NEWS

11 Dec 2024 - Performance Report: Seed Funds Management Hybrid Income Fund

[Current Manager Report if available]

11 Dec 2024 - Performance Report: Skerryvore Global Emerging Markets All-Cap Equity Fund

[Current Manager Report if available]

11 Dec 2024 - Performance Report: Bennelong Long Short Equity Fund

[Current Manager Report if available]

11 Dec 2024 -

|

"A is for Ambition": Apple and Amazon Bet Big on the Future Alphinity Investment Management December 2024 |

|

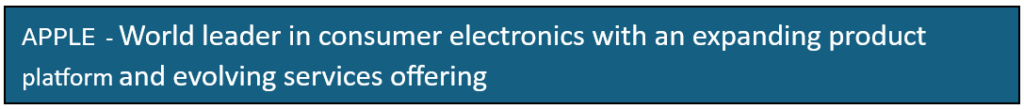

The recent Apple and Amazon third quarter 2024 results revealed further details around the critical leg of their strategies, with these tech giants continuing to lay down markers for how they see the next stage of tech evolution unfolding and staking out positions to profit from it. Looming large in this evolution is AI, with Apple looking to leverage capabilities across what is an enormous ecosystem of 2.2bn active devices while Amazon is focusing on pushing AI applications across their Cloud and consumer business. The recent results also provided key insights into shorter term business performance.  Key takeaway from the result? The key takeaway from the Apple result is that while the gains from the release of "Apple Intelligence" will be significant, they will take time. This was evidenced by the fact that despite this recent result coming in ahead of expectations, it was coupled with a guide for the coming quarter that was mildly below what the market was looking for (Apple guided to revenue growth of low to mid-single digits vs a market that was expecting +7%). This makes sense as "Apple Intelligence" has only just rolled out in the US in recent weeks, and will not become available in the UK, Australia, Canada, and New Zealand until December 2024. Other geographies will follow over the course of 2025. Most importantly, it is also December 2024 before we see a meaningful expansion of the AI features including the long-awaited Chat GPT integration. As such, the powerful iPhone upgrade cycle that we expect to come with "Apple Intelligence" is likely to be a slow burn, with momentum building through 2025 and into 2026. What impressed? The ability of Apple to turn a benign demand environment into double digit EPS growth is impressive. Products growth has been tepid but the higher growth Services business, margin expansion and a buy-back continues to drive EPS growth above 10%. What disappointed? While we appreciate that Apple Intelligence will take time, the pace of the roll-out driving the weaker than expected outlook for 4Q (which is their biggest quarter of the year) was mildly disappointing. However, Apple tend to focus on quality rather than speed, so we do think that their ability to monetise AI across an installed base of 2.2bn active devices is a compelling, multi-year opportunity. Interesting chart? The next phase for Apple is all about an iPhone replacement cycle coupled with an expansion of associated Services revenue. The chart below shows what happened the last time a compelling technology shift occurred, with 5G driving a compression in this replacement cycle. Since the most recent trough in FY21, replacement cycles have shifted out by more than 12 months. A compression of this replacement cycle back towards 4yrs will drive circa 10% EPS upgrades.  What are the key risks? There are a few key risks facing Apple in the coming years. Key among these are:

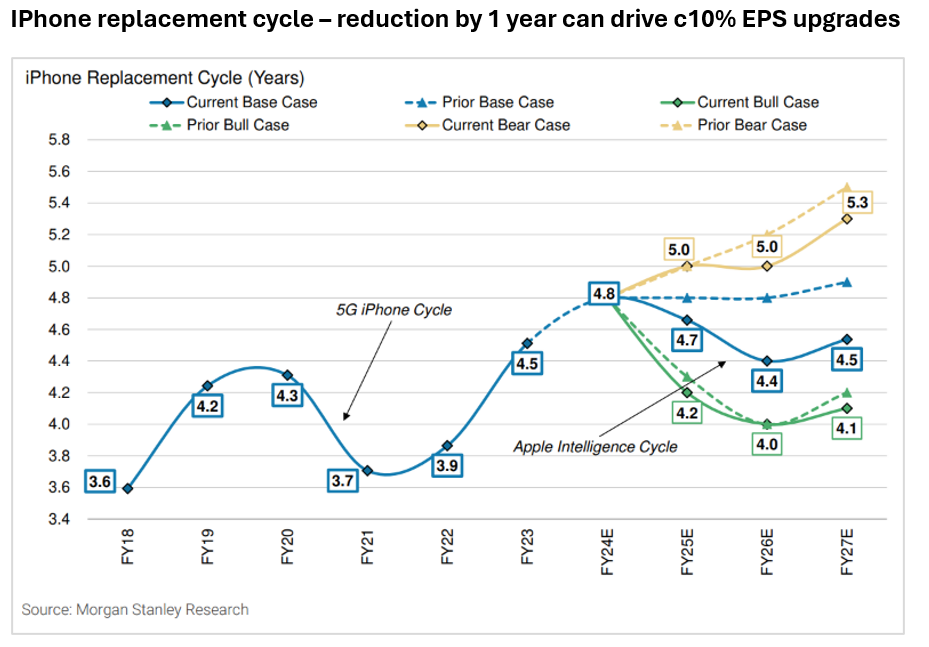

In summary, Apple's ability to monetise their enormous consumer ecosystem is almost unrivalled. They will find a structure through which to monetise Ai, both through device sales but more importantly through an expansion of Ai related Services offerings. There is no company better placed to be the window into Ai for the average consumer.  Key takeaway from the result? Margins, margins, margins. Given the scale of the Amazon business, a mild shift in margin outcomes can drive enormous gains in operating income and EPS. Amazon spooked the market during their 2Q24 results which showed margins for their core retail business to be weaker than expected, which was blamed on everything from mix (lower priced "everyday essentials" in baskets) to building extra satellites for their broadband business. However, come the 3Q24 result last week, all was forgotten as Amazon blew those margin expectations (that they ironically had guided to themselves) out of the water. So, the question becomes, will this margin expansion continue? What impressed? The margin outcome in the core retail business was impressive, particularly in the international segment. Despite pressures from mix and what appears to be heightened competition from legacy retailers (eg Walmart) and Chinese players (Temu, Shein), Amazon generated solid topline growth and exceptional margins. The Amazon cloud business AWS also showed a continuing reacceleration driven in part by AI. A combination of the "law of large numbers" plus optimisations had driven compression in cloud growth rates across Amazon (AWS), Microsoft (Azure) and Google (GCP). However, the advent of AI has driven a reacceleration in cloud growth, which is impressive given the base of business is significantly larger. What disappointed? While it may seem unusual to have any source of disappointment in an exceptionally strong result, the variability of the margin outcomes compared to what management expected could indicate a lack of visibility. While a "miss vs expectations" is very happily received when it is an upside surprise, it does raise some concerns that perhaps next time the "surprise" could be the other way. Interesting chart? Given the scale of the retail business, a shift in margin expectations has a material impact on earnings. A circa 100bps improvement in Retail margins vs current expectations for CY25 would drive a 7% beat in Amazon operating income.  What are the key risks? For Amazon, risks are on a couple of key fronts:

In summary, Amazon's 3Q24 earnings report highlighted the significant earnings potential of the business and underscored the company's strong market position and attractive consumer offerings. However, it is crucial to closely monitor Amazon's ability to sustain margin improvements and effectively navigate ongoing consumer pressures in the future. |

|

Funds operated by this manager: Alphinity Australian Share Fund, Alphinity Concentrated Australian Share Fund, Alphinity Global Equity Fund, Alphinity Global Sustainable Equity Fund, Alphinity Sustainable Share Fund |

10 Dec 2024 - Performance Report: Quay Global Real Estate Fund (Unhedged)

[Current Manager Report if available]

10 Dec 2024 - Performance Report: ASCF High Yield Fund

[Current Manager Report if available]

10 Dec 2024 - Mixed market sentiment for 2025 driven by global geopolitics and central bank easing cycles

|

Mixed market sentiment for 2025 driven by global geopolitics and central bank easing cycles Bennelong Funds Management November 2024 The incoming Trump administration has raised uncertainty about the outlook for global markets in 2025, particularly around the implementation of Trump's protectionist policies, according to Bennelong and its boutique partners Canopy Investors, 4D Infrastructure and Quay Global Investors.

