NEWS

28 Aug 2025 - Are you sure about that? The folly of forecasting

27 Aug 2025 - Recognising a stumble from a fall

|

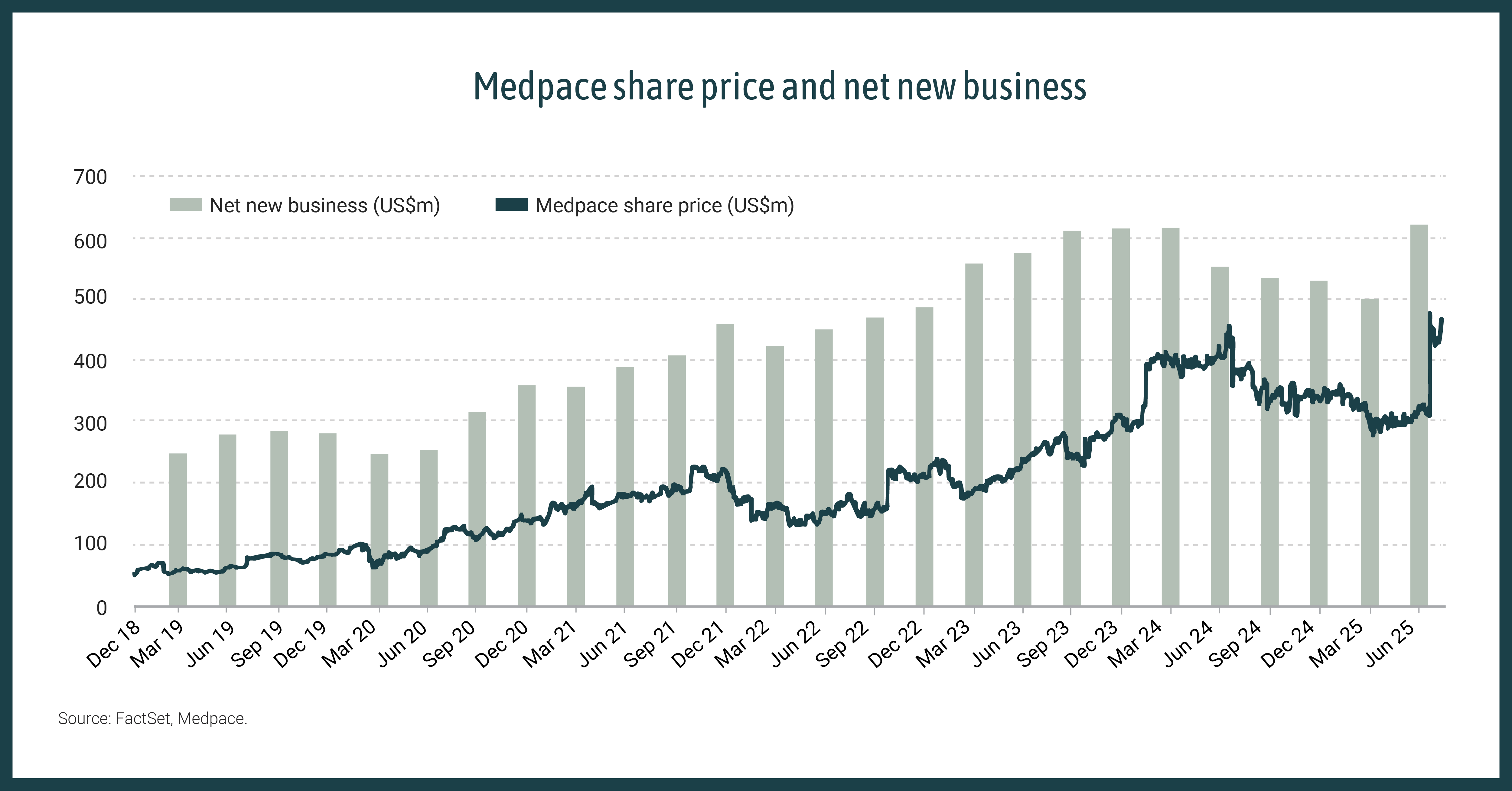

Recognising a stumble from a fall Canopy Investors August 2025 Quality companies typically trade at premium valuations, but when cyclical headwinds are conflated with secular falls, even the best businesses can be dismissed by the market. When heroes stumble excessive negativity can present opportunities to buy quality at a discount. Quality companies are often not hard to spot. The best are well known and trade at a premium valuation as a result. Despite their appeal, quality companies can be risky investments if the price paid is too high. Yet there are times when investors have the opportunity to buy quality at a discounted price, often when cyclical headwinds are conflated with secular concerns, fuelling negative sentiment and fear that the stock is 'dead money' with limited near-term upside. Medpace (MEDP)Take Medpace, for example, an investment in the Canopy Global Small & Mid Cap Fund. This founder-led clinical research organisation focuses on small biotechs and boasts an enviable track record: many years of sales growth exceeding 20%, expanding margins and returns, high cash conversion, and no debt. Its sales represent less than 5% of an addressable market expected to grow 10% pa over the long term. However, from mid-2024 Medpace disclosed lower net new business wins for four consecutive quarters, due to an unexpected increase in trial cancellations by its clients, blamed mostly on a weak funding environment. A litany of additional concerns piled on: potential negative impacts from US drug pricing policy changes, cuts to FDA and NIH funding under the new Secretary of Health and Human Services, and pricing pressure from larger competitors. Despite no fundamental change in the scale of unmet medical need addressed by small biotech, or to Medpace's ability to capture this long-term opportunity, the stock was dismissed by many as 'dead money' with no obvious near-term catalysts, and its share price declined by one-third over the course of a year. At Canopy, we believe investing in high-quality companies at the moment of maximum market pessimism can deliver high returns with relatively low risk. Our Fund holds positions in several companies at various points in their dead money journey. In this instance, we increased our investment in Medpace as investor concerns mounted and the share price fell, improving its return potential, even as the recovery timing remained uncertain. Eventually, the fundamentals reasserted themselves. In Q2, Medpace delivered a surprisingly strong result, with cancellations reverting to normal levels, driving higher net new business growth, which should support higher revenue growth over the coming years. When a positive surprise occurs in a so-called dead money stock, the reaction can be dramatic: Medpace's share price increased 50% the day after the Q2 result. While there was probably no way of predicting the result in advance, the Medpace experience highlights how long term investors can recognise a stumble, as opposed to a fall, and with conviction in the company's long-term prospects, buy quality at a discount.

