After many years of limited activity on green bonds in Australia, we have seen a number of developments in this space recently, with the announcement of the Australian Government issuing a green bond. This reflects the substantial increase in activity in green bond development globally.

Joining the latest episode of the ESG in 10 podcast, is Tamar Hamlyn, portfolio manager at Ardea Investment Management, to take us through the developments in the green bond space in Australia and what this means for sovereign bond investors.

NEWS

15 Aug 2023 - Investment Perspectives: Thinking about the cycle

|

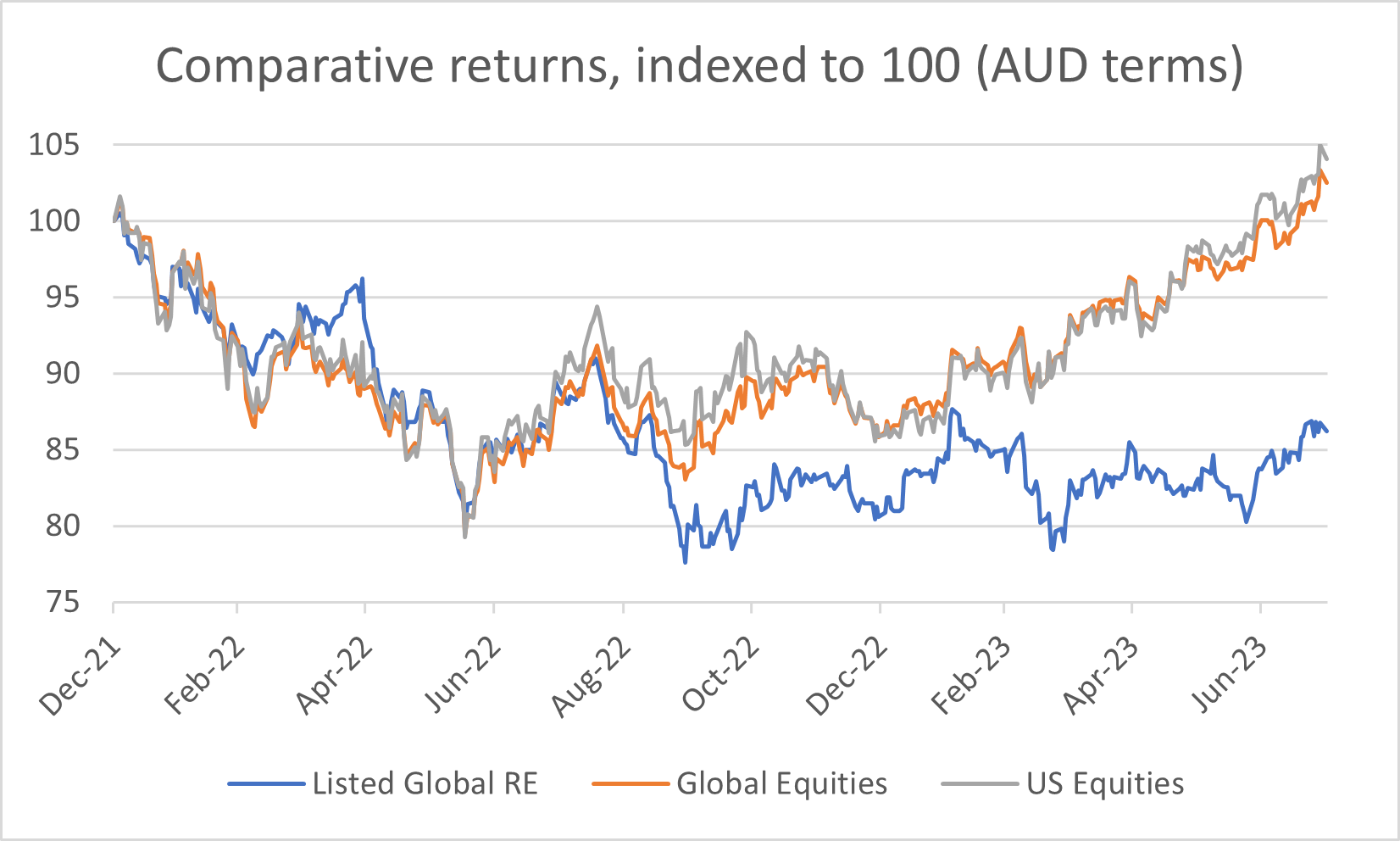

Investment Perspectives: Thinking about the cycle Quay Global Investors August 2023 Being an investor in listed global real estate has been tough of late. With expectations of a global recession caused by unprecedented interest rate increases, sentiment towards listed global real estate has soured. But what if there are other nuances at play, and the market is creating long-term opportunities for savvy investors? High rates impacting REITsThe Listed Global Real Estate Index peaked at the end of 2021. For unhedged Australian investors, it has since declined by approximately 14%, and underperformed global and US equities by 16% and 17% respectively.