The new US administration's activities and policy changes will be very important in driving market sentiment in 2025, and will create both opportunities and risks, according to Canopy Investors' portfolio manager, Kris Webster. "There remains significant uncertainty about the actual policies that will be introduced, and their ultimate impact, making the outlook for 2025 very uncertain. "However, based on Trump's stated policy positions, several domestic US sectors appear well positioned to benefit from his presidency. These include manufacturers, energy companies, and industries targeted for deregulation, for example financials. "Conversely, certain sectors may face headwinds including global exporters to the US, US importers, and companies with substantial China exposure. "Markets have already priced in some of these policy expectations, as evidenced by US dollar strength against major currencies. This dynamic has created increasingly attractive valuations for many high-quality stocks in markets outside the US, particularly those with limited exposure to US policy changes. Mr Webster says a critical uncertainty centres on how these policies might affect inflation and, by extension, interest rates - both of which significantly influence asset prices and highly leveraged companies. "It's possible the US government will moderate its policies around taxation, tariffs, and immigration, if inflation picks up again. "While we don't make short-term macro or market predictions, it is likely that the policy uncertainty anticipated in 2025 will drive increased market volatility. This environment should create opportunities for active investing, particularly in global small and mid-cap companies, where market inefficiencies tend to be more pronounced," he says. For global listed infrastructure, there is likely to be heightened policy noise in the US on what policies are prioritised for actual implementation, according to 4D Infrastructure CIO, Sarah Shaw. "Most notably, these include the 60 per cent tariff on Chinese goods and a universal 10 to 20 per cent tariff on all other countries. These could have an impact on infrastructure assets, in particular port and rail volumes in both export and import countries, with some volumes pulled forward ahead of the anticipated tariff increases, whilst some export markets will be substituted with other destination markets away from the US. "Trump is also looking to repeal some aspects of the Inflation Reduction Act (IRA), which may impact the growth outlook of some heavily US renewable focused developers and utilities. This could lead to an ongoing overhang till we see what is exactly implemented. "This pivot away from renewables and preferring traditional fossil fuels may be positive for north American pipelines if more federal lands are permitted for exploration. An undoing of Biden's pause of new LNG Export terminals will also help the long-term capital plans of those businesses," she says. "Lastly, the proposed policies are inflationary and a reversal in trend of interest rates could be a headwind for US nominal rate utilities which have had an incredibly strong year in 2024" Elsewhere in the world, Ms Shaw says there are divergent economic outlooks. "In Europe demand remains soft with interest rate trajectory down. China continues to struggle with a dormant economic outlook, increasing stimulus. In Brazil, growth continues to surprise to the upside with a reversal in the interest rate trajectory." Ms Shaw says that this macro uncertainty and geopolitical tensions will create volatility and noise, however by separating the attractive fundamentals of infrastructure from this noise and continuing to invest against the inefficiency of markets, investors can capture future earnings and growth in this asset class. "Infrastructure offers a unique combination of defensive characteristics and earnings resilience but with significant long-term growth thematics as well as an ability to capture economic cycles. "The need for global infrastructure investment over the coming decades is clear with five globally relevant and necessary thematics under pinning a multi decade growth story. With governments unable to wholly fund the infrastructure need, there's a significant opportunity for private investors to tap into this growth story. We can think of no more compelling or enduring global investment thematic for the coming 50 years," says Ms Shaw. Chris Bedingfield, portfolio manager at Quay Global Investors, sees a similar mixed story for global real estate assets. "Investors continue to make the mistake of thinking real estate is interest rate driven but the value in real estate can be found by focusing on thematics not influenced by macros factors or politics. "The aging population is a thematic we are focused on and 2025 marks the 80-year anniversary of the end of the second world war, meaning that next year, the first of the Baby Boomers will turn 80, an age where many turn to some type of assisted living. "Retail also continues to look very attractive. The recovery of in-store retail sales since COVID remains well above the prior pandemic trend. We expect good financial results from the best malls in 2025 as landlords continue to mark rents back to economic reality." Mr Bedingfield says there are signs that suggest a positive outlook for global REITs. "Timing the markets is hard. Miss a few good days and long-term total returns can alter significantly. This is especially so for listed real estate. "History suggests listed REITs run in anticipation of US Fed rate cuts and continue to perform for some time after, and we've seen this materialise after the first rate cut in September. "Moreover, higher building costs is already resulting in a shortage of global real estate, as the development equation does not work. This will simply squeeze future tenants, all the more to the benefit of landlords and investors of REITs," he says. The content contained in this article represents the opinions of the authors. The authors may hold either long or short positions in securities of various companies discussed in the article. The commentary in this article in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the authors to express their personal views on investing and for the entertainment of the reader. |