Source: FactSet, Medpace |

|

Funds operated by this manager: |

26 Aug 2025 - The art of the comeback

|

The art of the comeback Magellan Asset Management August 2025 |

|

The investment world often prizes consistency and upward momentum--but some of the most compelling returns come from companies that have temporarily lost their way. In a recent Magellan In The Know podcast, Investment Analysts Hannah Dickinson and Emma Henderson shed light on how discerning investors can tap into turnaround stories in the consumer sector and, more importantly, how to separate real opportunity from value traps. What makes a turnaround worth it?At Magellan, a turnaround doesn't mean betting on distressed companies or moonshot startups. Instead, it refers to high-quality businesses facing temporary setbacks--strategic or operational missteps that lead to material share price declines but are fixable. The rewards for identifying a true turnaround early can be significant. Successful recoveries can often result in share price rallies of 50% or more. However, the risks are just as real: historical studies show that only 20-30% of corporate turnarounds actually succeed. That's why we maintain a high bar, filtering only a few Four pillars of turnaround investingThe Magellan investment team apply a disciplined framework to assess whether or not a company genuinely has turnaround potential. The framework is built on four pillars: 1. Fundamentals: Is the business still high quality?Before diving into a company's recovery strategy, we ask ourselves whether or not the business still retains its core strengths. For example, Nike, despite recent setbacks, continues to operate in an attractive industry (sportswear) and retains global brand equity and competitive advantages. Similarly, Kering's challenges On the other hand, companies like Pepsi face more ambiguous issues, such as structural health concerns and policy shifts. These situations, while not necessarily doomed, are harder to categorise as classic turnarounds. 2. Leadership: Who is at the helm?Successful turnarounds often depend on the right CEO. Ideally, this is someone new--an outsider with full autonomy and a mandate to make bold changes. Starbucks offers a telling case: after several underwhelming leadership transitions, the company brought in Brian Niccol from Chipotle, whose track record and However, we would warn that even a celebrated CEO appointment doesn't guarantee success. If governance structures are weak or the leadership lacks experience in managing complexity, execution can flater. 3. Strategy and complexity: Is the plan credible?We look for turnaround strategies that focus on reinforcing a company's core competitive strengths rather than cost-cutting for short-term gains. Estée Lauder, for instance, operates in a highly attractive beauty market and has new leadership but its current plan leans too heavily on easy wins like headcount reduction and Amazon partnerships. We are cautious here, citing concerns regarding innovation, outdated IT systems and supply chain complexity. Nike, by contrast, has a more straightforward strategy: refresh its product innovation pipeline and rebuild damaged retail relationships. These are fixable issues that don't require reinvention of the business model. 4. Timing: Where are we in the recovery cycle?Rather than trying to 'time the market', we assess whether the company is early, mid, or late in its turnaround phase. Has a credible CEO been appointed? Is the strategy clearly communicated? Have investor expectations been reset? Nike again stands out as a case where much of the heavy lifting has occurred already. Product pullbacks have been made, reinvestment is underway, and green shoots in innovation are expected in the next 12-18 months. Conversely, Kering's turnaround is still in its early days with leadership in place, but Valuation and portfolio disciplineValuation is particularly tricky in turnarounds, where near-term earnings are often depressed. We move beyond simple metrics like P/E ratios and instead focus on scenario analysis, assessing a range of possible outcomes and the probability distribution of returns. Position sizing and diversification are critical. Turnarounds typically enter the portfolio as small allocations, with the Magellan investment team continually monitoring signs of progress closely. If the share price falls, we revisit the evidence: is the thesis still intact? If so, we may average down; if not, we remain disciplined in selling. It's not for the faint-hearted, but worth the effortTurnarounds are rarely smooth. They require patience, rigorous analysis, and a clear-eyed view of both risk and reward. However, when done correctly, anchored by strong fundamentals, capable leadership, credible strategy and well-timed execution, they may unlock unique, outsized returns. That said, these opportunities don't come easily. They demand deep sector knowledge, disciplined valuation work, ongoing monitoring, and the ability to separate short-term noise from meaningful signals. For individual investors, that level of commitment and emotional resilience can be difficult to sustain. That's why turnaround investing is often best approached with a disciplined framework and the resources to dig deep. It takes experience to cut through the noise, the analytical firepower to deeply understand what's truly going on inside a company, and the ability to avoid behavioural traps and know when the risk-reward equation truly stacks up. For investors willing to do the work, turnarounds could be one of the most rewarding corners of the market. |

|

Funds operated by this manager: Magellan Global Fund (Open Class Units) ASX:MGOC , Magellan Infrastructure Fund , Magellan Global Opportunities Fund No.2 (Class A) , Magellan Infrastructure Fund (Unhedged) , Magellan Global Fund (Hedged) , Magellan Core Infrastructure Fund , Magellan Global Opportunities Fund Important Information: Copyright 2025 All rights reserved. Units in the funds referred to in this podcast are issued by Magellan Asset Management Limited ABN 31 120 593 946, AFS Licence No. 304 301 ('Magellan'). This material has been delivered to you by Magellan and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should obtain and consider the relevant Product Disclosure Statement ('PDS') and Target Market Determination ('TMD') and consider obtaining professional investment advice tailored to your specific circumstances before making a decision about whether to acquire, or continue to hold, the relevant financial product. A copy of the relevant PDS and TMD relating to a Magellan financial product may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. The opinions expressed in this material are as of the date of publication and are subject to change. The information and opinions contained in this material are not guaranteed as to accuracy or completeness. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any financial product or service, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. This material may contain 'forward looking' statements and no guarantee is made that any forecasts or predictions made will materialise. No representation or warranty is made with respect to the accuracy or completeness of any of the information contained in this material. Magellan will not be responsible or liable for any losses arising from your use or reliance upon any part of the information contained in this material. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. Further important information regarding this podcast can be found on the Insights page on our website, www.magellangroup.com.au. |