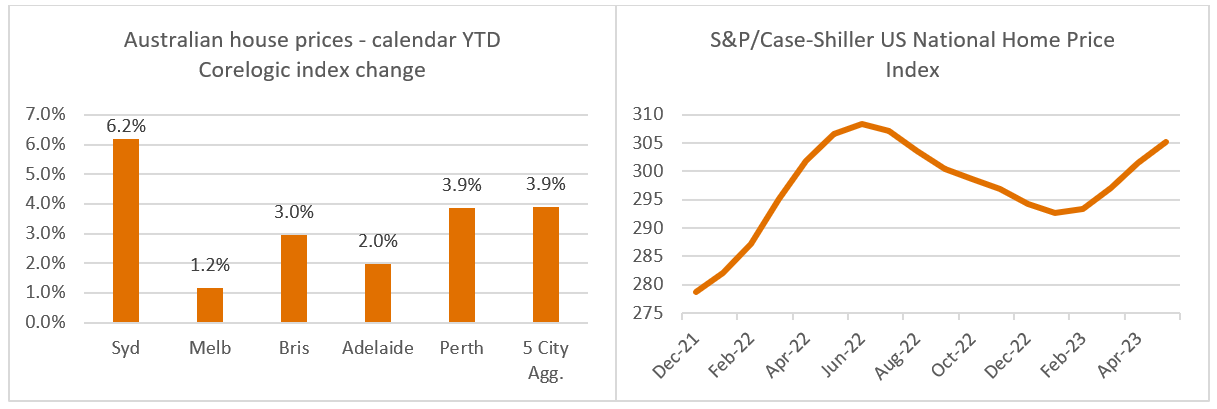

These returns have corresponded with an interest rate hiking cycle kicked off by the Bank of England in December 2021, followed by the US Federal Reserve rate in March 2022. Most other central banks in developed markets around the world followed soon after in response to rising inflation. Over the same period, bonds also started selling off. In the US, the 10-year treasury yield, the benchmark risk-free rate rose from 1.4% to the current rate of 4.0%, peaking as high as 4.3% along the way. The impact to REITs through a higher discount rate applied to the valuation of the cashflows has been immediate. Adding to the sentiment has been the expected reduction in levered cashflows as higher rates make their way through the P&L. As interest rates are used as a tool to cool the economy, the inference is that tenant demand (and therefore market rent growth) should follow suit, further tempering the expected outlook. While this rationale is entirely sensible, sometimes the market playbook doesn't follow suit. The mismatch between supply and demandWe recently toured North America, the UK and Europe, and met with 50+ listed real estate management teams across many sectors. Given the general share price malaise, and the magnitude and pace of rate hikes, it would not be unreasonable to expect a tempered outlook. However, observations 'on the ground' were in stark contrast, and most sectors had a positive outlook. And while focus is often on demand, a reccurring topic of the discussion was supply - or more specifically, lack thereof. Supply has been falling across many sectors for similar reasons. There was a general pause during Covid due to supply chain disruptions, labour shortages and general uncertainty. This is impacting deliveries today, while new development, and thereby future supply, is being impacted by construction cost inflation combined with a restrictive financing environment. Nowhere is this dynamic more obvious in Australia right now than in the local residential market, which is now steadily rising despite higher interest rates. It's also the same in the US. This 'supply shock' in the face of steady demand, which is playing out in higher residential prices, will also play out across many sectors around the world in higher rents. If you are an existing landlord with a sensible balance sheet, the future is looking quite rosy.

