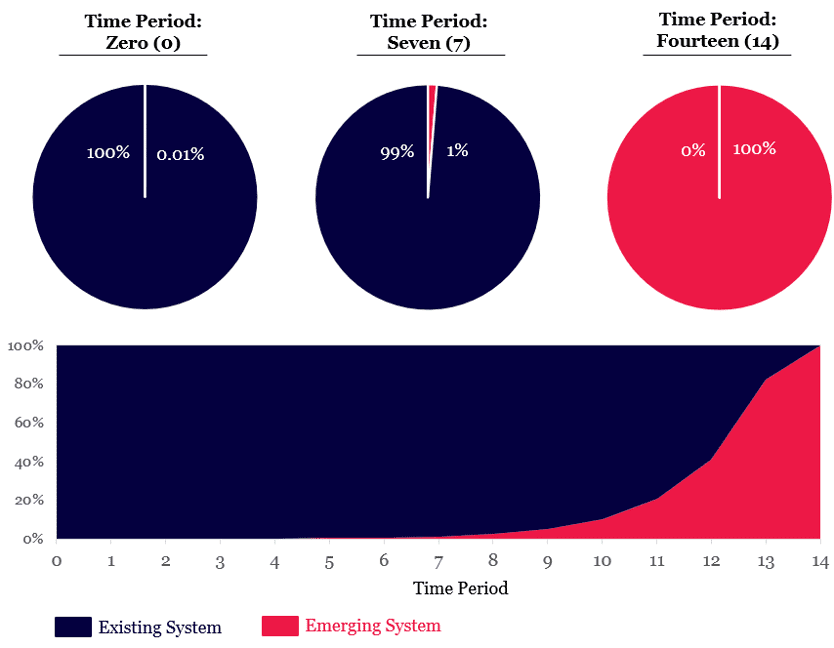

Multiples are a short-cut, lazy approximation for valuing a business For many market commentators and armchair enthusiasts, valuation multiples are their Maslow's hammer, and they apply it indiscriminately - perhaps because it is the only valuation tool they possess in their toolkit. Valuation multiples are a simplified, abbreviated and short-cut methodology for thinking about the value of a company. They blindly take a company's price (market cap, enterprise value) and divide it by a fundamental metric (revenue, operating income, EPS, etc). But they don't tell the whole story or give a complete picture of underlying value and are prone to sizeable error when applied in isolation. And, sadly, multiples have never been less useful than they are today. If investors can understand how multiples can mislead, and how to value companies in this new complex market, they will be better placed to identify and ride 'multi-decade compounders' - the current and next generation of Amazons and Microsofts that build massive long-term wealth. Multiples were not designed for today's world For traditional valuation multiples to be effective, a company needs stable and predictable cash-flows, which are generally found in mature industries like utilities, real-estate and infrastructure. Multiples do a poor job of valuing privileged businesses models that have advantaged economics, including barriers to entry, network effects, and unique datasets. They also fail to reflect the value of emerging opportunities (aka real options) embedded in the world's best businesses, including the likes of Facebook's AR/VR platform and Alphabet's AI unit. Multiples provide an inadequate view when companies have high and relatively sustained growth rates, particularly for the world's best software-driven ecosystems like Microsoft, Google, Amazon or in the alternative asset management space, like Blackstone, KKR, and Carlyle. Basically, multiples simply break down when investors are analyzing a disruptive company in the midst of an inflection or an industry that is adapting to a new world, a world we are seeing across myriad of sectors such as technology, healthcare, financials, transportation, and energy. The problem: Humans are very bad at exponential thinking The core of the problem can be traced back to the fact that humans are very bad at exponential thinking. We prefer to use a simplifying linear concept (like a multiple) for a more complex non-linear concept (high growth business). But we lose information, and that mapping mismatch can lead to errors and ultimately incorrect conclusions. Google's world-renowned futurist and Director of Engineering, Raymond Kurzweil, believes humans are linear thinkers by nature, whereas technology, biology and our environment are often exponential. That, he says, creates enormous blind spots when we pursue higher-order thinking and seek to solve increasingly complex problems. Let's consider a simple thought experiment often sighted as Kurzweil's 'law of exponential doublings'. It takes seven doublings to go from 0.01% to 1%, and then seven more doublings to go from 1% to 100%. So within 14 time periods an emerging system has gone from being completely invisible in the linear world (0.01%), to entirely encompassing it (100%). The Covid-19 pandemic and the exponential spread of the virus gave us a real-world look at what exponential growth feels like as our lives were significantly disrupted. Yet most of us are simply not built to intuitively reconcile this phenomenon. Visualizing exponential growth through doublings