25 Aug 2025 - Manager Insights | Argonaut Funds Management

|

Chris Gosselin, CEO of FundMonitors.com, speaks with David Franklyn, Managing Director and Co-Head of Funds Management at Argonaut. David outlines the Argonaut Natural Resources Fund, launched in 2020, which has delivered strong returns by investing across mining companies from majors like BHP to small-cap explorers. He highlights the fund's focus on themes such as energy transition and geopolitical risk, with gold as a safe haven and copper as the key growth driver, while noting that resources remain undervalued but vital to global growth.

|

The following article features insights in response to reader questions on investment strategy, asset allocation, and risk management.

22 Aug 2025 - Shares, Property, Volatility & More

|

Shares, Property, Volatility & More Marcus Today August 2025 |

|

The following article and video features insights from Marcus Today in response to reader questions on investment strategy, asset allocation, and risk management. While the views expressed are those of the author and reflect his personal investment philosophy, the principles discussed--such as comparing asset classes, managing volatility, and understanding leveraged products--are broadly relevant to investors and financial professionals. Readers should consider these perspectives alongside their own objectives and risk tolerance. Should You Sell a Paid-Off Investment Property?Ben asked: If the investment property has been paid off, should you sell it and invest in the stock market for a better return? There are a couple of things in there, Ben, which need to be debated. One is, does the stock market give you a better return? The answer to that is -- if the person who's investing is any good, because it is a skill -- then the returns would be better than the investment property, where the asset class grows rather slowly. So I would say the stock market in the right hands is better than the investment property. Should you sell an investment property just because it has been paid off? All I would say to you, Ben, is it's entirely personal. What are you trying to achieve with your investment property? If you're good at investing in property, it's succeeded for you, you know what you're doing. Maybe gear up and buy another investment property, if that's what you're good at. People should stick to what they're good at. So there's no one answer to this question. If the investment property has been paid off, it's entirely down to you -- what you want to do next. Should you put it in the stock market? Only if you know what you're doing.

Dividends vs Rent - Does Frequency Matter?Vishal asked: One of the problems with Australian shares is that they only pay dividends twice a year. Property puts rent in your pocket every week. What are your thoughts on that? Again, entirely a personal choice. Do you need income every month? Or does it not disturb you to get it every six months? I would say to you that wealthy retirees really don't care about needing cash. If you need a regular cash flow, you haven't got enough money, and you're a little bit desperate. Because most wealthy people will have enough money around to see them over for six months in between dividends from shares. Yes, you can spread it out with property, but also what you can do is spread it out with shares. For instance, the CBA pays a dividend, and then three months later ANZ, NAB and Westpac pay a dividend. And then three months later, CBA pays a dividend. So you see, you can put together a portfolio that pays at different times. There used to be a good table -- which you could do yourselves -- which shows you when, because they go ex-dividend the same time and they pay the same time every year, or almost every share. You could grab the top 20 income stocks. You could have a look at our Income Portfolio for some of those, grab the top 20 income stocks and see what month they pay. And you could buy them in proportions that would give you an income over time. But as I say, most wealthy retirees don't really care about the infrequency of getting a dividend. What they're really after is the big lump of franking credit refunds they get at the end of the year -- which you get once a year -- when they put their tax return in. And that's really what they're interested in. And they just budget the whole thing over the year. So no, I don't think there's any problem with shares paying twice a year instead of every month compared to property.

