NEWS

21 May 2024 - Performance Report: PURE Income & Growth Fund

[Current Manager Report if available]

21 May 2024 - Performance Report: Bennelong Emerging Companies Fund

[Current Manager Report if available]

21 May 2024 - Glenmore Asset Management - Market Commentary

|

Market Commentary - April Glenmore Asset Management May 2024 Equity markets were generally weaker in April. In the US, the S&P 500 fell -4.2%, whilst the Nasdaq was down -4.4%. In the UK, the FTSE rose +2.4%. On the ASX, the All-Ordinaries Accumulation Index fell -2.7%. Gold was the top performing sector for the second month in a row, whilst real estate was the worst performer, which offset its strong performance in March. The main driver of equity markets in the month was a change in thinking by investors around global monetary policy, which shifted from the next move being a rate cut, to in fact potentially another rate increase. This was due to inflation data released in the US on the 10th of April that showed higher than expected inflation. Consumer Price Index (CPI) data for March 2024 rose +0.4%, which was slightly higher than market expectations of +0.3%. Bond markets reacted to this news with higher yields. The US 10-year bond rate rose +42 basis points to 4.63%, whilst its Australian counterpart increased +46bp to 4.42%. The Australian dollar was flat, finishing the month at US$0.647. Funds operated by this manager: |

20 May 2024 - Performance Report: Argonaut Natural Resources Fund

[Current Manager Report if available]

20 May 2024 - Investment Perspectives: 14 of the most important charts for data centre investors right now

17 May 2024 - Hedge Clippings | 17 May 2024

|

|

|

|

Hedge Clippings | 17 May 2024 The next federal election is not due for another year, but the budget handed down on Tuesday had all the hallmarks of a government preparing for the polls without actually setting the date. Jim Chalmers won't admit it, but based on this comment from Chris Richardson during the week: "If the enemy is inflation, the IMF says you should cut spending and raise taxes. Instead, we're getting a very big tax cut and almost matching that with large increases in spending," then we're heading for trouble. If Richardson is correct, and we're certainly not going to doubt him, then Chalmers is at odds with the IMF, as well as one of Australia's top economists. Meanwhile, Treasury (presumably the advice he's relying on) is at odds with the RBA's estimate of inflation as pointed out in this piece: "Treasury has inflation heading in one direction - down - while the Reserve Bank says the opposite. They can't both be right, and what happens will play an outsized role in deciding when, or if, the central bank cuts interest rates. The government claims the budget has been designed to take three-quarters of a percentage point off inflation this year and another half a percentage point next year, while unemployment will rise slightly to 4.5 per cent next year. Time will tell if Treasury or the central bank - which has forecast inflation to be 3.8 per cent in December this year - is correct. Without a rate cut, there is close to zero chance of an early election." So Jim's budget is increasing spending via handouts across the year, topped up by Stage 3 tax cuts due in July, and wage increases already announced or in the pipeline, hoping inflation will reduce to 2.75% mid next year (around the scheduled election time) while the RBA's own forecast is for it to still be 3.2%. Given the RBA's stated driver of interest rates is taming inflation, there's a chance of a rate cut - or possibly more than one - by this time next year, but only if their forecasts are correct, and it's a big IF based on the stickiness of inflation to date. In the government's favour, this week's employment figures (along with some positive signs from the US) showed unemployment creeping up to 4.1% on a seasonally adjusted basis. The RBA's other role of maintaining full employment is secondary to inflation, but it is noteworthy that the number of unemployed people has risen 13.7% from one year ago, and Michele Bullock is on record as saying an unemployment rate of 4.5% or above would be required to have a significant effect on reducing inflation. You can't blame the Treasurer for pitching the budget and blowing the "surplus" trumpet towards the next election - whether in December or in the first half of next year, but he is ignoring the longer term deficits. He'll worry about those in due course, or leave them to his successor. News & Insights Magellan Global Quarterly Update | Magellan Asset Management April 2024 Performance News Bennelong Long Short Equity Fund |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday |

17 May 2024 - Performance Report: Bennelong Concentrated Australian Equities Fund

[Current Manager Report if available]

16 May 2024 - Performance Report: Cyan C3G Fund

[Current Manager Report if available]