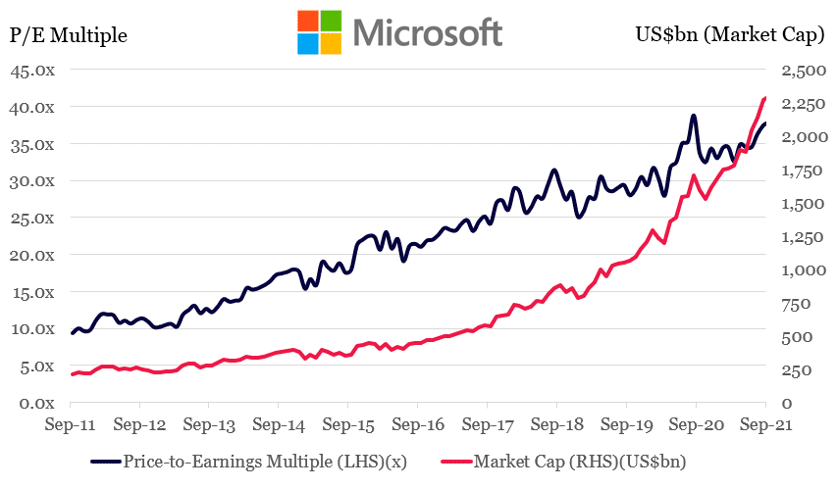

Source: Montaka Multiples meant investors missed massive Microsoft gainsMicrosoft is an example of a company where the use of multiples fail. For the last decade the company has been consistently criticized by some investors for having an 'extremely high multiple' and is on the verge of a sharp pull-back. This narrative continues to persist in parts of the market even today. Yet Microsoft's multiple has consistently expanded for the entirety of that time. A linear conversation about Microsoft's multiple ignores several underlying drivers of Microsoft's valuation, from its virtual monopoly in enterprise computing (Windows), strangle hold on productivity applications (Office), to the enormous opportunity ahead of its cloud business (Azure). Some six years ago Azure was an invisible real option within Microsoft. But it certainly feels pretty real today after growing from basically zero revenue to an estimated $40 billion annualized run-rate (June-2021). Azure continues to grow at around 40-50% year on year with enormous runway ahead. It demonstrates the exponential growth that many investors still struggle to believe or comprehend. Another fallacy those decrying Microsoft's 'high multiple' is that its market capitalization gains have been entirely driven by multiple expansion and the low-interest-rate environment. Those factors certainly play a role, but multiple expansion only explains a third of Microsoft's value gains. While Microsoft's multiple has expanded four-fold over the last decade, its market cap has increased nearly eleven-fold during that time - driven by a massive earnings inflection and exponential growth within the Azure business. That's an extremely significant error produced by the unhelpful market heuristic of multiples. Entrenched habits and lazy analysis have a very long-tail and multiples are a seductive short-cut. Microsoft's multiple has expanded for a decade