Volatility Is Normal - But ManageableRick asked: How do you look past volatility in the share markets, when the USA is so central to confidence in its performance? You don't. The share market is clearly mentally more volatile than property, and that's one of the great benefits of property -- it doesn't get reported to you in the media every night. Every morning, "the market did this, the market did that." "Your house has gone down 0.3% today, it's up 2%." That would freak you out as much as shares freak you out at the moment -- if it was being reported on all the time. So the impression is the property market is less volatile. How do you manage volatility in shares? Well, you manage it. Most of the market doesn't understand. Most people sitting at a dinner party talking shares will talk about BHP and the CBA in the same breath -- when the BHP share price is moving 5% a week and the Telstra share price moves 2% a week. It's two and a half times more risky, more volatile. Every share, every return you get, has a level of risk. You can work that out using average true range percentage of the share price -- we talk about that in the newsletter a lot -- but you need to understand volatility and risk has to be managed to match you. You have to match it to your own personal investing style. So that's how you handle the volatility -- by being aware of it and managing it. You can't get away from it. The fact that the property market appears less volatile and allows investors to sleep at night -- that's fine. You sleep at night. But I reckon I'll make more money in the stock market if I know what I'm doing. With the volatility, I just have to make sure I manage the volatility. And as you'll know, in any market today, remember -- we all know -- the way we manage the precipitous moments is we cash out. It is less risky. The whole market will tell you you can't time the market. "It's time in the market, not timing the market." I think that's wrong. And I believe timing the market is less risky than giving it to a fund manager who sits in the market come what may with some idea that it's all about the long term. What we do -- cashing out occasionally, getting back in again -- is going to get you a better return and is less risky than somebody who tells you all those Buffett-esque quotes about it being in the long term. "Don't buy anything for ten minutes you wouldn't hold for ten years." Absolute rubbish. You have to time the market, and it's less risky to do that. Geared ETFs - Use With Caution Scott asked: What are your thoughts on leveraging in shares via geared ETFs like GGUS, GEAR etc., if the investor understands the risk? Careful. If you treat some of these synthetic ETFs as investments, you will find they don't do what the underlying index does. Geared ETFs -- if they're created using derivatives -- are going to short-term do what the market does. Longer-term, they won't. Because if they've got derivatives involved, they constantly lose time value. So if you were to, say, buy a synthetic derivative-leveraged ETF over the Nasdaq -- to create that, you're constantly losing time value. So it will underperform the Nasdaq over the longer term. In my view, geared ETFs are for trading. They are not for long-term investment. So if you thought you were going to buy GGUS instead of the US market because you thought the market was going to go up long term, you're going to be disappointed. Because it's going to underperform long-term, because it's being created out of derivatives. Derivatives lose value all the time as time goes past. Slightly complicated -- but look up time value of options, or time decay in derivatives. DISCLAIMER: This content is for general information purposes only and does not constitute personal financial advice. Please consider your own circumstances or seek professional advice before making investment decisions. |

|

Funds operated by this manager: |

21 Aug 2025 - Growth amid structural changes

500 and NASDAQ increased +2.2% and +3.7%, respectively,

whilst in the UK, the FTSE rose +4.2%.

20 Aug 2025 - Glenmore Asset Management - Market Commentary

|

Market Commentary - July Glenmore Asset Management July 2025 Global equity markets had a solid month. In the US, the S&P 500 and NASDAQ increased +2.2% and +3.7%, respectively, whilst in the UK, the FTSE rose +4.2%. Domestically, the AllOrdinaries Accumulation index was broadly in-line with its US peers, rising +2.6%. This was led by the Healthcare (+8.7%) and Resources sectors (+4.5%), which benefitted from a rotation out of Banks (-1.3%), following a period of strong outperformance. Investor sentiment during the month was buoyed by the announcement of several US related trade deals, including with the European Union, Japan and South Korea, amongst others. As it stands, the "effective tariff rate" from the US is set to rise from an average of ~2% in 2024 to ~16%. Whilst the impact of this remains unclear, investors will undoubtedly be keeping an eye on economic data over the coming months. Closer to home, June quarter 2025 domestic inflation figures came in slightly weaker than expected, with the trimmed mean CPI (the RBA's preferred measure of underlying inflation) declining to 2.7% (YoY) from 2.9% in 1Q-2025. As a result, financial markets now expect to the RBA to cut the cash rate by 25bps during the upcoming 12th August meeting. In bond markets, the US 10-year bond yield rose +15 basis points (bp) to 4.37%, whilst its Australian counterpart rose +10bp to close at 4.26%. The Australian dollar was weaker in June, closing at US$0.643, down 1.6 cents. Funds operated by this manager: |