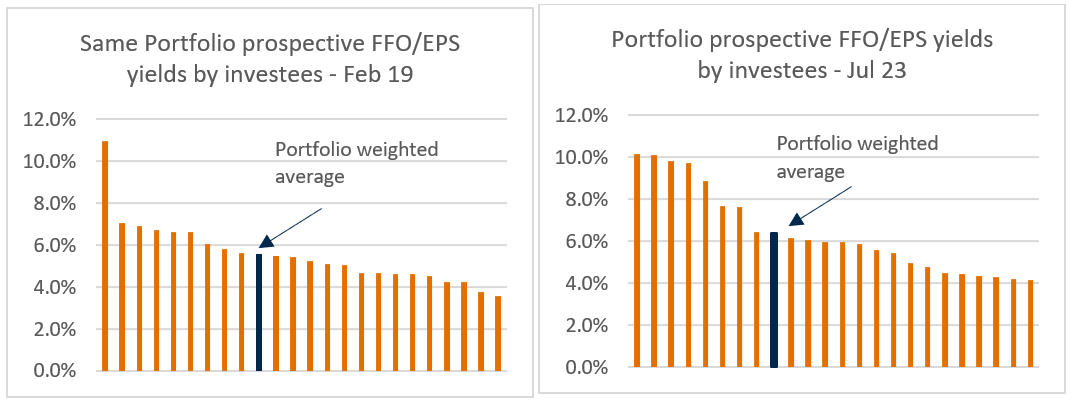

Source: CoreLogic, Federal Reserve Bank of St. Louis, Quay Global Investors It's not just in residential markets where the effects of a mismatch between supply and demand are being felt. The effects on rentsSenior housing in the US and Canada is an example of how both demand and supply are playing out favorably. Baby Boomers are fast approaching their 80s, which is the average age of residents' entry into assisted living senior housing. Demand from this cohort is strong and growing. In addition, rising construction costs, higher financing costs and Covid disruption has meant that there has been a lack of construction over the last three years, with inventory growth now at the lowest level since NIC MAP Vision, a provider of senior housing research, began reporting data in 2006. With a benign supply outlook and growing demand, vacancy rates are declining and rents are growing. We believe the sector is now on the cusp of a multi-year period of outsized rental growth. The theme of lack of supply is also being felt in the retail sector. Since the GFC, for a variety of reasons, supply has been on the decline. In fact, it has been well documented that many malls in the US have been shut as vacancy grew in the period post the GFC and prior to Covid. This was due to general weak demand, competition from internet retail, retailer bankruptcies and historic oversupply. However, since the significant stimulus introduced by governments in response to Covid, retail sales have boomed. The outcome has been a reversal in fortunes for retail landlords, with occupancies surging and cashflows returning to growth. And it's not just the in the US where lack of supply is helping rents to grow. In the UK student accommodation sector, The Unite Group recently gave an update stating that they expect rental growth to be around +7% for the upcoming academic year. This compares to a long-term rate of 3-3.5% and a period during Covid when they were shuttered. Driving this uptick is strong demand, surpassing pre-Covid levels, from students and universities seeking accommodation combined with an acute shortage of available beds and supply that cannot keep pace. A similar scenario is playing out in manufactured housing, single family homes and coastal apartment markets in the US, as well as many other sectors across other geographies. There are, however, exceptions where outsized development margins meant supply wasn't deterred by higher costs and restrictive financing. Examples include industrial, life science offices and sunbelt apartments, and all were considered beneficiaries of Covid. Within these markets where supply is constrained, all else being equal, until rents and/or values rise to levels that support new development, supply will continue to remain low. In the meantime, as demand continues to grow, rents will also grow. Depending on the sector and construction lead times, it could take years for supply to respond. The earnings growth opportunityFor our investees, this is translating into meaningful earnings growth. Since 2019, the average prospective earnings per share growth for the Quay Global Real Estate Fund (Unhedged) on a same stock basis, has increased by +20% (4.5% annualised). This is not a bad outcome considering Covid disruptions and 18 months of unprecedented interest rate rises. What's more, for the current year, we expect this rate of growth to accelerate to 5.5%. The negative returns in listed global real estate have been widespread, and we too have been caught up in these losses despite earnings that have been growing. Over the same period, since returns tended negative, the average FFO yield of the portfolio has increased from 5.6% to a current 6.4%, or a 16% derate. Combined with average earnings that are 20% higher, this is a 36% de-rate. To us, it would seem that recent returns have been driven by nothing more than market sentiment. The fundamentals have been solid.