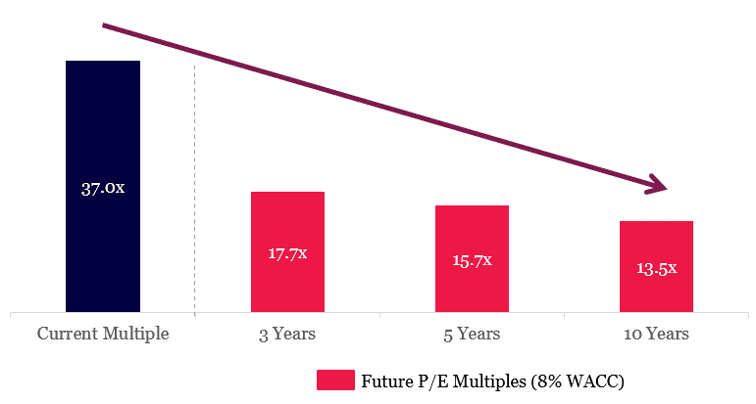

Source: Bloomberg, Montaka How to value companies in today's complex marketSo if multiples mislead, how do investors value companies in this new environment? The truth is, there are no short-cuts in valuing a business. It is a hard, detailed, and rigorous exercise that takes considerable time and insight to get right. At Montaka, all our investment theses are fundamentally driven and while not an exhaustive list, we look to gain insights across the following areas: - Detailed, bottoms-up, DCF (discounted cash flow) assessment of each company we invest in with an exploration of business model economics, TAM (total addressable market), competition, etc - Top-down perspective of the markets the company currently serves and potentially will serve in the future - Considerable time is spent considering what the business and industry will look like in 5 to 10 years and what challenges / opportunities may be encountered (this is a never-ending cycle of course) - We also establish a set of valuation scenarios that are weighted by the probability of the scenario being reached. They guide our view around upside and downside, and color our level of conviction in the position. We then effectively take a 'time machine' to several points in the future. For each time period we observe the multiple our valuation implies. This helps us check whether we are being too conservative, or too exuberant relative to what the market is willing to pay for the business today. In fact we often find instances where our DCF has compressed multiples in an unreasonable way or the market is being too conservative with its current price level. Get comfortable with high multiplesIf we continue with Microsoft as an example. The current share price (US$300) implies the market is being extraordinarily bearish on the Azure cloud business, and also believes Microsoft's future multiple will materially compress over the coming decade. We strongly disagree with the market's assessment on both fronts and believe it is significantly underestimating Microsoft's earnings potential and opportunity set, plus unreasonably discounts the quality of these earnings by slashing its multiple by more than half. In fact, under our bullish scenarios, we believe Microsoft's share price could increase several fold, even from here. Significant multiple compression implied by current share price

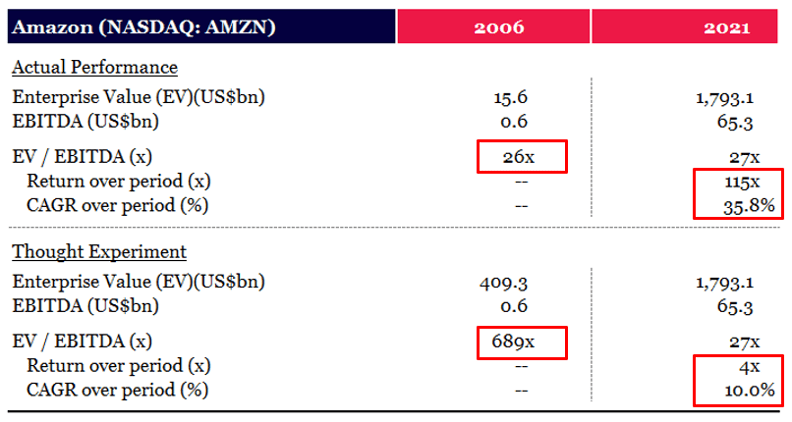

Source: Montaka Compounding your wealth over decadesWhen an investor looks at a multiple, it may seem high at first glance. But it is essential to focus beyond this and understand the underlying business, its growth opportunities and what current market expectations imply. Certainly, a high multiple can be a red flag for overvaluation. However, in isolation an investor can't draw any real conclusions from that multiple. As we've seen, in certain situations the current multiple may be outrageously low despite the incessant noise claiming the opposite. Let look at Amazon for example, in 2006, it was trading at an EBITDA multiple of 26x versus the market (S&P 500) which was trading at 10x. Certainly not cheap by typical measures. But as a thought experiment, if we were to discount the current Amazon enterprise value at an annual rate of 10% back to 2006, an investor should have willing to pay close to 690x EBITDA and they still would have quadrupled their money today. The market, however, materially undervalued Amazon and it went on to deliver investors 115x over that period. In fact, you could have paid double the share price for Amazon in 2006 and still made nearly 60x your money today.