19 Aug 2025 - Investment Perspectives: 10 charts shaping our thinking

18 Aug 2025 - Manager Insights | Digital Asset Funds Management

|

Chris Gosselin, CEO of FundMonitors.com, speaks with Clint Maddock, Director and Co-Founder at Digital Asset Funds Management, about the firm's Digital Income Fund and its market-neutral arbitrage strategy in the cryptocurrency space. Clint explains how the fund has delivered consistent double-digit annual returns with minimal drawdowns, and why growing mainstream adoption of digital assets continues to create opportunities.

|

15 Aug 2025 - Fed, BOJ and China navigate uncertain growth and inflation paths

|

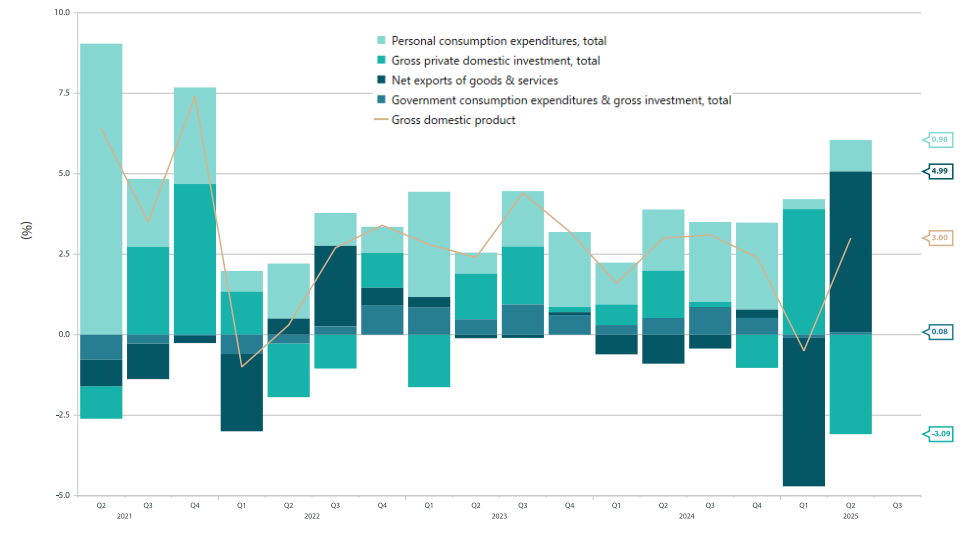

Fed, BOJ and China navigate uncertain growth and inflation paths Nikko Asset Management August 2025 Firm US GDP supports Fed's decision to keep rates on hold for nowThe Federal Reserve (Fed) kept rates on hold on 30 July, maintaining the policy rate in a range between 4.25% and 4.5%, following stronger-than-expected US Q2 GDP data. Although the Fed's rate decision was widely anticipated, the first double dissent in 30 years--from Fed governors Christopher Waller and Michelle Bowman--highlighted a divergence in outlooks among Federal Open Market Committee voters. Waller and Bowman pointed to early signals of softness in the labour market, although data suggest that economic activity continues to be supported by offsetting factors, even in the post-2 April world. In Q2, US consumption made a positive contribution to growth, albeit less strongly than in late 2024 (Chart 1). However, a significant expansion in net exports--compensating for front-loaded imports in Q1--more than offset a decline in private domestic investment and subdued government consumption. Still, US growth remains influenced by temporary factors, and households may not yet have felt the full brunt of US tariffs. Fed Chair Jerome Powell acknowledged emerging risks in the labour market but emphasised that employment is closer to one of the Fed's goals of full employment than inflation is to its mandate of price stability. Supporting Powell's point, the US core PCE index posted a smaller-than-expected decline, falling from 3.5% in Q1 to 2.5% in Q2, meaning that it is still half a percentage point above the Fed's target. Chart 1: US GDP contributions (seasonally adjusted, annualised rate)