Source: Quay Global Investors, Bloomberg, Sentieo Concluding thoughtsEconomists and commentators have expressed surprise at the resilience and recent strength of residential markets. In the local market, not only do the dire 30% falls from peak now seem unlikely, but based on current trajectory, new highs in the market could be probable by early 2024. This has been no surprise to us, as we spoke about in our recent Investment Perspectives article, Is the Aussie residential market bottoming? Ultimately, both demand and supply matter. But the 'supply shock' driving residential property prices is also a global phenomenon across many sectors for largely the same reasons. Most new developments simply don't stack up due to rising construction costs, difficult access to funding and uncertain transaction markets. As such, so long as tenant demand remains in place, the solid earnings fundamentals across many geographies and sectors we have enjoyed since 2019 are expected to continue, driving earnings growth, valuation and (for the patient) asset price performance. It's happening in both the local property market and globally. Author: Justin Blaess, Principal & Portfolio Manager Funds operated by this manager: Quay Global Real Estate Fund (AUD Hedged), Quay Global Real Estate Fund (Unhedged) For more insights from Quay Global Investors, visit quaygi.com The content contained in this audio represents the opinions of the speakers. The speakers may hold either long or short positions in securities of various companies discussed in the audio. This commentary in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the speakers to express their personal views on investing and for the entertainment of the listener. |

11 Aug 2023 - ESG in 10: Episode 9- The Australian Green Bond Program, with Ardea

|

ESG in 10: Episode 9 - The Australian Green Bond Program, with Ardea Fidante Partners July 2023 |

|

Funds operated by this manager: Bentham Asset Backed Securities Fund, Bentham Global Income Fund, Bentham Global Income Fund (NZD), Bentham High Yield Fund, Bentham Syndicated Loan Fund, Bentham Syndicated Loan Fund (NZD) |

10 Aug 2023 - Are You a Trader, an Investor, or a Hybrid of Both?

|

Are You a Trader, an Investor, or a Hybrid of Both? Marcus Today July 2023 |

|

Ask the average investor how they invest and you will get one of two answers. 'Fundamental Analysis' or 'Technical Analysis', and never the two shall meet. It all goes back to Benjamin Graham, who wrote 'The Intelligent Investor' in 1949, the Bible of Fundamental Analysis. In there was the line: "We do not hesitate to declare that (Technical Analysis) is as fallacious as it is popular". In that one sentence he erected a wall between Fundamental and Technical Analysis, or to put it another way, between investors and traders, and it has stood for 62 years, with the proponents of both seemingly hell bent on putting each other down, and they both have their points.

The Bad BitsTraders will tell you that investors:

But the truth is that they both have a lot to learn from each other, and if we look at the positives instead of the negatives, you'll see why. The Good BitsTraders:

The Bottom LineAs any experienced trader will tell you, there is no Holy Grail for success, no one approach that works. Amidst so much grey and so little black and white, the game is simply about trying to get an edge on random outcomes and to do that you would be a fool not to use every tool in the shed, and that's the point, every tool. Not one or the other, but every. You dismiss nothing and learn everything, and this is where so many people go wrong. They decide they are in one camp or the other when it would be far more effective to be in both. The bottom line is that you make a big mistake writing off traders as an investor, or investors as a trader. They both have some good bits and some great bits. You would do well to explore both. Author: Marcus Padley, Founder of Marcus Today |

|

Funds operated by this manager: |

9 Aug 2023 - Political lobbying risks in the US

|

Political lobbying risks in the US 4D Infrastructure July 2023

In recent years, political controversies involving US utility companies have caused significant concern for investors. There have been instances where lobbying activities have contravened the law and resulted in companies and individuals being criminally investigated and punished. Other instances, though not necessarily criminal, have also resulted in negative market reactions. In both scenarios, political lobbying controversies have been difficult for investors to foresee and, therefore, difficult to avoid. Utilities' role in US politicsUtilities are responsible for the delivery of power and gas from source to end-customers, and are considered key players in the energy supply chain. As a result of the importance of both energy prices and reliability to businesses and consumers alike, utilities are central to economic growth, efficiency and quality of life in their operating jurisdictions. For these reasons, utility operators believe their corporate responsibility dictates that they should have a voice in the development of energy legislation. With energy legislation and regulation established at both federal and state levels in the US, lobbying is considered important in ensuring that legislation is in the best interest of all stakeholders, including shareholders. Risk to investors of inappropriate lobbyingLobbying undertaken by utilities in an open and ethical manner supports a more thorough understanding of energy markets for legislators and a better outcome for both customers and shareholders. The obvious concern is that utilities and/or management teams lobby for their own self-interest or solely that of their shareholders, with little consideration to other stakeholders such as customers. Problems eventuate when lobbying contravenes the law and/or ethical expectations. Companies should have ethical charters outlining the values that guide how they operate, including how they interact in the political sphere. The old saying, "would you feel comfortable with your behaviour being published on the front page of the newspaper" is also a good guide for what constitutes ethical political lobbying. Potential violations of the law are often difficult to identify until it's too late and enforcement agencies are involved. Regardless of guilt, once a review is underway, the utility in question will feel pressure as the process evolves. This potentially includes:

Utilities across the world are bound by a social license to operate. Regardless of strict legality, that social license may be tarnished based on the public's perception that the company has received special treatment from legislators/regulators based on aggressive/unethical lobbying activities. This scenario could result in public backlash, and regulators/legislators taking detrimental action against the utility to reinforce their independence. This can take the form of fines, difficult regulatory decisions, out-of-cycle regulatory reviews and irrational oversight. Negative financial ramifications and poor market sentiment are the result, and re-establishing customer faith in regulators and utilities takes a long time. 4D's approach to political lobbying riskDue to the high legal, financial and reputational risk associated with lobbying activities, 4D undertakes significant due diligence to identify utilities that are at higher risk and steps being taken to mitigate this risk. Internal controlsPolitical lobbying should be guided by a political engagement policy or a similar document recognised by the company board. It should be easily publicly available and outline a set of criteria guiding lobbying efforts and political contributions, and provide authority for contributions and oversight. Best practice for authority of contributions is for the annual political contributions budget to be developed by the corporate affairs team (or equivalent). The individual contributions should be reviewed by a legal professional and signed off by the most senior executive in the team. It's often a good idea to include an executive or leadership committee review it to ensure widespread knowledge and acceptance of contributions. In our view, large contributions should be reviewed and signed off by the CEO (~>$1 million). The board audit subcommittee should also review contributions on behalf of the board. A recommendation should then be provided to the board as part of that oversight. Any newly planned contributions should also be reviewed by an audit committee. This ensures that senior leadership approve all contributions, approvals involve multiple parties, and the board has ultimate oversight. TransparencyEnsure public transparency of all contributions to individual political figures and parties, political action committees (PAC), other tax-exempt structures (such as 501(c)4 structures), trade associations and political consultancy/advisory groups. Stakeholders should have access to all internal control and governance documents relating to political engagement. Appropriate size of contributionsThe size of political contributions should be moderated so that they don't give the impression that a political favour is expected in exchange for the contribution. Many utilities have outlined that any individual contribution over $1 million requires CEO sign-off, suggesting that this size of contribution is rare. Overall contributions need to be moderated as no financial return should be expected on these funds - it should be perceived more as a cost, rather than an investment with the expectation of receiving something in return. Focus on the utilisation of structures for contributionsSome tax-exempt structures provide anonymity to contributors. Companies should seriously question why they need/prefer anonymity when making a contribution. Generally speaking, such structures have attracted scepticism from the media and stakeholders, and should be avoided unless there is a specific reason for their use. Some utilities in the past have engaged political consultancy groups. These groups have historically provided anonymity in political lobbying. Interactions with these groups should be transparent internally and externally, including taking meeting minutes for all interactions. Companies should be very clear on their motivations for engaging such groups, and they shouldn't be considered as vehicles to undertake clandestine political manoeuvres. US federal election laws prohibit corporations and labour unions from making political contributions to federal candidates and national political parties. As a result, companies often use their own, or third party, PACs to make contributions to individuals and parties. 'Pay for play' legislationSome utility management teams suggest that when a company makes significant contributions to support or oppose a particular ballot measure, it can be interpreted as a 'pay for play' situation. Rightfully or wrongfully, this could be perceived as bribery or a quid-pro-quo arrangement. Best practice would be to lobby through trade associations or PACs with correct governance practices in place to avoid any direct link between the company and an individual ballot measure or proposal. Third party verification of lobbying controls and practicesThird party verification of companies' political disclosures and practices can support investors' due diligence efforts. One of the more well-known verification groups is the Center for Political Accountability (CPA), which releases the CPA-Zicklin Index annually. Using 24 metrics, or "indicators", the CPA-Zicklin Index assesses companies' disclosure practices, spending and accountability policies for utilisation of corporate funds to influence elections. It does not address company spending on lobbying or PACs. 4D's actions post lobbying controversiesRecent lobbying controversies have influenced our decision to divest companies from our funds. We have exited positions based on the likelihood that a controversy violated the law, disrupted relationships with regulators and stakeholders, and/or there was a lack of definitive action from boards in identifying and rectifying flaws in lobbying controls, processes and disclosures. By contrast, we have also retained positions where our due diligence suggested the above negative thresholds were not violated. Every situation is considered on a case-by-case basis involving internal due diligence as well as engagement with the company in question. As part of our research into political lobbying best practice, we reached out to companies who rate highly on the CPA-Zicklin Index for comment on this paper and their approach to lobbying. Two such companies in Southern Company and CMS Energy provided their feedback below.