Source: Montaka. Based on June-2021 LTM earnings for 2021 column. At Montaka we have a single clear goal: to maximize the probability of achieving multi-decade compounding of our clients' wealth, alongside our own. We are convinced that the months and years ahead will present opportunities to make attractive, multi-generational investments and we are prepared and well-positioned to take advantage of these. To achieve that, we won't let multiples become our Maslow's hammer! Funds operated by this manager: Montaka Global 130/30 Fund, Montaka Global Fund, Montaka Global Long Only Fund |

11 Oct 2021 - Performance Report: Collins St Value Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The managers of the fund intend to maintain a concentrated portfolio of investments in ASX listed companies that they have investigated and consider to be undervalued. They will assess the attractiveness of potential investments using a number of common industry based measures, a proprietary in-house model and by speaking with management, industry experts and competitors. Once the managers form a view that an investment offers sufficient upside potential relative to the downside risk, the fund will seek to make an investment. If no appropriate investment can be identified the managers are prepared to hold cash and wait for the right opportunities to present themselves. |

| Manager Comments | Since inception in February 2016 in the months where the market was negative, the fund has provided positive returns 67% of the time, contributing to a down-capture ratio for returns since inception of 26.11%. Over all other periods, the fund's down-capture ratio has ranged from a high of 66.25% over the most recent 24 months to a low of -370.51% over the latest 12 months. A down-capture ratio less than 100% indicates that, on average, the fund has outperformed in the market's negative months over the specified period, and negative down-capture ratio indicates that, on average, the fund delivered positive returns in the months the market fell. The fund's Sortino ratio (which excludes volatility in positive months) has ranged from a high of 28.96 for performance over the most recent 12 months to a low of 1.28 over the latest 48 months, and is 1.47 for performance since inception. By contrast, the ASX 200 Total Return Index's Sortino for performance since February 2016 is 0.95. |

| More Information |

11 Oct 2021 - 3 common features of inflation-proof businesses

|

3 common features of inflation-proof businesses Stephen Arnold, Aoris Investment Management September 2021 Central banks remain steadfast in their message that the current bump in inflation will prove short-lived. Companies are less sure. A frequent message we have heard from businesses through the June quarter global earnings season was that inflation is 'not transitory'. Who will prove prescient? Time will tell. As investors, the best we can do is recognise the possibility of sustained higher inflation, and to own businesses that can prosper regardless of the course inflation takes. Below, we highlight three characteristics of these inflation-proof businesses, illustrated with examples from the Aoris portfolio. 1. Sell on value, not on price, and make sure that value is rising If you sell basic household products that don't improve year-to-year, rising inflation is bad news. The likes of Campbell Soup, Kimberly-Clark, Unilever and Procter & Gamble face stiff resistance from consumers, and retailers, when seeking to charge a few percent more for the same product. It's no surprise that these brands have lost market share in times of inflation as consumers seek out alternatives, including retailers' own private label brands. Nike, on the other hand, invests heavily in the aesthetics and technical features of their footwear and apparel. Their products are always improving, and the brand itself remains highly desirable. You may have noticed a high proportion of gold medal winning athletes at the Tokyo Olympics were wearing Nike, such as Eliud Kipchoge, the men's marathon winner in Nike's Alphafly NEXT% Flykit shoes. Inflation hasn't historically been a problem for Nike - their average price per item has risen at a rate of about 7% p.a. in recent years, but this is because the value offered by their products is rising. 2. A culture of continuous cost improvement Some companies build up fat through the good years. Each year, costs grow a little more than is necessary, then once each economic cycle the problem reveals itself. The burden of rising inflation on such companies is amplified by their layers of excess costs. To reign in the rampant expenses, a restructuring program is undertaken. This looks straightforward on paper but can be very demoralising and destabilising internally, as skills and experience are lost. I was told by a colleague recently of (yet another) redundancy round at a major Australian bank. Employee costs are removed, but for those who remain 'the loss of roles and changes in responsibility creates inefficiency, and now it just takes longer to get stuff done'. Companies that are effective at trimming the fat every year are generally going to be the ones who pull ahead of their peers through an inflationary period. Graco, a manufacturer of pumps and fluid handling equipment in the US mid-west, has an objective of creating factory floor efficiency each year to offset cost inflation. If input costs are rising at a rate of 3% then Graco seeks an equivalent productivity improvement, which it achieves through investment in manufacturing technology. It's able to do this because it is vertically integrated; it makes all the components that go into its products, while its competitors are just assemblers. Graco's factory workers are highly skilled and management treats them as an asset, not an expense. Impressively, Graco went through 2020 without a single redundancy. 3. Supply chain excellence and purchasing scale When costs are rising, smaller firms are often at a significant disadvantage. They have less buying heft when it comes to negotiating purchasing terms, and less sophisticated supply chains when it comes finding alternative suppliers and utilising data to navigate a period of rising costs. Consider Costco, one of the world's largest retailers with $250 billion of annual purchasing power. Part of Costco's 'secret sauce' is that it stocks only 4,000 items compared to over 100,000 at a typical Wal-Mart, so its vast purchasing power is focused and its supply chain is simple. Costco's highly regarded store brand, Kirkland (see image below), accounts for about one-third of sales, giving it a valuable optionality. If a national brand won't come to reasonable terms on price, Costco can replace it with Kirkland. In an environment of supply chain disruption and rising logistics and labour costs, Costco is in a highly advantaged position compared to most of the retailers it competes with. Inflation has been dormant for such a long time that it's hard to imagine it increasing to levels that might create problems for companies; but as investors it's a risk we must consider. At Aoris, we have no views on the direction inflation may take but have a clear view of the characteristics necessary for businesses to be 'all weather' and to prosper even if higher inflation persists. All 15 companies in the Aoris International Fund embody the characteristics of selling on rising value, a culture of continuous cost improvement, and supply chain excellence and purchasing scale. Find out more by visiting our website. Funds operated by this manager: |

