NEWS

13 Mar 2024 - New Funds on Fundmonitors.com

|

New Funds on FundMonitors.com |

|

Below are some of the funds we've recently added to our database. Follow the links to view each fund's profile, where you'll have access to their offer documents, monthly reports, historical returns, performance analytics, rankings, research, platform availability, and news & insights. |

|

||||||||||||||||||||||

| JPMorgan Global Research Enhanced Index Equity Active ETF (Managed Fund) (Hedged) | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

| JPMorgan Income Active ETF (Managed Fund) (Hedged) | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

| JPMorgan Sustainable Infrastructure Active ETF (Managed Fund) | ||||||||||||||||||||||

|

||||||||||||||||||||||

| JPMorgan Climate Change Solutions Fund - Class A Units | ||||||||||||||||||||||

|

||||||||||||||||||||||

| JPMorgan Global Bond Fund - Class A Units | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

| JPMorgan Global Macro Opportunities Fund - Class A Units | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

|

Want to see more funds? |

||||||||||||||||||||||

|

Subscribe for full access to these funds and over 800 others |

12 Mar 2024 - Performance Report: Bennelong Emerging Companies Fund

[Current Manager Report if available]

12 Mar 2024 - Performance Report: Airlie Australian Share Fund

[Current Manager Report if available]

12 Mar 2024 - Wrestling the gorilla

|

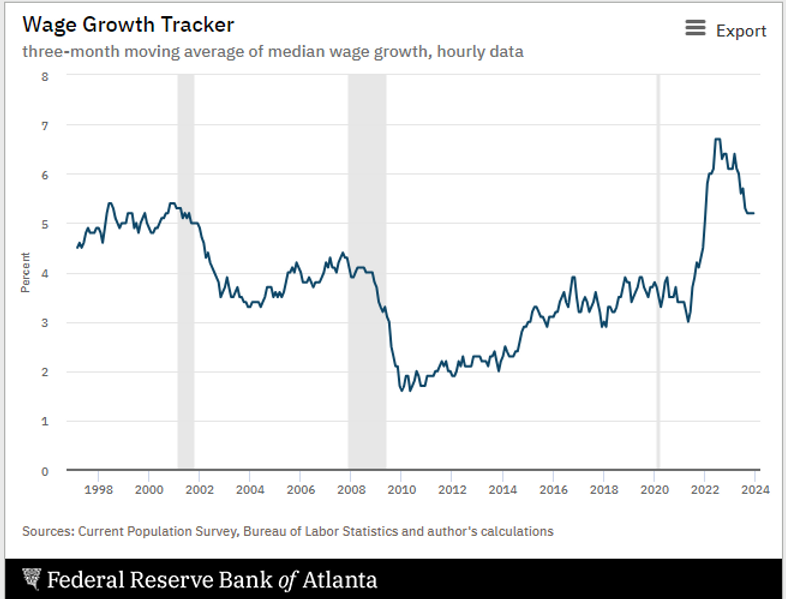

Wrestling the gorilla Insync Fund Managers March 2024 Despite incessant commentary to the contrary, the US economy is the strongest it has been in over 30 years. We have said many times why trying to predict economic outcomes in an upcoming year is fraught with danger. We even charted a few famous commentators and forecasts versus actual outcomes. Simply, no matter how famous or big the institution, or how clever the person, they are wrong far more than right. Given that these macro forward views shape how most fund managers invest and make decisions, it's a worthwhile exercise for advisers to track the managers they use against how successful and aligned to their own commentary they really are. For the record, we are not in the game of forecasting macro settings, as we see little value in it once ego is placed to one side. It's very important with this in mind to note that factually, when everything seems bleakest it is uncannily common for it to be at its brightest. Let's look at the economic gorilla of the world - the US. At the end of 2022 and early 2023, most managers, economists and commentators warned that bad times lay ahead. Here are eight key indicators that show that for last year and indeed for at least 30 years, the US has never been in better shape. 1. Wage growth: Despite all the worry and bleak predictions and what has become accepted as bad times, the reverse is true. Wages experienced 5% growth.