16 May 2024 - Quarterly consumer price index update

|

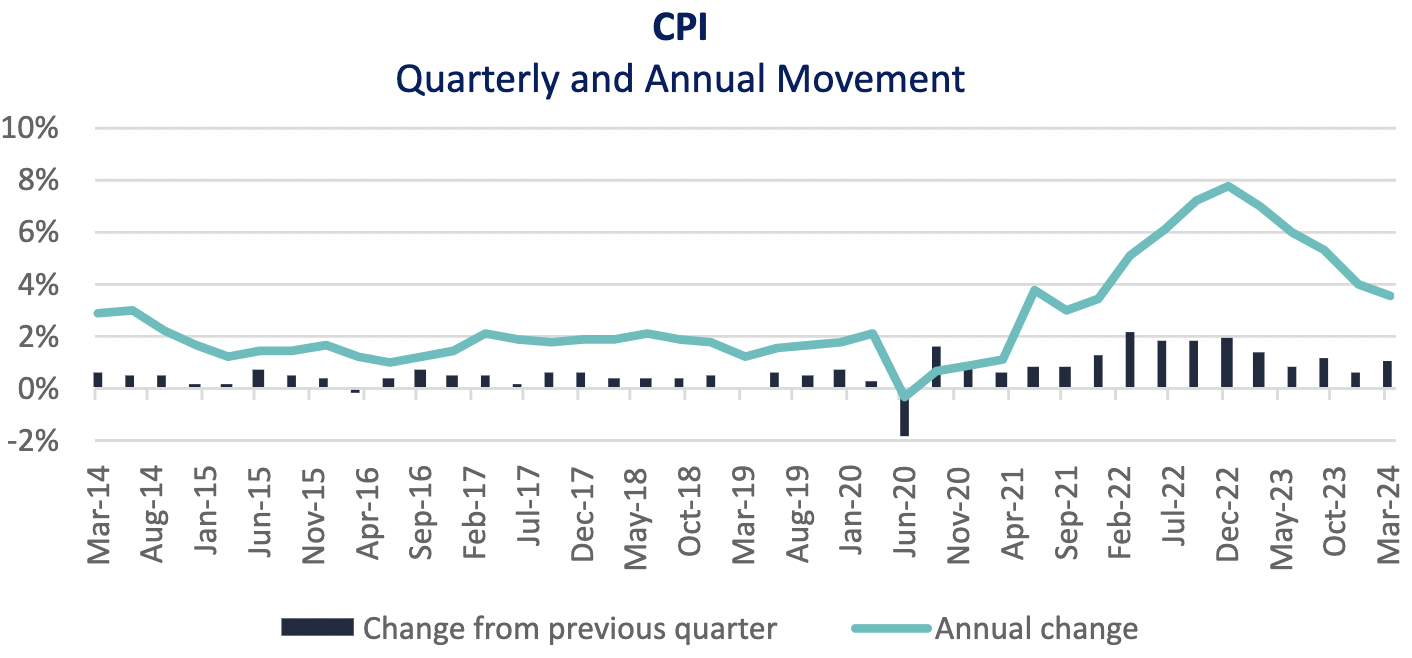

Quarterly consumer price index update Montgomery Investment Management May 2024 The long-awaited quarterly consumer price index (CPI) figure was reported this week. Over the March quarter, CPI rose by 1.0 per cent, which follows the previous 0.6 per cent December quarter increase. Over the 12 months to March 2024, CPI rose by 3.6 per cent. Whilst the annual rate of inflation is trending downwards, the quarterly figure increased by 0.4 per cent and poses ongoing challenges. Education fees rose by 5.9 per cent. This uplift was the strongest quarterly rise reported since 2012. Similarly, the U.S. faces ongoing inflationary challenges. The annual inflation rate rose by 3.5 per cent in March, a 0.4 per cent increase from the 3.2 per cent reported in February. The market anticipated 3.4 per cent. Both central banks require confidence that inflation is steadily slowing back within their respective target ranges. Widely speaking, it is evident that there is economic turbulence with ongoing geopolitical uncertainty having widespread global economic affects. Back home, other factors to consider are the strong labour market and upcoming tax cuts. The labour market remains relatively tight with the unemployment rate at 3.8 per cent in March. This coupled with the incoming stage three tax cuts, provides more turbulence and adjustment in the RBA's economic outlook and monetary policy decisions.

Author: Natalie Kolenda Funds operated by this manager: Montgomery (Private) Fund, Montgomery Small Companies Fund, The Montgomery Fund |

15 May 2024 - Performance Report: Altor AltFi Income Fund

[Current Manager Report if available]