8 Oct 2021 - Hedge Clippings | 08 October 2021

|

||||||

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday

|

8 Oct 2021 - Performance Report: Bennelong Australian Equities Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The Bennelong Australian Equities Fund seeks quality investment opportunities which are under-appreciated and have the potential to deliver positive earnings. The investment process combines bottom-up fundamental analysis with proprietary investment tools that are used to build and maintain high quality portfolios that are risk aware. The investment team manages an extensive company/industry contact program which helps identify and verify various investment opportunities. The companies within the portfolio are primarily selected from, but not limited to, the S&P/ASX 300 Index. The Fund may invest in securities listed on other exchanges where such securities relate to the ASX-listed securities. The Fund typically holds between 25-60 stocks with a maximum net targeted position of an individual stock of 6%. |

| Manager Comments | The fund's returns over the past 12 months have been achieved with a volatility of 8.51% vs the index's 9.42%, and the annualised volatility of the fund's returns since inception in February 2009 is 14.55% vs the index's 13.48%. Since inception in February 2009 in the months where the market was positive, the fund has provided positive returns 93% of the time, contributing to an up-capture ratio for returns since inception of 152.32%. Over all other periods, the fund's up-capture ratio has ranged from a high of 166.21% over the most recent 24 months to a low of 131.56% over the latest 12 months. An up-capture ratio greater than 100% indicates that, on average, the fund has outperformed in the market's positive months over the specified period. |