2. GDP: 3.3% Real growth with an annualised run rate of 4.9%.

3. Inflation: This stands at just over 3% nominal. So we're talking 2% real wage growth and 6% nominal economic growth. Several commentators last year worried about a 1970s style stagflation. Remember that? The simple fact is that today's situation looks more like the 1990s economy than the 1970s.

4. Unemployment: This remains stubbornly low, after Covid and government free money distributions. In the 1990s, it averaged 6% and was never as low as 4%. The super-driver of Demographics is playing its part in this.

5. Government debt: Ahh, some wag the finger that it's all debt fuelled, but let's see.

Government debt is indeed a lot higher now than it was back then, and of course $34 trillion is a lot of money but expressed as a percentage of the economic output (% of GDP), is this so different or abnormal? It was far higher in the 1990s and today sits around the longer-term average. 6. Household debt: Whilst looking at debt, let's look at US families and their ability to service their debts and higher rates closer to longer term averages than the last 10 years. It is far, far better than in the 1990s.

7. The federal deficit: Surely this is bad? Let's see.

Yes, it did dip sharply for a short period during the first global pandemic since the 1920s, but it's nearing 1990 levels again. Not as gloomy as many may lead you to believe.

8. What is worse is sentiment: It was last this bad way back in the early 1970s during the great financial crisis, although it has recently bounced back. Unedited, unreviewed, non-expert information, thanks to the social media boom, has likely influenced this - something we didn't have in the 1990s.

Will the good times end? Perhaps it's best said by that infamous barman from the 1980s movie 'Cocktail'... "Everything ends badly otherwise it wouldn't end." The unknown but most essential question is of course when? For those in cash, and there has been a lot sitting on the sidelines for years now, bad times would have to be catastrophic, with an ending of biblical proportions. Not only that, but those in cash would also have to make immediate constant gains and have that continue for years afterwards, just to keep alongside in dollar value terms those who remained invested in productive business assets all these years. The odds of a biblical-sized catastrophe and timing it close enough to exit, then re-enter at the gloomiest most negative point, compared to hanging in and not getting spooked, are very low indeed. #InvestmentstrategyFunds operated by this manager: Insync Global Capital Aware Fund, Insync Global Quality Equity Fund Disclaimer |

11 Mar 2024 - Performance Report: Quay Global Real Estate Fund (Unhedged)

[Current Manager Report if available]

11 Mar 2024 - Performance Report: Altor AltFi Income Fund

[Current Manager Report if available]

8 Mar 2024 - Performance Report: Bennelong Concentrated Australian Equities Fund

[Current Manager Report if available]

8 Mar 2024 - Performance Report: Rixon Income Fund

[Current Manager Report if available]

8 Mar 2024 - What the higher cost of capital means for investors

|

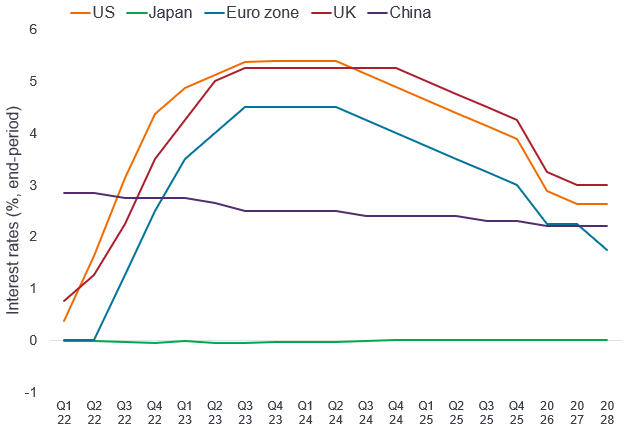

What the higher cost of capital means for investors Janus Henderson Investors February 2024 With borrowing costs for the next decade likely to be meaningfully higher than pre pandemic, how will the investment landscape shift? In the third and final article with the Economist Intelligence Unit (EIU) we explore their expectations, while Janus Henderson CEO Ali Dibadj looks at the implications for investors. Rates to remain highThe cost of capital largely dictates the weather for financial markets and for the companies that rely on them for funding. For much of the past decade, low interest rates have made it cheap for many companies to invest in expansion, but have thinned margins for banks and fixed income funds. The rise in policy rates since 2022 has raised the cost of investment for companies, at a time when they are under pressure to invest heavily in the energy and digital transformations. However, for many of the financial businesses supplying that investment funding - particularly for banks and fixed income funds - higher interest rates raise margins and make their businesses more attractive to investors. We, at the Economist Intelligence Unit (EIU), expect these trends to persist in 2024. The European Central Bank (ECB) and the US Federal Reserve (Fed) are likely to start gradually lowering interest rates from the second half of 2024, but the slow pace of the cuts will soften further as inflation approaches the 2% mark that central banks desire. Markets that followed US policy rates upwards, such as India and Mexico, will follow this downward trend too. Policy rates are already low in China and Japan, and we believe that the cost of capital will remain low in both Asian economies in 2024. Price pressures are likely to remain manageable, and, as a result, the central banks of these countries will look to keep exchange rates attractive in order to boost export competitiveness. Over the rest of EIU's five-year forecast period, interest rates will moderate further in Europe and the US, falling to the 2-3% range by 2028, but will remain higher than during the decade of easy money of the 2010s. Fortunately, global growth is forecast to strengthen to 2.7% a year on average in 2025-28, supporting corporate cashflow and supporting continued investment into technology and clean energy. There are substantial risks to this interest-rate forecast, however, given the possible escalation of the wars in Ukraine and Gaza, as well as US-China tensions over Taiwan, which could disrupt supply chains and fuel inflation over the forecast period. Interest rates will start to fall in 2024

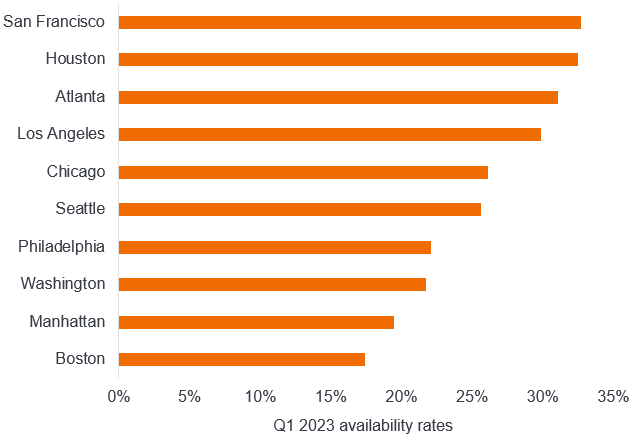

Source: Central banks; EIU as at January 2024. Investors will favour fixed income instruments but avoid certain types of property fundsHigher policy rates have prompted an increase in market interest rates, including those that are applicable for fixed income securities, such as money market instruments, as well as loans and deposits. Asset managers who deal in fixed income securities may potentially benefit from a fillip in returns, bolstered by higher interest rates. This could mark a reversal in the fortunes of bonds and related instruments, shunned by investors during a long period of sluggish, even negative, policy rates. At the end of 2023, investors executed a volte-face, rushing back into money market funds and other instruments that offered positive real returns adjusted for inflation. We expect a dip in interest rates towards the end of 2024 to support both equities and fixed income securities, helping to maintain or boost valuations further. Lower interest rates will ease the burden on company finances while investors could mop up greater real returns from fixed income securities as inflation declines to comfortable levels. These returns will stabilise in developed countries as inflation and interest rates normalise in 2025-28. However, they are likely to narrow in developing countries, where inflation is likely to remain higher, particularly for food. We believe property investments will suffer, however, even more so in China where the sector faces a deep crisis. The future of work is now tilted towards hybrid and some amount of remote work rather than a return to all days in the office, which means that office buildings and centrally located shopping malls have permanently fallen out of favour. Since they are highly leveraged, property companies will likely have to resort to some form of debt restructuring next year. The impact of this indebtedness will feed back to shares of property companies and funds that invest in the sector, making selectivity increasingly important. Funds focusing on warehousing, data centres and infrastructure have the potential, however, to provide appreciably higher returns. Over the longer term, residential development should also support a more general recovery for property investments. Office availability rates have more than doubled in many US downturns

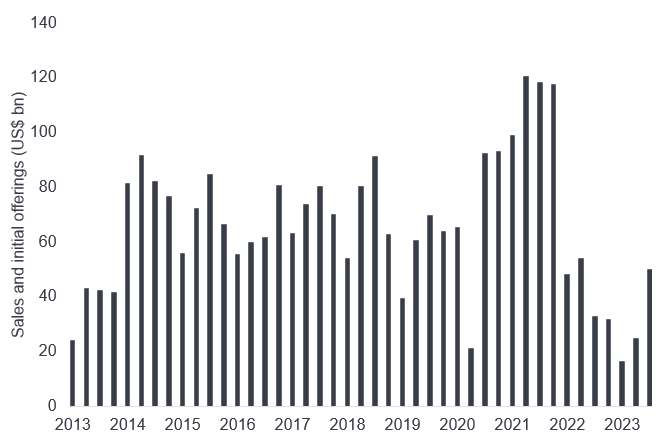

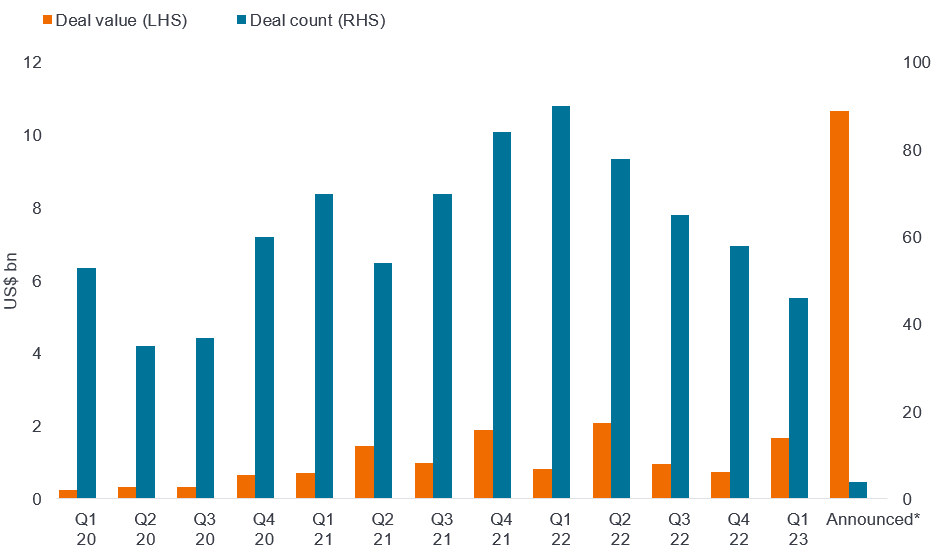

Source: Savills. Startups may struggle, private equity will await rate cutsSteep policy rates have made it harder for startups to raise funds from private investors or via open market listings. With policy rates likely to remain high for at least the first half of 2024, the funding environment will remain difficult for freshly-minted companies in several sectors, including fintech. With highly liquid and safe instruments offering around 5% in markets such as the US, investors are likely to remain markedly risk-averse and selective. New business models are unlikely to attract investors, notwithstanding a recent rush towards artificial intelligence (AI) investments and chipmaker initial public offerings (IPOs), such as the one by ARM, a technology firm headquartered in the UK. Despite coming off a decade-low, asset sales by private equity firms remain feeble

Source: Bloomberg. VC deals for generative AI are gaining traction

Source: PitchBook, as at 1 April 2023. Given these considerations, we believe that the fundraising environment for most startups, including fintech firms, will remain harsh in 2024, with only slow improvements over the following years. As a result, companies will use up the funds built up when policy rates were low as they find new funding hard to come by. IPOs and venture capital-backed companies that do succeed in attracting capital may have to lower their valuations considerably leading to losses for early investors. Even though most central banks, particularly the ECB and the Fed, have paused rate hikes, buyout managers are being hindered by short-term interest rates of nearly 5.5%. Consequently, debt financing remains an expensive proposition and leveraged buyouts remain few and far between. Private equity players are likely to remain on the sidelines until the second half of 2024, when we believe the first rate cuts will occur. Our hawkish outlook for interest rates over the next five years means that it will be a while before we witness the fundraising heydays during the era of easy money. Investment will continue to increase regardlessDespite these constraints, we believe that the outlook for corporate and government investment is positive. Our forecasts for foreign direct investment suggest that inflows will rebound in 2024, amid a resurgence in investment into China as well as continued investment into the US, notably in green-tech sectors supported by government incentives. Gross fixed investment will carry on increasing steadily, as countries focus on building out the infrastructure needed for the energy and digital transitions. There are three main reasons for this sustained investment, which will see money flow in from both governments and corporates. The green and digital transitions are both capital-intensive transformations that are being fully supported by government grants, tax breaks and other tax breaks in many countries, with carbon emissions penalties adding extra impetus. In addition, climate change is likely to increase the depreciation rate of capital, as physical assets will degrade faster with more natural disasters, and money has to be spent on climate-proofing and adaptation. Moreover, the breakdown of relations between China and the US means that more money is being spent on duplication, both for these transformations and for general supply chains. However, investment risks will remain relatively high, and not just for geopolitical reasons. Many borrowers, whether governments, households or companies, will struggle to shoulder heavier burdens on their borrowing, and may miss repayments or default entirely. Levels of non-performing loans (NPLs) have already ticked up somewhat in most major economies, aside from China, where defaults by property developers have already triggered a crisis. These risks are unlikely to trigger financial crises, particularly in developed countries, but they demonstrate that higher interest rates will remain a double-edged sword.

Author: Ali Dibadj, Chief Executive Officer |

|

Funds operated by this manager: Janus Henderson Australian Fixed Interest Fund, Janus Henderson Australian Fixed Interest Fund - Institutional, Janus Henderson Cash Fund - Institutional, Janus Henderson Conservative Fixed Interest Fund, Janus Henderson Conservative Fixed Interest Fund - Institutional, Janus Henderson Diversified Credit Fund, Janus Henderson Global Equity Income Fund, Janus Henderson Global Multi-Strategy Fund, Janus Henderson Global Natural Resources Fund, Janus Henderson Tactical Income Fund This information is issued by Janus Henderson Investors (Australia) Institutional Funds Management Limited ABN 16 165 119 531, AFSL 444266 (Janus Henderson). The funds referred to within are issued by Janus Henderson Investors (Australia) Funds Management Limited ABN 43 164 177 244, AFSL 444268. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested. Past performance is not indicative of future performance. Prospective investors should not rely on this information and should make their own enquiries and evaluations they consider to be appropriate to determine the suitability of any investment (including regarding their investment objectives, financial situation, and particular needs) and should seek all necessary financial, legal, tax and investment advice. This information is not intended to be nor should it be construed as advice. This information is not a recommendation to sell or purchase any investment. This information does not purport to be a comprehensive statement or description of any markets or securities referred to within. Any references to individual securities do not constitute a securities recommendation. This information does not form part of any contract for the sale or purchase of any investment. Any investment application will be made solely on the basis of the information contained in the relevant fund's PDS (including all relevant covering documents), which may contain investment restrictions. This information is intended as a summary only and (if applicable) potential investors must read the relevant fund's PDS before investing available at www.janushenderson.com/australia. Target Market Determinations for funds issued by Janus Henderson Investors (Australia) Funds Management Limited are available here: www.janushenderson.com/TMD. Whilst Janus Henderson believe that the information is correct at the date of this document, no warranty or representation is given to this effect and no responsibility can be accepted by Janus Henderson to any end users for any action taken on the basis of this information. All opinions and estimates in this information are subject to change without notice and are the views of the author at the time of publication. Janus Henderson is not under any obligation to update this information to the extent that it is or becomes out of date or incorrect. |

6 Mar 2024 - Performance Report: ASCF High Yield Fund

[Current Manager Report if available]