|

|

Funds operated by this manager: 4D Global Infrastructure Fund (Unhedged), 4D Global Infrastructure Fund (AUD Hedged), 4D Emerging Markets Infrastructure Fund For more information about 4D Infrastructure, visit https://www.4dinfra.com/ The content contained in this article represents the opinions of the authors. This commentary in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the authors to express their personal views on investing and for the entertainment of the reader. |

8 Aug 2023 - Webinar Podcast 01 Aug 2023 | Infrastructure Funds - Analysing the Opportunities and Risks

|

Webinar Podcast | Infrastructure Funds - Analysing the Opportunities and Risks FundMonitors.com 01 August 2023 |

|

Listen to the podcast to discover the key insights and opportunities in this dynamic investment landscape. In this informative 45-minute session, we explored the potential benefits and risks of investing in infrastructure funds and uncovered the various types of infrastructure assets, including transportation, energy, and social infrastructure. Our panel consisting of Sarah Shaw from 4D Infrastructure, Ben McVicar from Magellan, and Matt Lorback from Atlas Infrastructure also delved into the regulatory and policy considerations impacting infrastructure investments. |

7 Aug 2023 - The three factors driving stock returns

4 Aug 2023 - A site visit with a difference

3 Aug 2023 - In Conversation with Airlie's Analysts

|

In Conversation with Airlie's Analysts Airlie Funds Management July 2023 |

|

Airlie Australian Share Fund Portfolio Manager, Emma Fisher, engages in a conversation with Airlie's senior analysts, Vinay Ranjan and Joe Wright. Emma discusses the performance of the Australian market during the past 12 months and asks Joe and Vinay to share insights on how some of their stocks have performed during the year within the Fund. This includes Mineral Resources, QBE Insurance and James Hardie. Funds operated by this manager: Important Information: Units in the fund(s) referred to herein are issued by Magellan Asset Management Limited (ABN 31 120 593 946, AFS Licence No. 304 301) trading as Airlie Funds Management ('Airlie') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should obtain and consider the relevant Product Disclosure Statement ('PDS') and Target Market Determination ('TMD') and consider obtaining professional investment advice tailored to your specific circumstances before making a decision to acquire, or continue to hold, the relevant financial product. A copy of the relevant PDS and TMD relating to an Airlie financial product or service may be obtained by calling +61 2 9235 4760 or by visiting www.airliefundsmanagement.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any financial product or service, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of an Airlie financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Airlie makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Airlie. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Any third party trademarks contained herein are the property of their respective owners and Airlie claims no ownership in, nor any affiliation with, such trademarks. Any third party trademarks that appear in this material are used for information purposes and only to identify the company names or brands of their respective owners. No affiliation, sponsorship or endorsement should be inferred from the use of these trademarks.. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Airlie. |

2 Aug 2023 - Do they have your back or just your back pocket? The fun, games, and fees of equity investing

|

Do they have your back or just your back pocket? The fun, games, and fees of equity investing Collins St Asset Management July 2023 FY23 recap: ASX 200 defies the bears to end up +10% over last financial year It is often said that: When someone with money meets someone with experience, the person with the experience gets the money and the person with the money gets an experience. For equity investors, regardless of whether or not they choose their own investments or outsource some or all of that responsibility to an external manager/adviser, this remains a very real and important risk to be on top of. Many Directors and Management teams do not run companies for the benefit of shareholders despite all of the claims and promises of future gold and glory laid out in glossy annual reports. Fat salaries for start up company Directors, gifted equity to management in large established businesses and all manner of perks and parties along the way are, all too sadly, par for course. To that end, its important to understand the governance structure of a company and the way in which senior decision makers are remunerated before deciding whether or not to invest. Some key questions we at Collins St Asset Management seek to understand before deploying capital include:

Sadly, a rolling stone gathers no moss in much the same way as an upwardly mobile executive can suffer no financial pain by moving from one company to the next just before the next crisis is uncovered. Of course, Directors and senior Management are not alone in their pursuit of cushy rent-seeking corporate opportunities. Whilst many intermediaries in the funds management space are often no better, there are a variety of fee models on offer which invariably incentivise different behaviours. The table below provides an overview of some of the different ways professional fund managers may seek to charge their clients: Overview of fee structures Author: Rob Hay, Head of Distribution & Investor Relations For wholesale investors only |

|

Funds operated by this manager: |

.jpg)