| More Information |

8 Oct 2021 - Why have investors become theme junkies?

|

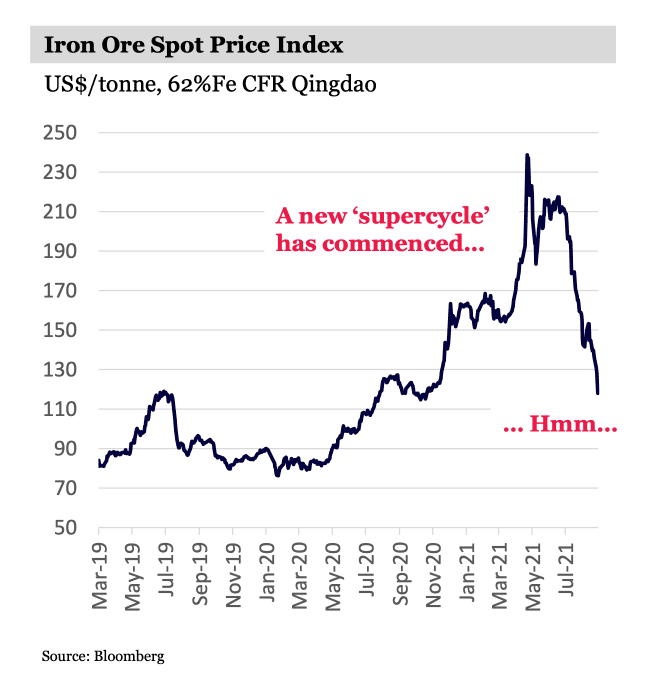

Why have investors become theme junkies? Andrew Macken, Montaka Global Investments October 2021 Most investors love a good theme. A long-term industry-shifting thematic trend provides fantastic structural support to a portfolio. Today there are no shortage of themes being spruiked to investors. New themes to emerge in just the last year include a commodities supercycle, the return of inflation, and a maturation of the world's mega-tech businesses, to name just a few. The only problem is, it remains far from clear if these new themes are even themes at all. Are we really experiencing a commodities supercycle?The iron ore price has collapsed by 50% in the last four months. This is not entirely surprising given the recent sharp weakening in Chinese credit growth - the primary economic fuel that underpins higher commodity prices. Iron Ore Spot Price Index

Is inflation really returning?Bond markets are certainly far from convinced. The last time markets expected some semblance of normal inflation in 2018, the US 10-year government bond was yielding around 3% per annum. Today, with a 'booming' economy and inflation 'taking off' the US 10-year yield remains at approximately 1.5%. And have the world's mega-tech businesses really maturedThis was the consensus view late last year. Conventional wisdom then said the likes of Amazon, Alphabet (Google) and Microsoft were now so big and had done so well for investors that, surely investors would find better returns elsewhere. Markets seem to have revised this view in recent months, acknowledging instead that we remain in the early innings of a digital transformation of corporates, governments and consumers that massively benefits these mega-tech stocks. (Investors will remember a similar falling-out-of-favour for mega-techs in 2018 - only to be back in favour again by 2019). In today's noisy market, there is a real danger that investors become 'theme' junkies where it's easy to mistake short-term trends and movements for real, long-term changes that deliver huge compounding returns over years. If investors can recognise this danger, they will not only be able to avoid the proliferation of fake themes, but they will also be better placed to identify and ride the real themes that deliver the big long-term returns. Have we all become 'theme junkies'?Like most investors, for me, there is nothing better than a reliable long-term theme. If you can position your portfolio on the right side of a strong theme it acts like a powerful tailwind and allows you to really compound your capital over the long term. For example, take the long-term structural reallocation of marketing spend to the world's leading digital channels, such as Facebook and Google, that drive superior ROIs through intelligent targeting. This theme is unquestionably reliable and has underwritten a meaningful part of Montaka's portfolio for more than five years. But it's easy to forget that durable long-term themes are exactly that: long-term. They evolve slowly but surely. Demographics and the aging populations of many of the world's largest economies is a classic example of a long-term structural theme that continues to play out as most long-term themes do. Slowly but surely. Today, however, it almost feels like investors are looking for a new decade-long theme … every two weeks. Investors have become theme junkies. On the one hand, this makes sense. Surely if owning one strong theme is great, then owning three, five or 10 themes is even better, right? Not necessarily. If you own a small handful of great themes, there are strong arguments to simply leave it at that. By adding additional 'less-good' themes, you are simply diluting your overall returns. But the human mind often doesn't appreciate this - we tend to think that more themes must always be better than fewer themes. And it's rarely the case. When an investor learns about a new theme, it is one of the more intellectually gratifying moments of investing. In today's high-gratification world, it is natural for investors to chase these intellectual hits and gravitate towards sources of new themes. Those in the business of competing for your attention are willing suppliers and will seek to give you what you want with a supply of never-ending themes.

The danger of too many new themesBut most of these new themes are not real themes. Investors are being sold short-term cycles as long-term themes. Some are not even short-term cycles, but merely the ebbs and flows that result from the natural moodiness of 'Mr. Market' himself. Chinese tech names were recently sold off hard after the Chinese Government introduced new competition, privacy and national security regulations. Many investors, including famed thematic investor, Cathie Wood, sold down their China positions. In July, Wood explained her move by citing a "valuation reset" and believed that Chinese tech valuations "probably will remain down". The new "theme" was that China was now too dangerous to invest in. But by the following month, news reports said Wood had repurchased many of the same China positions that had been sold. Investors can and should change their minds as often and as significantly as is necessary. But from month to month, or even year to year, a strong long-term theme typically doesn't change much at all.