Source: Nikko Asset Management, Hutchins Center on Fiscal & Monetary Policy, BEA Tariff deadline rush underscores reasons to wait and seeA deluge of new information on US tariffs continues to pour in, with the market and the US economy still trying to digest its implications. Tariff rates range widely, from 15% on exports from heavyweight South Korea to a higher-than-expected 25% on Indian goods. The only constant appears to be that tariffs remain subject to upward pressure, although the situation is perhaps not as severe as some worst-case scenarios had projected. The full economic impact of the newly agreed tariffs remains unclear, but it is likely that the most significant effects of the US tariff war still lie ahead. As we pointed out in Global Investment Committee's outlook: narrowing growth differentials , a New York Fed corporate survey shows that most companies plan to pass on tariff costs, at least partially, and that they typically do so with a lag of one to three months. Since we are not even a month past the initial 4 July "reciprocal" tariff deadline announced in April, further pass-through may still be pending in inflation data. Of course, the timing of such price rises may not be ideal as the job market has shown early signs of softening. However, repeated micro-adjustments to global supply chains and prices that result in consistent shocks may work against arguments for rate cuts based on labour market weakness. This could be particularly true if consumers internalise such repeated shocks and adjust their long-term inflation expectations upward. It is worth noting that once internalised and passed through into long-term expectations, inflation tends to be sticky. As such, it is not certain if the prevailing effect will ultimately be a decline in demand driven by rising unemployment. BOJ stands pat but slightly more hawkish on growth and inflation outlookThe Bank of Japan (BOJ), like the Fed, opted on 31 July to remain in wait-and-see mode, keeping its policy rate on hold at 0.5%. However, in its updated outlook the BOJ modestly revised its near-term growth view from 0.5% to 0.6%. In addition, it significantly revised its near-term core CPI outlook from 2.2% to 2.7%. The central bank also modestly upgraded its longer-term core CPI projection; its two-year forward CPI forecast was revised back to 2% from 1.9%. These revisions, all else equal, provide a greater argument for a more hawkish BOJ compared to May. Meanwhile, the assumption that core CPI will slow from 2.7% in the current fiscal year to 1.8% in the next is highly dependent on the pricing-out of fresh food prices and absence of other inflationary factors going into fiscal 2026. Should prices remain more robust over late 2025 and household purchasing power stay intact, the BOJ may be prompted to bring forward its rate hike timeline. Our central scenario remains that the BOJ is likely to hike rates before the end of 2025. China's Politburo also in wait-and-see mode, keeps policy powder dryAmid the global wave of data, China's Politburo expressed confidence in the resilience of the Chinese economy but has so far refrained from offering new policy measures. As trade negotiations with the US have now been extended, China could be trying to maintain some dry powder to react to the eventual outcome of the talks--particularly if it poses any additional challenges to external demand. A key development is the 4th Plenum in October, which will focus on the 15th Five-year plan (2026 to 2030). This event may provide an opportunity for new policy announcements in response to what is revealed after extended China-US trade talks. By October, the need for consumption-focused stimulus may become apparent, particularly if China's current "anti-involution" campaign--aimed at curbing excessive capacity--proves ineffective in offsetting price declines stemming from households' soft demand and precautionary savings. Funds operated by this manager: Nikko AM Global Share Fund , Nikko AM ARK Global Disruptive Innovation Fund , Nikko AM NZ Cash Fund , Nikko AM NZ Corporate Bond Fund , Nikko AM Core Equity Fund (NZ) , Nikko AM Global Shares Hedged Fund (NZ) , Nikko AM KiwiSaver Scheme Balanced Fund (NZ) , Nikko AM ARK Disruptive Innovation Fund (NZ) Important disclaimer information Please note that much of the content which appears on this page is intended for the use of professional investors only. |