9 Dec 2024 - Performance Report: Bennelong Australian Equities Fund

[Current Manager Report if available]

9 Dec 2024 - How Trump will impact equity markets

|

How Trump will impact equity markets Magellan Asset Management November 2024 |

|

The United States has spoken. President Trump will return to the White House in the new year. But how can we cut through the noise to reveal the investment, economic and geopolitical ramifications? Magellan's Head of Global Equities and Portfolio Manager, Arvid Streimann, has over 25 years' experience of following markets and politics, and over this time has built up a network of trusted contacts, he can offer a measured, independent view of the situation, including his expectations on Donald Trump's policy initiatives and decision making. He's joined by Investment Director Elisa Di Marco for an exploration of the implications of a Republican clean sweep, including the impact on standards of living and consumer sentiment, as well as the potential for deregulation, and President Trump's promise to adopt protectionist policies in an effort to develop self-sufficiency. They share insights into geopolitical dynamics, including U.S.-China relations, Iran and Ukraine, and discuss the risks and opportunities for investors. |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Core Infrastructure Fund, Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged) Important Information: Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should obtain and consider the relevant Product Disclosure Statement ('PDS') and Target Market Determination ('TMD') and consider obtaining professional investment advice tailored to your specific circumstances before making a decision about whether to acquire, or continue to hold, the relevant financial product. A copy of the relevant PDS and TMD relating to a Magellan financial product may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any financial product or service, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. No representation or warranty is made with respect to the accuracy or completeness of any of the information contained in this material. Magellan will not be responsible or liable for any losses arising from your use or reliance upon any part of the information contained in this material. Any third party trademarks contained herein are the property of their respective owners and Magellan claims no ownership in, nor any affiliation with, such trademarks. Any third party trademarks that appear in this material are used for information purposes and only to identify the company names or brands of their respective owners. No affiliation, sponsorship or endorsement should be inferred from the use of these trademarks. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |

6 Dec 2024 - Hedge Clippings | 06 December 2024

|

|

|

|

Hedge Clippings | 06 December 2024 As we approach the end of the year it's normal to reach for the crystal ball and peer into the future. This is particularly the case as there's so much at stake, and so much that might - or in the case of the RBA's stance on interest rates - might not change. Politically, the potential for change is already in place, with Donald Trump returning to the inauguration stage on the 20th of January. Although we might know the presidential inauguration date, and have been given a pretty clear outline of his policies, big question marks hang over both their effect on the US economy, and the reaction to them from the rest of the world - particularly from China which is already facing a further slowdown - and politically from Russia and Israel. More recently, there's been turmoil in France, and back in Australia, there's an election due by May, which it seems could go either way. However, you can't look into the crystal ball without also looking in the rear-view mirror. This week's PinPoint Macro Analytics article (see link to full article below), summarises Australia's economy over the past year as a "curate's egg" - partly good and partly bad. Inflation improved, but not enough to enable the RBA to move off their "narrow path" while GDP growth slowed to just 0.3% in the September quarter, and 0.8% over 12 months. Of course the original "curate's egg" was all bad - it just depended on which side of the table - the Bishop's or his unfortunate Curate's - one was sitting. So it is with Australia's economy, particularly if you're struggling with the cost of living, or with an oversized mortgage. Inflation in Australia only improved thanks to government support for electricity prices, while GDP growth only stayed positive thanks to government support. Dr. Chalmers would argue that's what his priorities should be. Meanwhile private demand through household consumption and business investment contributed nothing to September's insipid GDP growth rate. On the positive side, Australia's employment market remained strong, with unemployment hovering around 4.0%. Ironically, had this not been the case, the RBA might have moved to cut rates, a move some economists are now calling for, even if they're not expecting it to happen pre-election. Depending on how you look at it, the RBA has navigated the inflation cycle well, having not raised rates as much as their offshore counterparts, and as a result haven't moved to cut them either. Looking forward to 2025, PinPoint's research sees the global outlook remaining somewhat uninspiring, with the IMF describing the situation as "underwhelming". Still, while risks continue to skew towards the downside, recession fears have not made their way into most credible forecasts. News & Insights Market Update | Australian Secure Capital Fund Investment Perspectives: A Nike case study - lessons for real estate investors | Quay Global Investors Risks & Issues for 2025 - Part 1 | PinPoint Macro Analytics November 2024 Performance News Bennelong Australian Equities Fund Seed Funds Management Hybrid Income Fund |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday |