NEWS

28 Feb 2024 - Performance Report: Argonaut Natural Resources Fund

[Current Manager Report if available]

28 Feb 2024 - Global Matters: Gridlock - the vital role of Australia's transmission infrastructure

27 Feb 2024 - Performance Report: Emit Capital Climate Finance Equity Fund

[Current Manager Report if available]

27 Feb 2024 - Australian Secure Capital Fund - Market Update

|

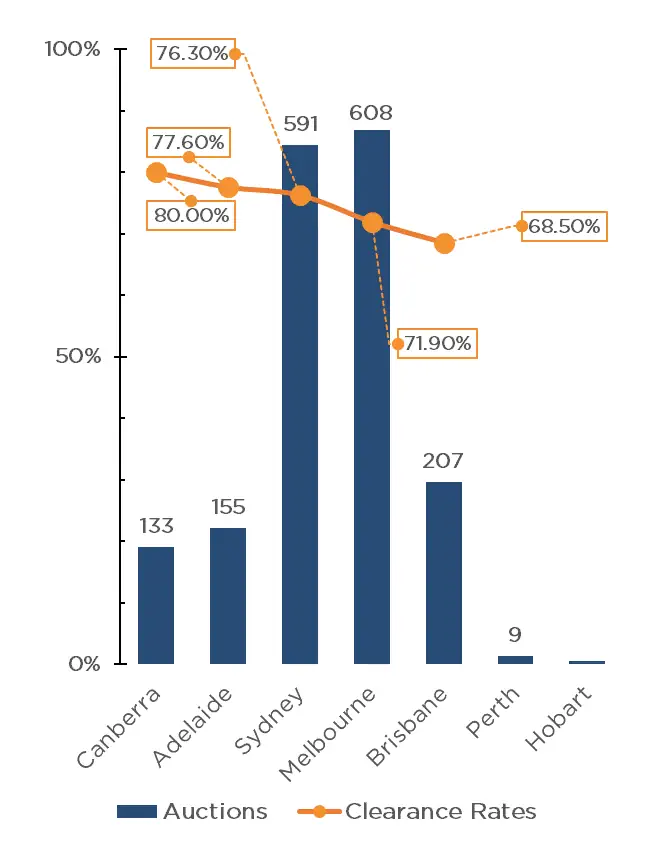

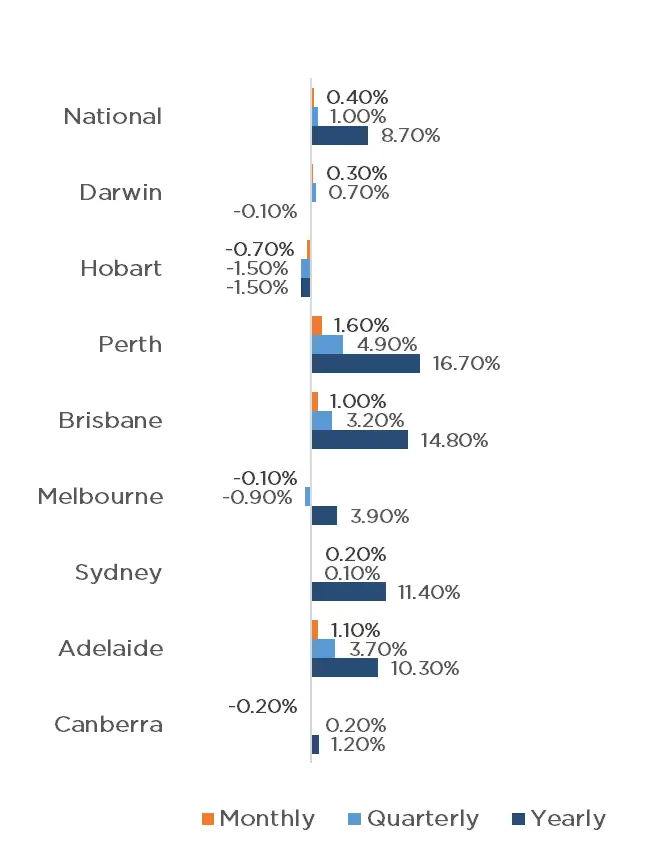

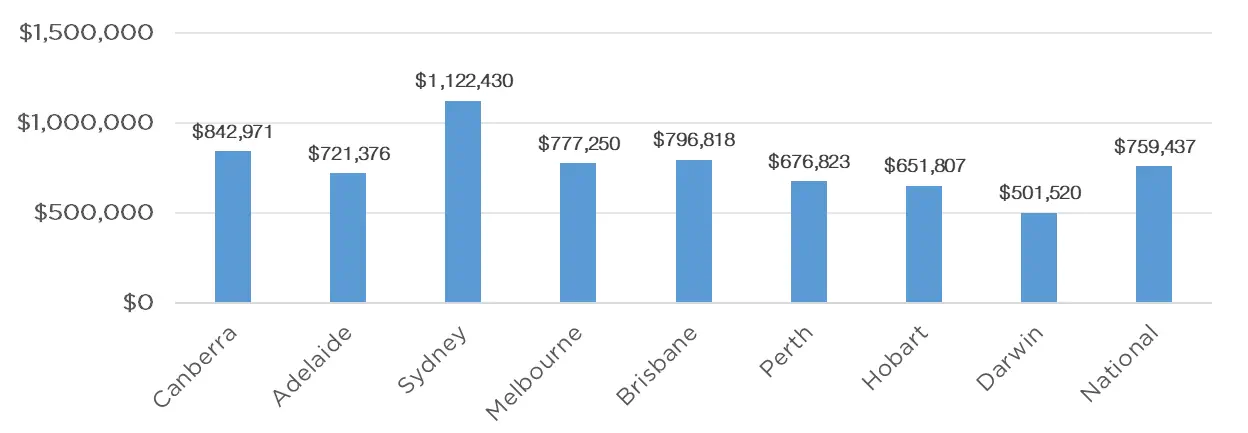

Australian Secure Capital Fund - Market Update Australian Secure Capital Fund February 2024 The first RBA meeting of the year has taken place, with the cash rate remaining on hold at 4.35%. Recent inflation data has given economists confidence that we have reached the end of the rate hike cycle. The first weekend of February brought the start of the 2024 auction season, with a mammoth 1,671 auctions being held across the combined capitals. This is the second largest opening weekend since 2008, with only the corresponding weekend in 2022 holding more auctions, with 1,779 taking place. This result was up 26.4% on 2023 data, and was more than double than double the number of auctions held over the year so far (803). Melbourne recorded the most auctions for the weekend, with 603 taking place, followed closely by Sydney with 562. Brisbane, Adelaide and Canberra also recorded triple digit auction numbers with 203, 159 and 132 auctions taking place respectively, whilst Perth and Tasmania held just 9 and 3 auctions respectively. Preliminary clearance rates have also begun the season strongly, with a clearance rate of 73.9% across the combined capital cities, well above the 61.9% of 2023. Canberra led the way with 80.0%, followed by Adelaide, Sydney and Melbourne with 77.6%, 76.3% and 71.9% respectively. Brisbane being the only capital below 70% with a 68.5% result. The property market continues to show growth, albeit signs of cooling do exist, with a 0.4% increase across both the combined capitals and regionals. Perth continues to experience the highest rate of growth, increasing by 1.6% for January, followed by Adelaide and Brisbane with 1.1% and 1% respectively. Darwin and Sydney also experienced growth of 0.3% and 0.2% respectively, whilst prices in Melbourne, Canberra and Hobart have fallen by 0.1%, 0.2% and 0.7% respectively. The annual change remains significant with a 10% increase across the combined capitals, and 4.9% increase for regional centers, contributing to a national increase of 8.70%. This has been driven by four of the capitals experiencing double figure growth with 16.70% for Perth, 14.80% for Brisbane, 11.40% for Sydney and 10.30% for Adelaide. Melbourne and Canberra also recorded growth for the year with 3.90% and 1.20% whilst only Darwin and Hobart saw prices fall for the year with 0.1% and 0.4% respectively. This has led to Brisbane now holding the second highest median value in the country, overtaking Melbourne with a median value of $796,818 compared to Melbourne's $777,250. Whilst the property market has begun to show signs of easing, given that economists predict we are at the end of the rate hike cycle, we anticipate that property prices will still experience growth throughout 2024, as interest rates begin to subside, and the lack of housing supply continues. Clearance Rates & Auctions week of 4th of February 2024

Property Values as at 1st of February 2024

Median Dwelling Values as at 1st of February 2024

Quick InsightsWill Values Fall? Unlikely.With home values in capitals such as Sydney still 2.4% lower than their peaks, many investors such as Sydney-based investor Nicholas Marangos-Gilks are more motivated than ever to increase demand in the market. Buyers are not waiting for the rate cut to occur. Tim Lawless, CoreLogic research director, has commented, "We are still seeing housing values below their record highs in Sydney, Melbourne, Hobart, Darwin and the ACT. In these cities we could see motivation from buyers looking to get into the market while values are still below their peaks." Source: Australian Financial Review Looser Planning, not Restrictive TaxesEliminating negative gearing and ditching capital gains tax discounts will not solve the worsening housing affordability crisis, but boosting supply by easing planning rules will, a new report says. Centre for Independent Studies chief economist and former Reserve Bank official Peter Tulip said restrictive planning rules have added more than 40% to house prices in Sydney and Melbourne, while property taxes boosted values by 4% at most. "There are arguments from the tax policy perspective that negative gearing and the capital gains discount should be considered, but it's not relevant to the question of housing affordibility," he said. Source: Australian Financial Review Author: Filippo Sciacca, Director - Investor Relations, Asset Management and Compliance Funds operated by this manager: ASCF High Yield Fund, ASCF Premium Capital Fund, ASCF Select Income Fund |

26 Feb 2024 - Performance Report: Altor AltFi Income Fund

[Current Manager Report if available]

26 Feb 2024 - New Funds on Fundmonitors.com

|

New Funds on FundMonitors.com |

|

Below are some of the funds we've recently added to our database. Follow the links to view each fund's profile, where you'll have access to their offer documents, monthly reports, historical returns, performance analytics, rankings, research, platform availability, and news & insights. |

|

|||||||||||||||||||||

| Aura Core Income Fund | |||||||||||||||||||||

|

|||||||||||||||||||||

| View Profile | |||||||||||||||||||||

|

|

|||||||||||||||||||||

| JPMorgan Equity Premium Income Active ETF (Managed Fund) | |||||||||||||||||||||

|

|||||||||||||||||||||

| View Profile | |||||||||||||||||||||

| JPMorgan Equity Premium Income Active ETF (Managed Fund) (Hedged) | |||||||||||||||||||||

|

|||||||||||||||||||||

| JPMorgan US 100Q Equity Premium Income Active ETF (Managed Fund) | |||||||||||||||||||||

|

|||||||||||||||||||||

| JPMorgan US 100Q Equity Premium Income Active ETF (Managed Fund) (Hedged) | |||||||||||||||||||||

|

|||||||||||||||||||||

| View Profile | |||||||||||||||||||||

|

Want to see more funds? |

|||||||||||||||||||||

|

Subscribe for full access to these funds and over 800 others |

24 Feb 2024 - Hedge Clippings | 23 February 2024

|

|

|

|

Hedge Clippings | 23 February 2024 This week for a change, Hedge Clippings is going to ignore the Reserve Bank, inflation, interest rates, and even politics, as Barnaby's retired to the bush, and Donald Trump has seemingly even gone quiet as he considers his next legal option. Instead, we're reverting to our bread and butter, the performance of markets and managed funds. It's been just over 3 months since the extraordinary rally in equities kicked off last November. At the end of October last year, the ASX200 Absolute Return Index (ARI) was negative (just) YTD since January 2023, and up only 2.95% over 12 months. By the end of December, the index was up 12.4%. Things did slow down somewhat in January, with a return of 1.19%, by which time the 12 month rolling return had fallen to 7.08% thanks to its performance in January 2023 "falling off" the 12 month's numbers. In the small cap sector, the numbers were even more extreme as risk appetite among investors, plus limited liquidity in most stocks in the sector took a toll. At the end of October '23, the ASX Small Ordinaries ARI was down 6.05% YTD, and -5.11% over 12 months. By the end of December, it had risen over 14% to finish the year up 7.82%, before dipping to a 12 month number of +2.09% by the end of January. Small caps of course are notoriously volatile: In September 2022 the index was down 22% over 12 months, but a year earlier, September 2021, the index was up 30.4%, having risen no less than 52% in the 12 months to March '21 in an amazing rebound from the initial depths of COVID in March 2020 of -21% over 12 months. Experienced investors and advisors will correctly point out that when investing in the market, and managed funds in particular, it's the long (term) game that counts. Most offer documents (and ASIC) suggest a 5-7 year term to ride out the swings and roundabouts. Taking that approach, and the long term suggests an 8-9% annualised return (including dividends) from the Australian equity market and 10-12% from global equities based on the MSCI All Countries World Index. Over the same 5-7 year period, managed funds in AFM's Equity Peer Groups - both Large and Small/Mid Cap - have on average largely provided the same returns after fees as the index: The issue of course is volatility, or standard deviation of returns, but as shown below, so is the concept of average. Many will correctly point to the fact that individual stocks and fund's performance varies dramatically and with careful selection, performance can far exceed the above (although passive investing in an index ETF doesn't provide this, but that's a discussion for another day). Of course equities aren't the only game in town, particularly in volatile markets. Over the past 2-3 years, Private & Hybrid Credit funds have proven that they can return the same as equities (8-10% plus) with a fraction (or none) of the volatility, plus a regular income stream paid monthly or quarterly. We're currently preparing our Fixed Income Private Credit Sector Review to shine a light on this emerging, and increasingly popular sector which features a surprisingly diverse range of strategies and underlying assets. News & Insights New Funds on FundMonitors.com Market Commentary - January | Glenmore Asset Management Stock Story: Charter Hall | Airlie Funds Management January 2024 Performance News Glenmore Australian Equities Fund Insync Global Capital Aware Fund Bennelong Emerging Companies Fund |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday |

23 Feb 2024 - Performance Report: Digital Asset Fund (Digital Opportunities Class)

[Current Manager Report if available]

23 Feb 2024 - It's quality time for Global Equities

|

It's quality time for Global Equities Yarra Capital Management January 2024 In times of change, new market leaders will emergeFinancial regulators like to say that past investment performance is not a clear indicator of future performance. Yet, we investors often look to the past to gain insights into potential future market conditions. There are patterns that can be exploited or traps that may be avoided. However, as we head into 2024, the past may not offer the usual useful insights. From a macro perspective, central banks' experimentation with quantitative easing―which provided relatively benign market conditions since the Global Financial Crisis--is being unwound, and this "quantitative tightening" presents a new territory for policymakers and investors. Simultaneously, we appear to be approaching a peak in monetary tightening, and inflation appears to be in retreat, but the end game for this battle remains opaque. Recent market actions suggest a turning point is approaching, yet when it comes to timing key events, markets can often be wrong. Geopolitics also offers few signs of stability. The peace dividend that has prevailed for several decades has abruptly ended, with ongoing developments in the Middle East being the latest addition to broader uncertainty. In addition, a series of national elections in 2024--culminating with a possible second presidential term for Donald Trump in the US--will ensure further drama unfolds. With all of this in mind, investors will need to adjust their expectations, and portfolios, to account for higher for longer interest rates, the challenges of slower economic growth, stickier inflation, and a testing geopolitical environment. So, in this sea of uncertainty, where can we find a stable port in which to anchor with confidence? For us, we stand by our philosophy of Future Quality--the belief that companies which can grow, attain and sustain superior returns on invested capital, and have all the key quality pillars in place (Franchise, Management, Balance sheet and Valuation), will be the best candidates for capturing longer-term alpha. While each company will embark on its own, unique journey to Future Quality, there are also common pathways, often driven by structural requirements. Therefore, these companies are less dependent on macro cycles, which we can leverage over the long term. These include the following: AI AdoptionThe emergence of artificial intelligence (AI) was a dominant market force in 2023. We were initially hesitant about joining this party, but our subsequent research has led us to reappraise this position. While we still believe AI contains an element of hype, it has the potential to transform technology for the next generation. It is too early to define the longterm winners from the new business models and use cases being inspired by AI, but there are market leaders already benefitting from the rapid adoption of this new technology that fit our Future Quality criteria. Over recent months, we have added Synopsys, Nvidia, and Meta to the portfolio. Enablers of the energy transitionThere is a need to reduce humankind's reliance on fossil fuels and create cleaner alternatives through renewable sources of energy, but this transition is not straightforward. Increased spending is needed to sustain existing energy production at the same time as mitigating carbon missions. While there is a fruitful pool of investment opportunities on both sides of this equation, the transition is heavily reliant on fiscal spending and political support could prove to be fickle. Portfolio winners in this space have been Schneider, Linde and Chart Industries (sold in Q3 2023). Normalisation and structural growth in global travelThe travel industry is still in the process of recovering from pandemic-imposed restrictions, with countries at differing stages of normalisation. Yet, when you look at the core consumers of travel, demand remains robust. This is particularly true for younger generations, who place greater value on "experiences". Furthermore, a new travel cohort is emerging from developing countries where rising gross domestic product per capita means more people will be able to afford to travel in the future. Booking Holdings, Amadeus and Samsonite have been positive contributors to the portfolio in 2023. Providers and enablers of healthcare efficiencyWith an ageing population, providing sufficient and efficient healthcare, as well as reducing the cost of such services, will be one of the world's most important challenges going forward. In our view, this demographic test will--and has been--a great hunting ground for investment ideas as healthcare companies innovate to deliver much-needed solutions. That said, some subindustries within the healthcare sector have underperformed of late because of the pandemic pulling demand forward and creating ongoing staff shortages. We are heading into a changing world, where the more recent past can no longer be relied on to guide our path forward. There are tools we can use to provide a greater degree of certainty. Our Future Quality approach is designed to help us identify franchises that are set to endure. Some of these companies may not have been in the vanguard of market leadership over the last decade. However, in this instance, we can more reliably believe history when it tells us that in times of change, the market leaders at the start are rarely the same as the ones leading us out of it. |

|

Funds operated by this manager: Yarra Australian Equities Fund, Yarra Emerging Leaders Fund, Yarra Enhanced Income Fund, Yarra Income Plus Fund |

22 Feb 2024 - Performance Report: Bennelong Emerging Companies Fund

[Current Manager Report if available]