How to overcome theme saturationSo how do investors avoid becoming theme junkies? Less is more. Stick to investment themes that are unquestionably reliable and resist the temptation to add new, weaker-form themes to your portfolio. Of course, a strong theme doesn't guarantee a good investment on its own. (Good investments always stem from under-priced assets - irrespective of any theme at play). But a strong theme can often transform a good investment into a great investment by lifting the earnings power of a well-positioned business to new heights previously unanticipated by the market. Montaka, for example, retains significant exposure to the world's leaders in cloud computing. This is not a new theme, of course. But it remains highly attractive: the ongoing shift to cloud computing remains in its early innings. It is unquestionably persistent and a small handful of leaders, such as Microsoft and Amazon, will be the big winners. Other reliable long-term themes in Montaka's portfolio include the continuing:

The path to long-term successWhen an investor builds their portfolio on a bedrock of strong investment themes, most of the daily machinations of the market simply become noise. Interesting noise, for sure - but noise, nonetheless. You can look past the daily noise with renewed confidence when you realise clearly that people are competing for your attention by spruiking fake 'themes'. Online social channels are also amplifying this noise. Riding real themes, of course, often means a portfolio's performance will look different from other investors. Owning the right long-term theme does not mean that a portfolio won't underperform from time to time. Long-term themes can just as easily fall in and out of favour as individual stocks do. But it pays to stay the course. Performing differently to others is a pre-requisite for superior long-term compounding. And remaining focused on the forest for the trees - investing in real themes and not fake themes - is the path to long-term investment success. Funds operated by this manager: Montaka Global 130/30 Fund, Montaka Global Fund, Montaka Global Long Only Fund |

7 Oct 2021 - Performance Report: AIM Global High Conviction Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | AIM are 'business-first' rather than 'security-first' investors, and see themselves as part owners of the businesses they invest in. AIM look for the following characteristics in the businesses they want to own: - Strong competitive advantages that enable consistently high returns on capital throughout an economic cycle, combined with the ability to reinvest surplus capital at high marginal returns. - A proven ability to generate and grow cash flows, rather than accounting based earnings. - A strong balance sheet and sensible capital structure to reduce the risk of failure when the economic cycle ends or an unexpected crisis occurs. - Honest and shareholder-aligned management teams that understand the principles behind value creation and have a proven track record of capital allocation. They look to buy businesses that meet these criteria at attractive valuations, and then intend to hold them for long periods of time. AIM intend to own between 15 and 25 businesses at any given point. They do not seek to generate returns by constantly having to trade in and out of businesses. Instead, they believe the Fund's long-term return will approximate the underlying economics of the businesses they own. They are bottom-up, fundamental investors. They are cognizant of macro-economic conditions and geo-political risks, however, they do not construct the Fund to take advantage of such events. AIM intend for the portfolio to be between 90% and 100% invested in equities. AIM do not engage in shorting, nor do they use leverage to enhance returns. The Fund's investable universe is global, and AIM look for businesses that have a market capitalisation of at least $7.5bn to guarantee sufficient liquidity to investors. |

| Manager Comments | The fund's Sharpe ratio is 1.89 for performance over the past 12 months, and over the past 24 months is 1.64. Since inception, the fund's Sharpe ratio is 1.49 vs the Global Equity Index's Sharpe of 1.3. Its Sortino ratio (which excludes volatility in positive months) is 4.16 for performance over the past 12 months, and over the past 24 months is 3.31. Since inception the fund's Sortino ratio is 3.01 vs the Global Equity Index's Sortino of 1.95. Since inception in July 2019 in the months where the market was positive, the fund has provided positive returns 89% of the time, contributing to an up-capture ratio since inception of 102.88%. For performance over the past 12 month, the fund's up-capture ratio is 97.76%, and is 113.51% over the past 24 months. An up-capture ratio greater than 100% indicates that, on average, the fund has outperformed in the market's positive months. The fund's down-capture ratio since inception is 82.83%, highlighting the fund's capacity to outperform in negative markets. |

| More Information |

7 Oct 2021 - Touch gives investors a slice of Afterpay talent

|

Touch gives investors a slice of Afterpay talent Graeme Carson, Cyan Investment Management 01 October 2021 |

|

"The next Afterpay" has to be a candidate for the most overused phrase in investment circles at the moment. Companies and investors alike are finding comparisons to draw, growth ambitions to conquer and lofty pricing to justify, in the hope that they have uncovered the next global growth super start-up.

Touch Ventures (ASX:TVL) is an investment company that listed on the ASX on Wednesday 29 September. It was founded in late 2019 and Afterpay, its largest shareholder, now owns about 24% through its wholly owned subsidiary Touchcorp - hence the name. Touch's strategy is to own up to 10 material investments in unlisted companies that are truly scalable, operating in the retail innovation, consumer, finance and data segments. These opportunities, into each of which Touch will initially invest $10-$25m with the aim of acquiring a 10%-40% non-controlling interest, will be identified by Touch Ventures' own management and investment team or referred by Afterpay through a formal collaboration agreement, which is in place until at least 2025. To date, Touch has made 5 investments, 4 of which have been originated by Afterpay. It appears this is the vehicle Afterpay has assembled to work with, invest in and add value to some of the best emerging businesses it finds as it works with retailers, consumers, investment banks, financial markets and investors around the globe. Since Cyan first encountered this business just over a year ago, three things have caught our eye:

This is a winning teamBy team, we mean everyone involved, including management, board, shareholders, investors and advisers. The easy starting point was obviously Afterpay. Since we invested in that business at its initial public offering in 2016, it has become an international success story. Afterpay has built a powerful position with the biggest players in the biggest markets in the world in retail, data and consumer finance. Not a bad potential investment partner! The team within Touch, led by Hein Vogel, is also high-pedigree. Then there's the board and advisers, including Mike Jeffries and Hugh Robertson, both of whom have been directly involved in Afterpay since its unlisted days. Touch looked compelling a year ago but then earlier this year a material investment from US firm Woodson Capital Management, now its second largest shareholder, and a board seat for the highly regarded Jim Davis offered further validation. Follow that strategistIt's not easy to get exposure to a portfolio of high-growth, scalable, emerging businesses that have come from a reliable source. This portfolio also comes with a shareholder that can enhance these businesses either directly within the Afterpay ecosystem, or by providing expertise and a supported pathway to scalability. This is a unique opportunity to get a listed vehicle that offers liquidity while investing in emerging companies with exposures well beyond Australia's shores. What's in the boxSince we first invested in Touch it has expanded its portfolio to 5 investee companies, deploying around $75m in invested capital. This table from the recent prospectus shows the portfolio. Source: Touch Ventures Prospectus The portfolio is expected to grow to around 10 large holdings in the short to medium term, with potential for smaller investments (generally less than $2m each) in even earlier stage companies. The next round of investments will be funded by the $100m raised through the IPO, in which all the larger existing shareholders invested. Touch is a listed investment company. It aims to make money via growth in the value of its underlying investments rather than their revenue. All investments are carried at their original entry-point valuation until there is a capitalisation event or very clear reason for a revaluation. The collective value of all the investments is the net asset value. It's likely that the stock market will value Touch at a significant premium to its net asset value. The carrying value of these businesses is largely unchanged from Touch's entry point (Happay has been increased but offset by PlayTravel). If I owned an emerging tech business and an Afterpay-led investment company took a stake, I would assume my business had been strongly validated and its value had just increased - and that's before any value my new share holders could add. It's worth noting that at the price investors paid in the IPO, the company has the same valuation it had when Woodson Capital Management invested in February. We think Touch Ventures is a unique vehicle and a compelling opportunity. It's also worth remembering that Square will be acquiring Afterpay early next year, which could lead to greater value creation for Touch shareholders. |

|

Funds operated by this manager: Cyan C3G Fund |

6 Oct 2021 - Webinar Invitation | Paragon

|

Webinar: Performance Update & Outlook Friday, 8 October 2021 at 12:00PM AEST

Funds operated by this manager: |

6 Oct 2021 - Fund Review: Insync Global Capital Aware Fund August 2021

INSYNC GLOBAL CAPITAL AWARE FUND

Attached is our most recently updated Fund Review on the Insync Global Capital Aware Fund.

We would like to highlight the following:

- The Global Capital Aware Fund invests in a concentrated portfolio of 15-30 stocks, targeting exceptional, large cap global companies with a strong focus on dividend growth and downside protection.

- Portfolio selection is driven by a core strategy of investing in companies with sustainable growth in dividends, high returns on capital, positive free cash flows and strong balance sheets.

- Emphasis on limiting downside risk is through extensive company research, the ability to hold cash and long protective index put options.

For further details on the Fund, please do not hesitate to contact us.